The Corcoran Report

June 2024 | BROOKLYN | RENTAL MARKET

June 2024: : Record-High Rents Slow Lease Activity

Leases Signed

-1% YoY

-23% MoM

June 2023

June 2022

June 2021

Rents

8% YoY

% MoM

June 2024 Median Rent

June 2023 $3,800

Average Rent

6% YoY

June 2024

-1% MoM

June 2023

$4,396

Active Listings

15% YoY

8% MoM

Days on Market

-49% YoY

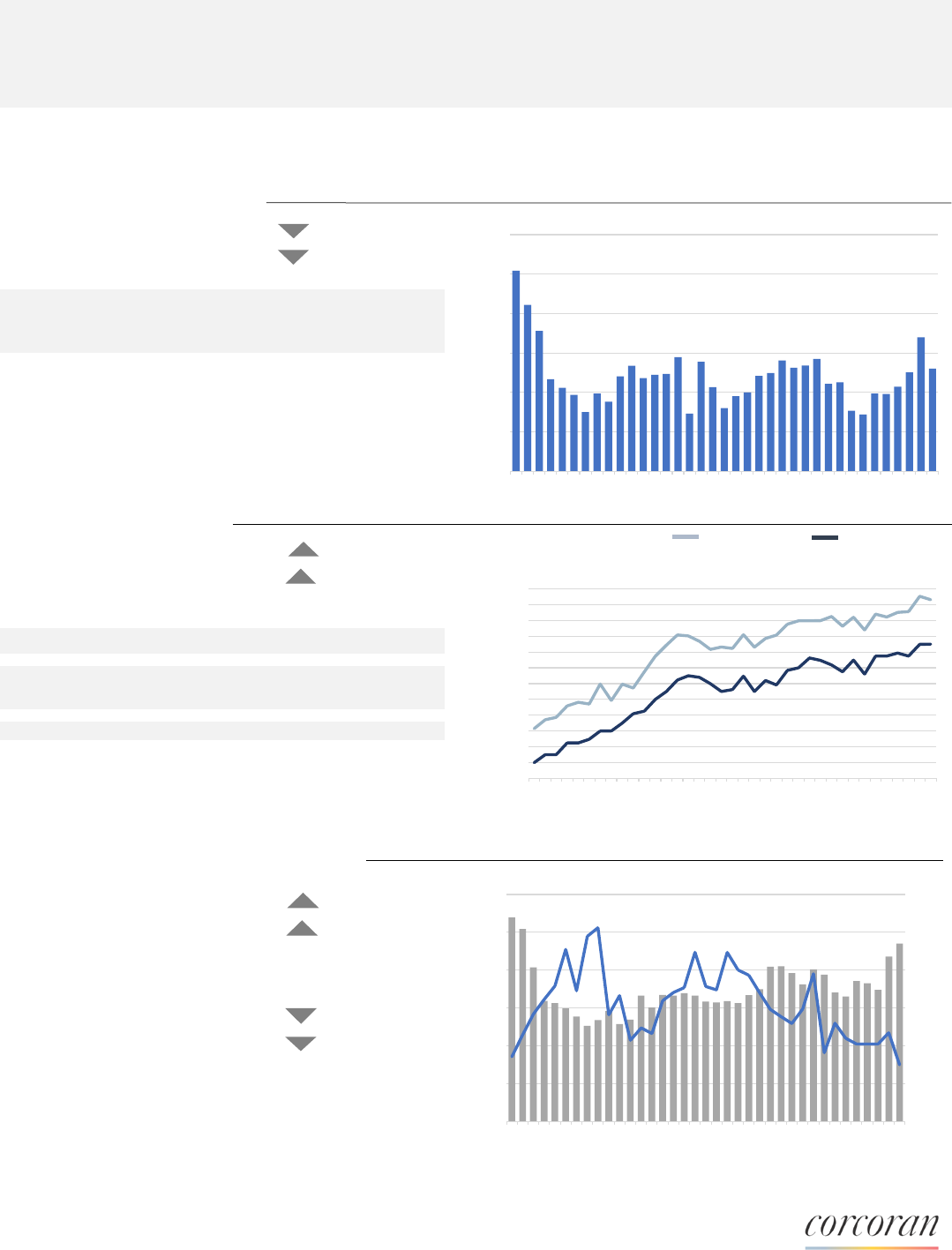

June marked the 33rd consecutive month of annual growth for

median and average rent. Median rent reached a new record high

although average rent remains slightly below May's peak.

Active listings increased 15% annually and 8% compared to May,

bringing some much-needed supply to a historically tight

marketplace. Days on market continued its downward trend, falling

annually for the 8th consecutive month as record prices hurried

renters to act fast in their apartment searches.

-36% MoM

4,705

30

$4,100

$4,663

June lease activity decreased 1% year-over-year and 23% compared with May. Average and median rents continued to climb, increasing annually for the

33rd consecutive month. Active listings increased 15% annually and 8% compared to May bringing some much needed supply to the marketplace

1,301

1,314

1,226

The number of reported signed leases decreased a marginal 1%

compared to last year. Despite the fact that historically June is a

more active month than May, the market slowed 23% month-over-

month well below the five year average. It is likely that record-high

rents diminished lease activity.

2,544

Figure reflects leases reported signed within the report month reported by any agency in Brooklyn and may include furnished and/or short term rentals. Not all leases that are signed are publicly reported. By

bedroom stats exclude units larger than three bedrooms. Price figures based on last asking prices for leases reported signed but actual rents may be lower. Figure reflects units actively listed as of the last day of

the report month. Days on market only reflects units that were listed for more than one day prior to being marked as leased. All material herein is intended for information purposes only and has been compiled from

sources deemed reliable. Though information is believed to be correct, it is presented subject to errors, omissions, changes or withdrawal without notice. This is not intended to solicit property already listed. Equal

Housing Opportunity. The Corcoran Group is a licensed real estate broker. Owned and operated Anywhere Real Estate Inc.

0

500

1,000

1,500

2,000

2,500

3,000

Jun 21

Jul 21

Aug 21

Sept 21

Oct 21

Nov 21

Dec 21

Jan 22

Feb 22

Mar 22

Apr 22

May 22

Jun 22

Jul 22

Aug 22

Sept 22

Oct 22

Nov 22

Dec 22

Jan 23

Feb 23

Mar 23

Apr 23

May 23

Jun 23

Jul 23

Aug 23

Sept 23

Oct 23

Nov 23

Dec 23

Jan 24

Feb 24

Mar 24

Apr 24

May 24

June 24

Number of Leases Signed

Signed Leases

$2,400

$2,600

$2,800

$3,000

$3,200

$3,400

$3,600

$3,800

$4,000

$4,200

$4,400

$4,600

$4,800

Jun 21

Jul 21

Aug 21

Sept 21

Oct 21

Nov 21

Dec 21

Jan 22

Feb 22

Mar 22

Apr 22

May 22

Jun 22

Jul 22

Aug 22

Sept 22

Oct 22

Nov 22

Dec 22

Jan 23

Feb 23

Mar 23

Apr 23

May 23

Jun 23

Jul 23

Aug 23

Sept 23

Oct 23

Nov 23

Dec 23

Jan 24

Feb 24

Mar 24

Apr 24

May 24

June 24

Median Rent

Monthly Rent

Average Median

0

20

40

60

80

100

120

0

1,000

2,000

3,000

4,000

5,000

6,000

May 21

Jun 21

Jul 21

Aug 21

Sept…

Oct 21

Nov 21

Dec 21

Jan 22

Feb 22

Mar 22

Apr 22

May 22

Jun 22

Jul 22

Aug 22

Sept…

Oct 22

Nov 22

Dec 22

Jan 23

Feb 23

Mar 23

Apr 23

May 23

Jun 23

Jul 23

Aug 23

Sept…

Oct 23

Nov 23

Dec 23

Jan 24

Feb 24

Mar 24

Apr 24

May 24

Days on Market

Number of Active Listings

Listed Inventory and Days on Market

1

The Corcoran Report

June 2024 | BROOKLYN | RENTAL MARKET

Leases Signed by Bedroom

Studios 210

14% YoY

One Bedrooms 523

3% YoY

Two Bedrooms 403

-0.5% YoY

Three Bedrooms 128

-25% YoY

Average Rent by Bedroom

Studios

$3,313

7% YoY

One Bedrooms

$3,952

6% YoY

Two Bedrooms

$5,229

12% YoY

Three Bedrooms

$6,325

7% YoY

Days on Market by Bedroom

Studios

36

-32% YoY

One Bedrooms

26

-50% YoY

Two Bedrooms

33

-48% YoY

Three Bedrooms

31

-52% YoY

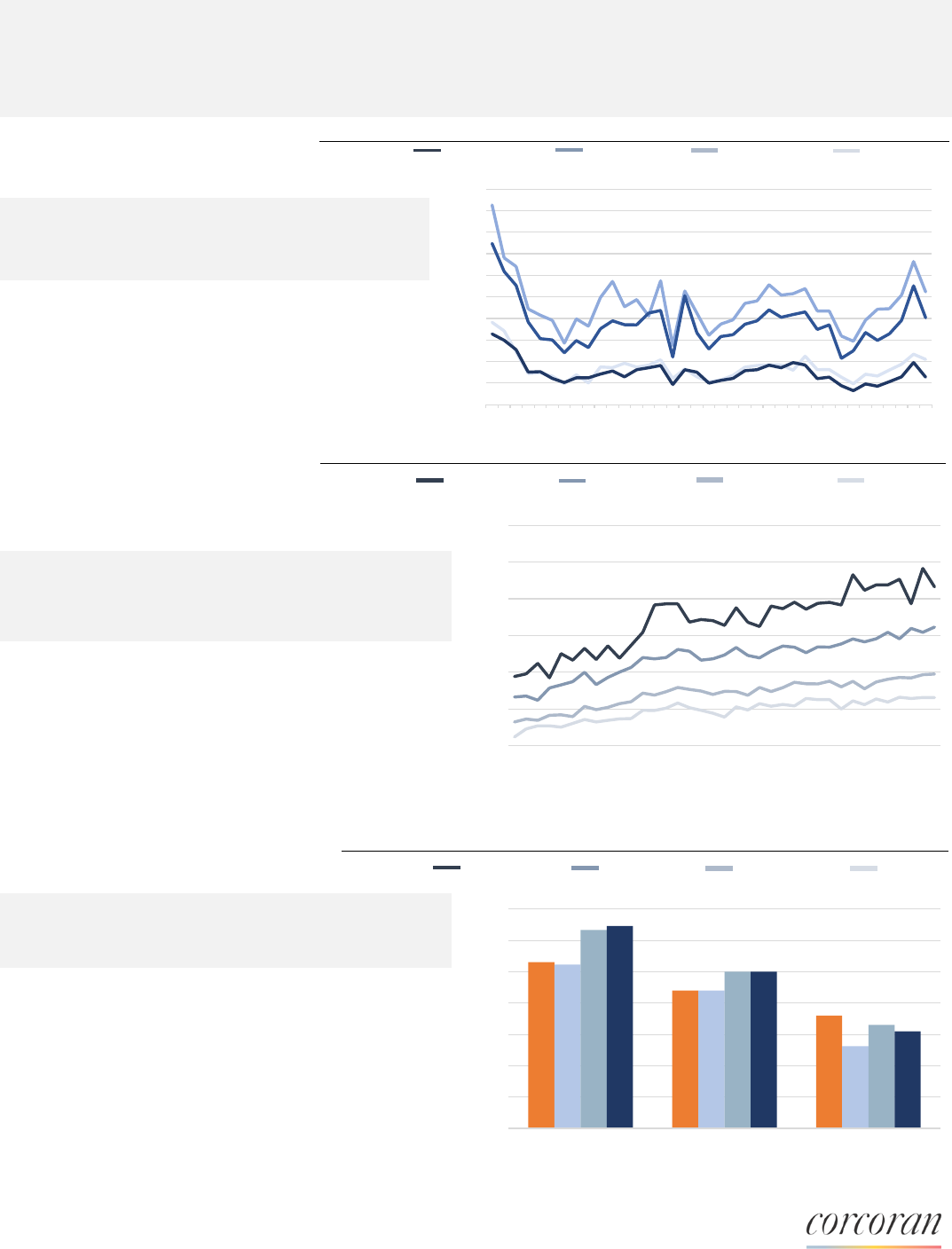

Days on market decreased significantly year-over-year, with all

unit types experiencing double-digit declines. Three bedrooms

had greatest annual declines in days on market, as would-be

buyers are choosing to rent due to high mortgage rates.

Leasing activity increased annually for studios and one

bedrooms but fell for two and three bedrooms. Studios had

the largest increase, up 14% compared to last year. Studio

activity has increased annually for three consecutive months

as high pricing has forced renters to look at smaller, more

affordable options.

Average rent rose year-over-year across all bedroom types, with two-

bedroom units seeing the most significant increase at 12%, reaching

a new record high. One bedrooms neared $4,000 also reaching a

new record.

0

100

200

300

400

500

600

700

800

900

1,000

Jun 21

Jul 21

Aug 21

Sept 21

Oct 21

Nov 21

Dec 21

Jan 22

Feb 22

Mar 22

Apr 22

May 22

Jun 22

Jul 22

Aug 22

Sept 22

Oct 22

Nov 22

Dec 22

Jan 23

Feb 23

Mar 23

Apr 23

May 23

Jun 23

Jul 23

Aug 23

Sept 23

Oct 23

Nov 23

Dec 23

Jan 24

Feb 24

Mar 24

Apr 24

May 24

June 24

Number of Leases Signed

Signed Leases by Bedroom Type

Three Bedrooms Two Bedrooms One Bedrooms Studios

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

Jun 21

Jul 21

Aug 21

Sept 21

Oct 21

Nov 21

Dec 21

Jan 22

Feb 22

Mar 22

Apr 22

May 22

Jun 22

Jul 22

Aug 22

Sept 22

Oct 22

Nov 22

Dec 22

Jan 23

Feb 23

Mar 23

Apr 23

May 23

Jun 23

Jul 23

Aug 23

Sept 23

Oct 23

Nov 23

Dec 23

Jan 24

Feb 24

Mar 24

Apr 24

May 24

June 24

Average Rent

Average Rent by Bedroom

Three Bedrooms Two Bedrooms One Bedrooms Studios

0

10

20

30

40

50

60

70

June 2023 May 2024 June 2024

Average Days on Market

Days on Market by Bedroom

Three Bedrooms Two Bedrooms One Bedrooms Studios

Figure reflects leases reported signed within the report month reported by any agency in Brooklyn and may include furnished and/or short term rentals. Not all leases that are signed are publicly

reported. By bedroom stats exclude units larger than three bedrooms. Price figures based on last asking prices for leases reported signed but actual rents may be lower. Figure reflects units

actively listed as of the last day of the report month. Days on market only reflects units that were listed for more than one day prior to being marked as leased. All material herein is intended for

information purposes only and has been compiled from sources deemed reliable. Though information is believed to be correct, it is presented subject to errors, omissions, changes or withdrawal

without notice. This is not intended to solicit property already listed. Equal Housing Opportunity. The Corcoran Group is a licensed real estate broker. Owned and operated by Anywhere Real

Estate Inc. LLC.

2

The Corcoran Report

June 2024 | BROOKLYN | RENTAL MARKET

Leases Signed by Neighborhood

June 2024 June 2023 Y-O-Y

Greenpoint 109 79 38%

North Williamsburg 134 91 47%

South Williamsburg 64 45 42%

DUMBO 37 23 61%

Brooklyn Heights 42 58 -28%

Boerum Hill / Cobble Hill 49 55 -11%

Carroll Gardens / Gowanus / Red Hook 52 60 -13%

Downtown Brooklyn 161 135 19%

Park Slope 117 143 -18%

Fort Greene / Clinton Hill 110 99 11%

Prospect Heights 48 90 -47%

Crown Heights / Prospect-Lefferts 64 69 -7%

Bedford-Stuyvesant 108 105 3%

East Williamsburg / Bushwick 69 89 -22%

Prospect Park South 54 81 -33%

South Brooklyn 83 86 -3%

Average Rent by Neighborhood

June 2024 June 2023 Y-O-Y

Greenpoint $5,089 $4,919 3%

North Williamsburg $5,214 $5,134 2%

South Williamsburg $4,643 $5,043 -8%

DUMBO $7,192 $6,953 3%

Brooklyn Heights $6,899 $6,131 13%

Boerum Hill / Cobble Hill $5,824 $5,631 3%

Carroll Gardens / Gowanus / Red Hook $6,067 * $4,396 38%

Downtown Brooklyn $4,474 $4,976 -10%

Park Slope $4,700 $4,619 2%

Fort Greene / Clinton Hill $4,391 $4,526 -3%

Prospect Heights $4,691 $4,519 4%

Crown Heights / Prospect-Lefferts $3,948 $3,459 14%

Bedford-Stuyvesant $4,095 * $3,493 17%

East Williamsburg / Bushwick $3,542 $3,374 5%

Prospect Park South $3,602 * $3,325 8%

South Brooklyn $2,979 $2,624 14%

* New Record

Prospect Park South includes Windsor Terrace, Greenwood Heights, Prospect Park South, Kensington and Flatbush. South Brooklyn includes neighborhoods south of Foster Avenue,

west of McDonald Avenue south of Greenwood Cemetery, east of Utica Avenue south of Fulton Street, and east of East New York Avenue south of Clarkson Avenue.

June 2024: Higher prices led leasing activity to decline in more than half of Brooklyn neighborhoods. DUMBO increased most significantly, up 61%. Three

neighborhoods achieved records for average rent. Carroll Gardens / Gowanus / Red Hook saw the largest increase in average rent due to an influx of high-

end townhouse rentals.

-70% -50% -30% -10% 10% 30% 50% 70%

Greenpoint

North Williamsburg

South Williamsburg

DUMBO

Brooklyn Heights

Brm Hl / Cbl Hl

Crl Grds / Gwns / Rd Hk

Downtown Brooklyn

Park Slope

Fort Gr. / Clinton Hill

Prospect Heights

Crwn Hts / PLG

Bedford-Stuyvesant

East Williamsburg / Bushwick

Prospect Park South

South Brooklyn

Annual Change in Leases Signed

-20% -10% 0% 10% 20% 30% 40% 50%

Greenpoint

North Williamsburg

South Williamsburg

DUMBO

Brooklyn Heights

Brm Hl / Cbl Hl

Crl Grds / Gwns / Rd Hk

Downtown Brooklyn

Park Slope

Fort Gr. / Clinton Hill

Prospect Heights

Crwn Hts / PLG

Bedford-Stuyvesant

East Williamsburg / Bushwick

Prospect Park South

South Brooklyn

Annual Change in Average Rent

Figure reflects leases reported signed within the report month reported by any agency in Brooklyn and may include furnished and/or short term rentals. Not all leases that are signed are

publicly reported. By bedroom stats exclude units larger than three bedrooms. Price figures based on last asking prices for leases reported signed but actual rents may be lower. Figure

reflects units actively listed as of the last day of the report month. Days on market only reflects units that were listed for more than one day prior to being marked as leased. All material

herein is intended for information purposes only and has been compiled from sources deemed reliable. Though information is believed to be correct, it is presented subject to errors,

omissions, changes or withdrawal without notice. This is not intended to solicit property already listed. Equal Housing Opportunity. The Corcoran Group is a licensed real estate broker.

Owned and operated by Anywhere Real Estate Inc.

3