Figure reects leases reported signed within the report month reported by any agency in Brooklyn and may include furnished and/or short term rentals. Not all leases that are signed are publicly

reported. By bedroom stats exclude units larger than three bedrooms. Price gures based on last asking prices for leases reported signed but actual rents may be lower. Figure reects units actively

listed as of the last day of the report month. Days on market only reects units that were listed for more than one day prior to being marked as leased. All material herein is intended for information

purposes only and has been compiled from sources deemed reliable. Though information is believed to be correct, it is presented subject to errors, omissions, changes or withdrawal without

notice. This is not intended to solicit property already listed. Equal Housing Opportunity. The Corcoran Group is a licensed real estate broker. Owned and operated by Anywhere Real Estate LLC.

Leases Signed

March 2024: New Price Records Drive Slowest March since 2020

The number of reported signed leases decreased by 11% compared to March 2023. Median and average rent increased for the 30th consecutive month,

both setting new records. Fewer leases caused the number of active listings to climb annually.

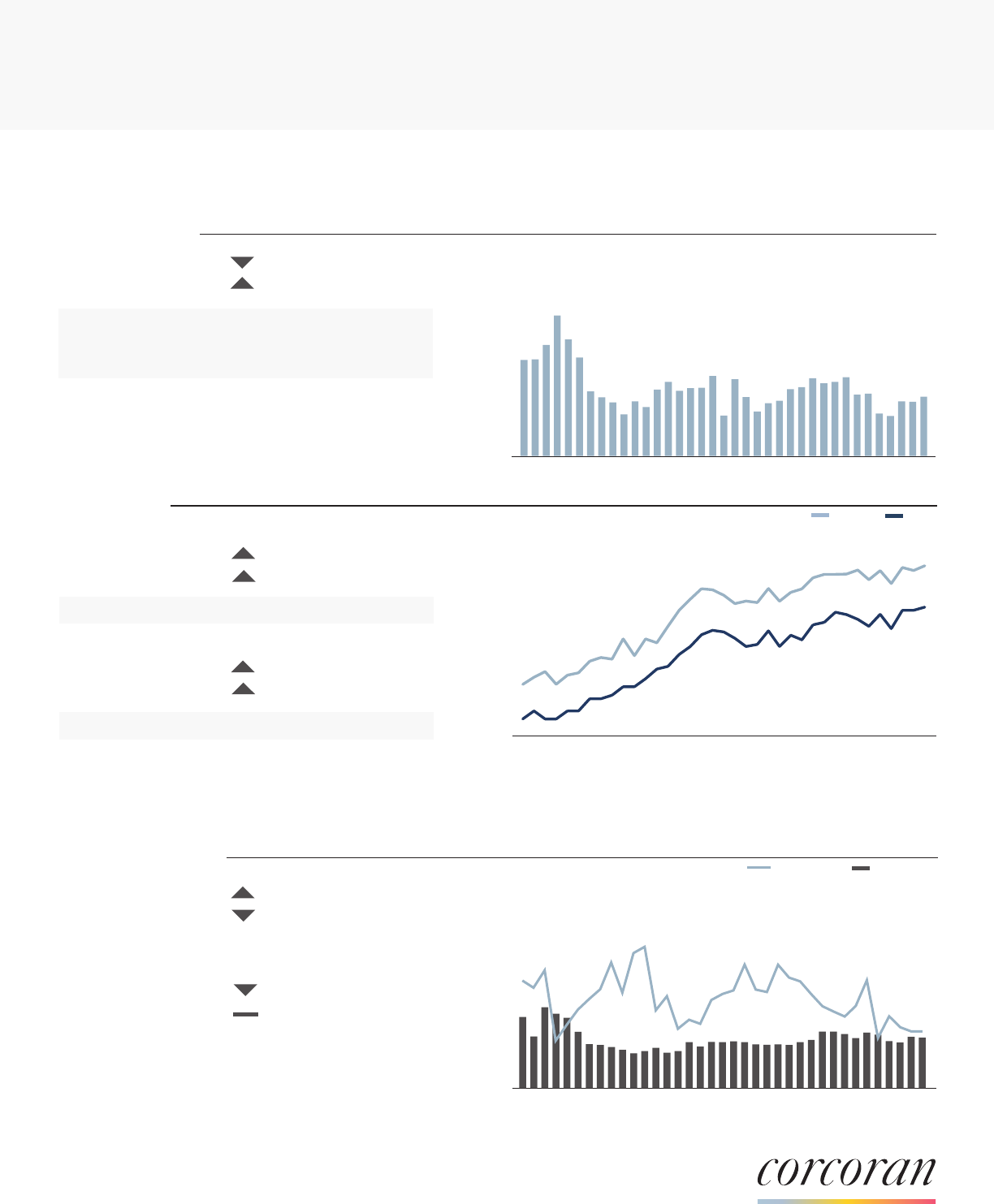

SIGNED LEASES

NUMBER OF LEASE SIGNED

3,000

2,500

2,000

1,500

1,000

500

0

Reported signed leases decreased by 11% annually but increased 9%

compared to February. The monthly gain was typical of seasonality

but the 9% gain was lower than the previous ve-year average.

1,072

-11% VS. MARCH 2023

+9% VS. FEBRUARY 2024

Rent Rates

Average Listings

Feb 2023

Feb 2021

1,210

1,203

March marked the 30th consecutive month of annual growth for

median and average rent. Median and average rent reached new

highs. Median rent is nearly $1,000 higher (33%) compared to

March 2020.

Mar 2023

$3,640

Active listings rose 17% year-over-year as slower annual lease activity

caused availabilities to pile up. However, new-to-market supply

contributed to lower days on market.

Mar 21

Apr 21

May 21

Jun 21

Jul 21

Aug 21

Sep 21

Oct 21

Nov 21

Dec 21

Jan 22

Feb 22

Mar 22

Apr 22

May 22

Jun 22

Jul 22

Aug 22

Sept 22

Oct 22

Nov 22

Dec 22

Jan 23

Feb 23

Mar 23

Apr 23

May 23

Jun 23

Jul 23

Aug 23

Sept 23

Oct 23

Nov 23

Dec 23

Jan 24

Feb 24

Mar 24

MONTHLY RENT

MEDIAN RENT

$4,600

$4,400

$4,200

$4,000

$3,800

$3,600

$3,400

$3,200

$3,000

$2,800

$2,600

$2,400

Mar 21

Apr 21

May 21

Jun 21

Jul 21

Aug 21

Sep 21

Oct 21

Nov 21

Dec 21

Jan 22

Feb 22

Mar 22

Apr 22

May 22

Jun 22

Jul 22

Aug 22

Sept 22

Oct 22

Nov 22

Dec 22

Jan 23

Feb 23

Mar 23

Apr 23

May 23

Jun 23

Jul 23

Aug 23

Sept 23

Oct 23

Nov 23

Dec 23

Jan 24

Feb 24

Mar 24

LISTED INVENTORY AND DAYS ON MARKET

AVERAGE RENT

12,000

10,000

8,000

6,000

4,000

2,000

0

Mar 21

Apr 21

May 21

Jun 21

Jul 21

Aug 21

Sep 21

Oct 21

Nov 21

Dec 21

Jan 22

Feb 22

Mar 22

Apr 22

May 22

Jun 22

Jul 22

Aug 22

Sept 22

Oct 22

Nov 22

Dec 22

Jan 23

Feb 23

Mar 23

Apr 23

May 23

Jun 23

Jul 23

Aug 23

Sept 23

Oct 23

Nov 23

Dec 23

Jan 24

Feb 24

Mar 24

The Corcoran Report

MARCH 2024 | BROOKLYN | RENTAL MARKET

Average

Median

1

3,655

+17% VS. MARCH 2023

-2% VS. FEBRUARY 2024

Days on Market

41

-49% VS. MARCH 2023

0% VS. FEBRUARY 2024

120

100

80

60

40

20

0

$3,988

+10% VS. MARCH 2023

+1% VS. FEBRUARY 2024

Feb 2023

$4,172

$4,502

+8% VS. MARCH 2023

+1% VS. FEBRUARY 2024

March 2024 Median Rent

March 2024 Average Rent

Listed Inventory

Days on Market

DAYS ON MARKET

Feb 2021 1,738

Figure reects leases reported signed within the report month reported by any agency in Brooklyn and may include furnished and/or short term rentals. Not all leases that are signed are publicly

reported. By bedroom stats exclude units larger than three bedrooms. Price gures based on last asking prices for leases reported signed but actual rents may be lower. Figure reects units actively

listed as of the last day of the report month. Days on market only reects units that were listed for more than one day prior to being marked as leased. All material herein is intended for information

purposes only and has been compiled from sources deemed reliable. Though information is believed to be correct, it is presented subject to errors, omissions, changes or withdrawal without

notice. This is not intended to solicit property already listed. Equal Housing Opportunity. The Corcoran Group is a licensed real estate broker. Owned and operated by Anywhere Real Estate LLC.

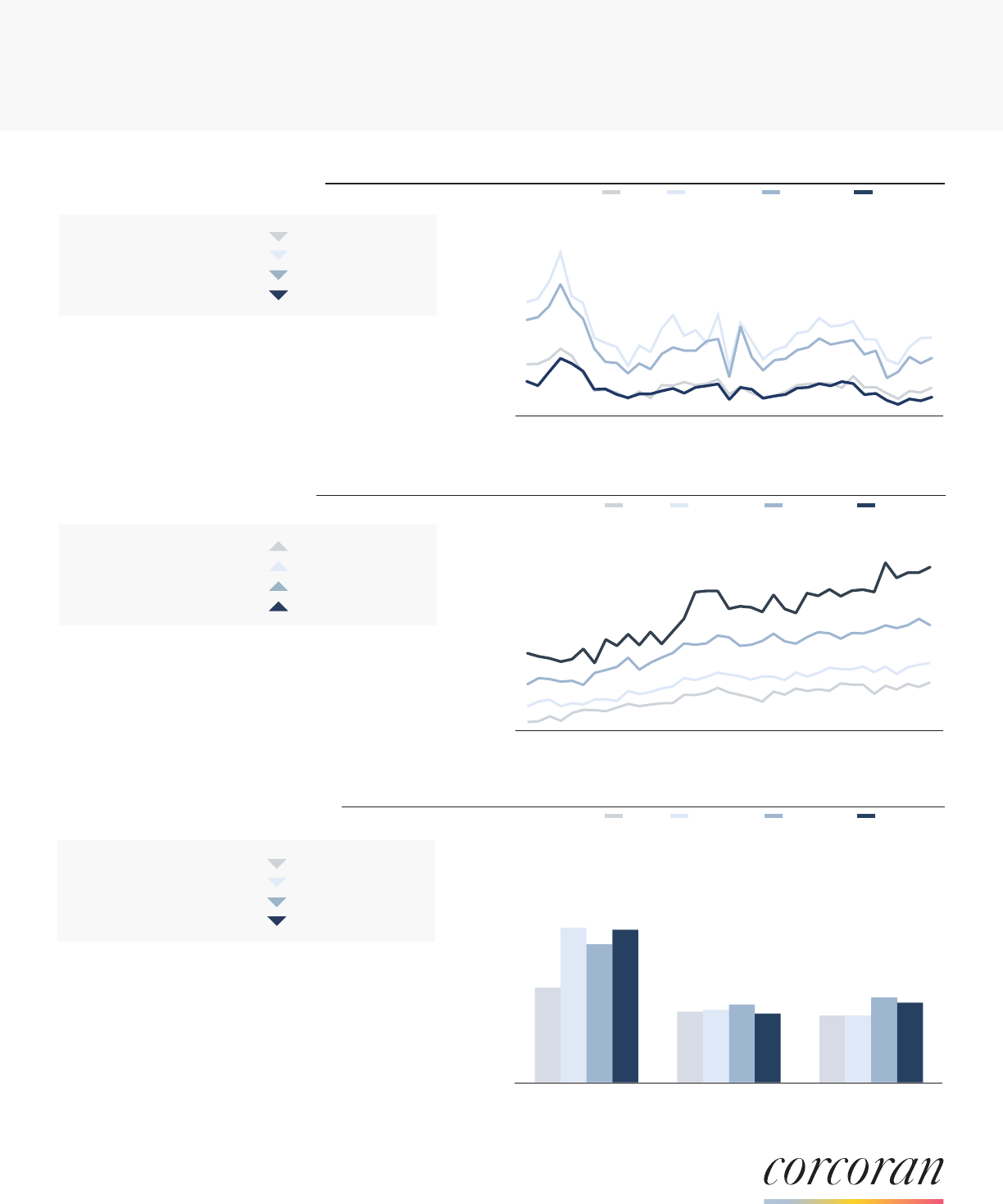

Leases Signed by Bedroom

The Corcoran Report

MARCH 2024 | BROOKLYN | RENTAL MARKET

Reported signed leases decreased annually for all bedroom types.

Leasing slowed the most for two and three bedrooms, both of which

experienced the largest annual average rent gains.

Average Rent by Bedroom

Average rent increased year-over-year for all bedroom types.

Studios and one bedrooms surpassed their previous peaks,

reaching new records. Two and three bedrooms each had double-

digit increases as still-high mortgage rates pushed prospective

buyers to rent larger product.

AVERAGE RENT BY BEDROOM

AVERAGE RENT

$7,000

$6,500

$6,000

$5,500

$5,000

$4,500

$4,000

$3,500

$3,000

$2,500

$2,000

Mar 21

Apr 21

May 21

Jun 21

Jul 21

Aug 21

Sep 21

Oct 21

Nov 21

Dec 21

Jan 22

Feb 22

Mar 22

Apr 22

May 22

Jun 22

Jul 22

Aug 22

Sept 22

Oct 22

Nov 22

Dec 22

Jan 23

Feb 23

Mar 23

Apr 23

May 23

Jun 23

Jul 23

Aug 23

Sept 23

Oct 23

Nov 23

Dec 23

Jan 24

Feb 24

Mar 24

SIGNED LEASES BY BEDROOM TYPE

NUMBER OF LEASES SIGNED

1,000

900

800

700

600

500

400

300

200

100

0

Mar 21

Apr 21

May 21

Jun 21

Jul 21

Aug 21

Sep 21

Oct 21

Nov 21

Dec 21

Jan 22

Feb 22

Mar 22

Apr 22

May 22

Jun 22

Jul 22

Aug 22

Sept 22

Oct 22

Nov 22

Dec 22

Jan 23

Feb 23

Mar 23

Apr 23

May 23

Jun 23

Jul 23

Aug 23

Sept 23

Oct 23

Nov 23

Dec 23

Jan 24

Feb 24

Mar 24

Days on Market by Bedroom

Days on market declined drastically year-over-year, with all unit

types decreasing by double-digits. Renters gravitated toward

less expensive options, shortening the marketing time for studios

and one bedrooms to 37 days.

DAYS ON MARKET BY BEDROOM

AVERAGE DAYS ON MARKET

90

80

70

60

50

40

30

20

10

0

2

Studios

One Bedrooms

Two Bedrooms

Three Bedrooms

161

445

329

107

-7%

-5%

-12%

-32%

YoY

YoY

YoY

YoY

One BedroomsStudios

Two Bedrooms

Three Bedrooms

Studios

One Bedrooms

Two Bedrooms

Three Bedrooms

$3,321

$3,859

$4,909

$6,532

6%

8%

12%

25%

YoY

YoY

YoY

YoY

Studios

One Bedrooms

Two Bedrooms

Three Bedrooms

37

37

47

44

-29%

-57%

-38%

-48%

YoY

YoY

YoY

YoY

Mar 2023 Feb 2024 Mar 2024

One BedroomsStudios

Two Bedrooms

Three Bedrooms

One BedroomsStudios

Two Bedrooms

Three Bedrooms

Figure reects leases reported signed within the report month reported by any agency in Brooklyn and may include furnished and/or short term rentals. Not all leases that are signed are publicly

reported. By bedroom stats exclude units larger than three bedrooms. Price gures based on last asking prices for leases reported signed but actual rents may be lower. Figure reects units actively

listed as of the last day of the report month. Days on market only reects units that were listed for more than one day prior to being marked as leased. All material herein is intended for information

purposes only and has been compiled from sources deemed reliable. Though information is believed to be correct, it is presented subject to errors, omissions, changes or withdrawal without

notice. This is not intended to solicit property already listed. Equal Housing Opportunity. The Corcoran Group is a licensed real estate broker. Owned and operated by Anywhere Real Estate LLC.

The Corcoran Report

MARCH 2024 | BROOKLYN | RENTAL MARKET

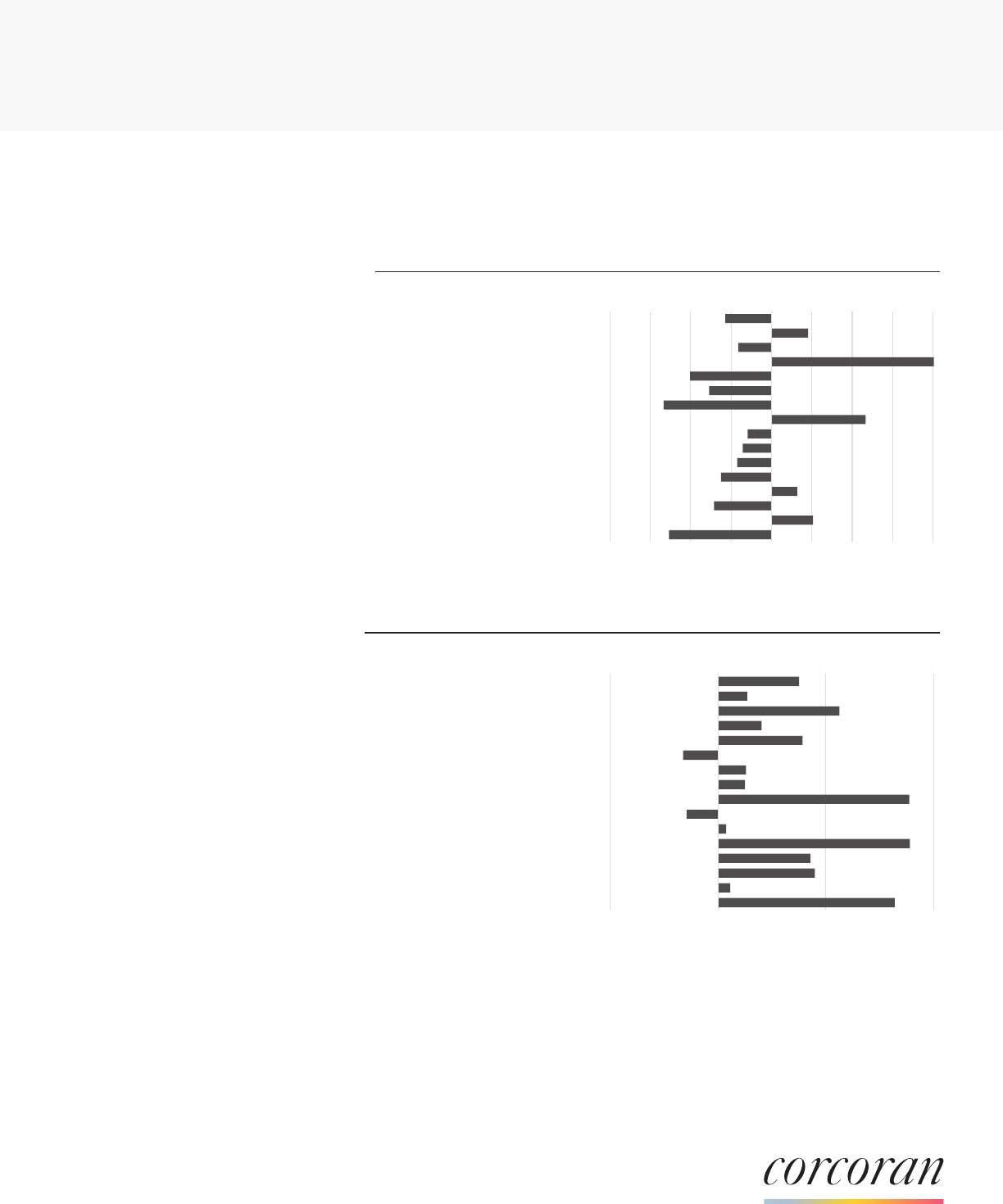

March 2024: Despite the market wide slowdown, leasing activity increased in ve of sixteen neighborhoods. DUMBO doubled its leasing from last

year due to strong leasing activity at newly built rental properties. Park Slope and Crown Heights / Prospect-Lefferts had the most signicant increase

in rent expanding by 18% due to an inux of high-end townhouse rentals.

Leases Signed by Neighborhood

Mar 2024 Mar 2023 YoY

Greenpoint

64 83

-23%

North Williamsburg

104 88

18%

South Williamsburg

61 73

-16%

DUMBO

42 20

110%

Brooklyn Heights

37 62

-40%

Boerum Hill / Cobble Hill

38 55

-31%

Carroll Gardens / Gowanus / Red Hook

28 60

-53%

Downtown Brooklyn

154 105

47%

Park Slope

75 85

-12%

Fort Greene / Clinton Hill

79 92

-14%

Prospect Heights

54 65

-17%

Crown Heights / Prospect-Lefferts

57 76

-25%

Bedford-Stuyvesant

88 78

13%

East Williamsburg/Bushwick

53 74

-28%

Prospect Park South

70 58

21%

South Brooklyn

67 136

-51%

ANNUAL CHANGE IN LEASES SIGNED

Greenpoint

North Williamsburg

South Williamsburg

DUMBO

Brooklyn Heights

Brm Hl / Cbl Hl

Crl Grds / Gwns / Rd Hk

Downtown Brooklyn

Park Slope

Fort Gr. / Clinton Hill

Prospect Heights

Crwn Hts / PLG

Bedford-Stuyvesant

East Williamsburg/Bushwick

Prospect Park South

South Brooklyn

0%

3

Average Rent by Neighborhood

Mar 2024 Mar 2023 YoY

Greenpoint

$4,852 $4,513

8%

North Williamsburg

$5,003 $4,871

3%

South Williamsburg

$4,954 $4,452

11%

DUMBO

$6,292 $6,048

4%

Brooklyn Heights

$7,366 $6,829

8%

Boerum Hill / Cobble Hill

$4,950 $5,116

-3%

Carroll Gardens / Gowanus / Red Hook

$4,418 $4,306

3%

Downtown Brooklyn

$4,652 $4,539

3%

Park Slope

$5,191 $4,408

18%

Fort Greene / Clinton Hill

$4,277 $4,406

-3%

Prospect Heights

$4,651 $4,616

1%

Crown Heights / Prospect-Lefferts

$4,055 $3,441

18%

Bedford-Stuyvesant

$3,549 $3,269

9%

East Williamsburg/Bushwick

$3,596 $3,300

9%

Prospect Park South

$3,116 $3,081

1%

South Brooklyn

$2,913 $2,502

16%

Greenpoint

North Williamsburg

South Williamsburg

DUMBO

Brooklyn Heights

Brm Hl / Cbl Hl

Crl Grds / Gwns / Rd Hk

Downtown Brooklyn

Park Slope

Fort Gr. / Clinton Hill

Prospect Heights

Crwn Hts / PLG

Bedford-Stuyvesant

East Williamsburg/Bushwick

Prospect Park South

South Brooklyn

0%

Prospect Park South includes Windsor Terrace, Greenwood Heights, Prospect Park South, Kensington and Flatbush. South Brooklyn includes neighborhoods south of Foster

Avenue, west of McDonald Avenue south of Greenwood Cemetery, east of Utica Avenue south of Fulton Street, and east of East New York Avenue south of Clarkson Avenue.

40%

ANNUAL CHANGE IN AVERAGE RENT

-10%

80%-80% -60%

10% 20%

-40% -20% 20% 60%