September 2023

Chief Investment Ofce GWM

Investment Research

UBS Global

Real Estate

Bubble Index

2 UBS Global Real Estate Bubble Index 2023

Learn more at:

www.ubs.com/

global-real-estate-

bubble-index

3 Editorial

4 Key results

5 Deating bubbles

7 Regional focus

13 City benchmarks

15 City spotlights

22 City overview

23 Methodology & Data

UBS Global Real Estate

Bubble Index

This report has been prepared by

UBS Switzerland AG, UBS AG Singapore

Branch, UBS AG Hong Kong Branch, UBS AG

London Branch and UBS Financial Services

Inc. (UBS FS).

Please see the important disclaimer

at the end of the document. Past

performance is not an indication

of future returns.

Editor in Chief

Matthias Holzhey

Authors

Matthias Holzhey

Maciej Skoczek

Claudio Saputelli

Katharina Hofer

Regional contributors

Jonathan Woloshin (US)

Dean Turner (London)

Wen Ching Lee (Singapore)

Matteo Ramenghi (Milan)

Ronaldo Patah (São Paulo)

Editorial deadline

19 September 2023

Design

CIO Content Design

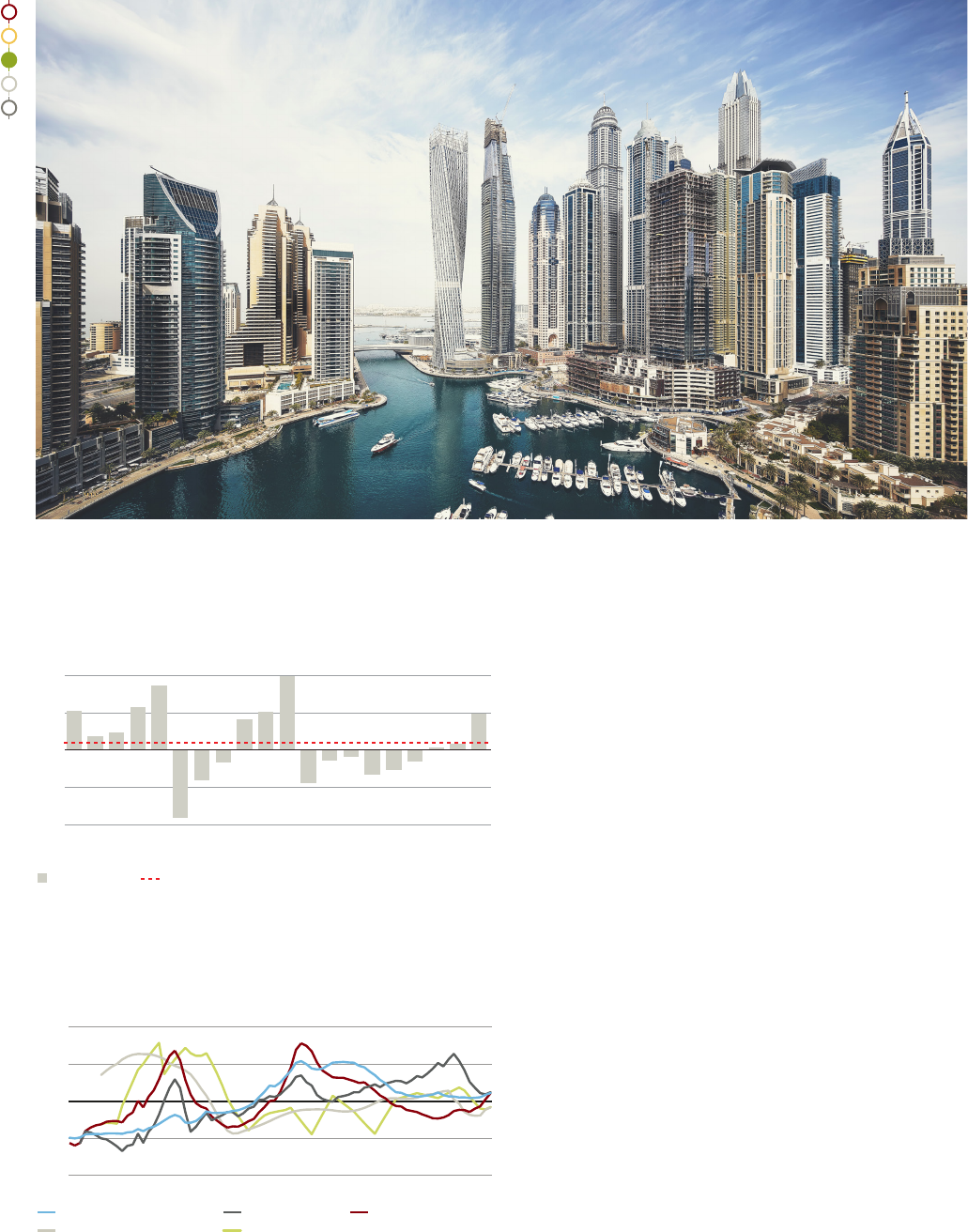

Cover photo

Getty Images

Language

English

Contact

Subscribe

Electronic subscription is also

available via Investment Views

on the UBS e-banking platform.

Content

3 UBS Global Real Estate Bubble Index 2023

Dear reader,

Low nancing costs have been the lifeblood of global housing markets over the past

decade, driving home prices to dizzying heights. However, the abrupt end of the low

interest rate environment has shaken the house of cards. On average of all cities,

within the past year, ination-adjusted home prices have seen the sharpest drop

since the global nancial crisis in 2008. Cities that have been classied in the bubble

risk zone at least once in the past three years recorded an even stronger average

price decline. But the impact of higher interest rates has varied markedly across cities,

with the price correction depending on several other factors as well.

Where home nancing was already at the limit of aordability with low interest

rates, higher interest rates almost inevitably led to a slump in local demand.

If a market was characterized by a signicant decoupling of purchase prices from

rents, the rise in mortgage rates shied demand back to the rental market. In housing

markets that were predominantly short-term nanced, owner households immedi-

ately felt the higher nancing costs and were forced to accept lower prices when

selling. Where buy-to-let became popular during the low interest rate period, re

sales due to higher interest rates and slumping protability intensied a correction.

In cities where several of these factors came together at the same time—as in

Toronto, Frankfurt, and Stockholm, for example—re-pricing took place all the

faster and more severely.

In this issue, nd out in which cities property prices and valuations have fallen

the most, where (further) corrections are imminent, and where price increases

are continuing or could happen in the future.

We hope you enjoy reading it.

Editorial

Claudio Saputelli

Head Swiss & Global Real Estate

Chief Investment Ofce GWM

Matthias Holzhey

Senior Real Estate Economist

Chief Investment Ofce GWM

4 UBS Global Real Estate Bubble Index 2023

Prices in

reverse gear

Most analyzed urban centers have

seen a real house price drop during

the last four quarters. In cities at

bubble risk during the last three years,

property prices have declined by 10%

on average.

Ination as

game-changer

Ination made a decisive contribution

to the reduction in imbalances. While

rising interest rates put pressure on

house prices, ination supports income

and rental growth. The latter has accel-

erated in most cities outside the US and

reached the highest value in almost

a decade.

Fewer cities

at bubble risk

Risk scores have dropped sharply

in most cities in recent quarters.

High imbalances persist in Zurich and

Tokyo—relatively low mortgage and

ination rates have not caused any

market disturbance there.

Defying

gravity

The most sought-aer destinations

in recent years are Singapore, Dubai,

and Miami. In those hotspots of interna-

tional demand, rental and for-sale price

growth clearly stand out. Prices are up

as much as 40% and rents 50% higher

than two years ago.

Tight nancing

conditions

Financial aordability of housing

has collapsed as mortgage rates

have roughly tripled since 2021 in

most markets. Therefore, household

leverage has been declining in most

countries in recent quarters.

Too early

for turnaround

There is more downside in real house

prices. However, a housing shortage

has set the stage for a renewed boom

in many cities—if interest rates fall.

Stockholm

Frankfurt

Munich

Zurich

Milan

Madrid

Dubai

Singapore

Sydney

Hong Kong

Tokyo

Geneva

Boston

New York

Los Angeles

San Francisco

Vancouver

Paris

Toronto

Miami

London

Amsterdam

1.65

1.24

0.47

0.67

0.14

0.74

1.71

1.35

0.98

0.49

0.73

1.13

0.46

1.27

0.80

1.21

1.38

1.03

0.47

0.81

0.27

0.34

0.93

Tel Aviv

Bubble risk (>1.5)

Overvalued (0.5 to 1.5)

Fair-valued (–0.5 to 0.5)

0.09

São Paulo

Warsaw

– 0.28

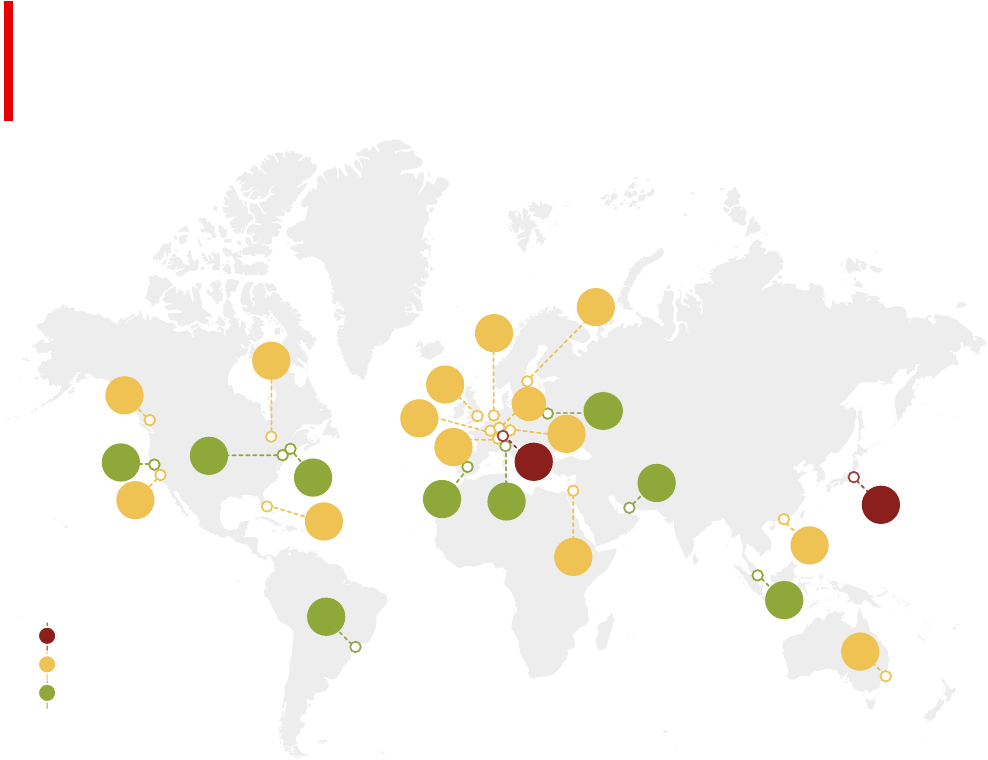

Key results

5 UBS Global Real Estate Bubble Index 2023

The global surge in ination and interest rates over the past

two years has led to a sharp decline in imbalances in the hous-

ing markets of global nancial centers on average, as measured

by the UBS Global Real Estate Bubble Index. In this year’s

edition, only the two cities Zurich and Tokyo have remained

in the bubble risk category, down from nine cities a year ago.

Formerly in the bubble risk zone, Toronto, Frankfurt, Munich,

Hong Kong, Vancouver, Amsterdam, and Tel Aviv saw their

imbalances decline and are now in the overvalued territory.

Housing markets in Miami, Geneva, Los Angeles, London,

Stockholm, Paris, and Sydney are overvalued as well.

Also, New York, Boston, San Francisco, and Madrid have expe-

rienced a drop in imbalances. These markets are now fairly

valued, according to the index, as are Milan, São Paulo, and

Warsaw. Singapore and Dubai are fairly valued as well, even

though their reputation as geopolitical safe-havens has recently

triggered a surge in demand for both renting and buying there.

Price corrections across the board

House price growth has suered due to rising nancing costs

as average mortgage rates have roughly tripled since 2021 in

most markets. Annual nominal price growth in the 25 cities

analyzed has come to a standstill aer a buoyant 10% rise

a year ago. In ination-adjusted terms, prices are even 5%

lower now than in mid-2022. On average the cities lost

most of the real price gains made during the pandemic

and are now close to mid-2020 levels again.

However, higher interest rates have impacted house prices

dierently depending on existing market imbalances

and prevailing mortgage terms. In Frankfurt and Toronto

—the two cities with the highest risk scores in last year’s

edition—real price tumbled by 15% in the last four quarters.

A combination of high market valuations and relatively short

mortgage terms put prices also under strong pressure in

Stockholm and to a lesser degree in Sydney, London, and

Vancouver. In contrast, in Madrid, New York, and São Paulo

—cities with moderate risk valuations so far—real home prices

have continued to rise at a subdued pace.

Identifying a bubble

Price bubbles are a recurring phenomenon in property markets.

The term “bubble” refers to a substantial and sustained mispric-

ing of an asset, the existence of which cannot be proved unless

it bursts. But historical data reveals patterns of property market

excesses. Typical signs include a decoupling of prices from local

incomes and rents, and imbalances in the real economy, such

asexcessive lending and construction activity. The UBS Global

Real Estate Bubble Index gauges the risk of aproperty bubble on

the basis of such patterns. The index does not predict whether

and when a correction will set in. A change in macroeconomic

momentum, a shi in investor sentiment or amajor supply

increase could trigger adecline in house prices.

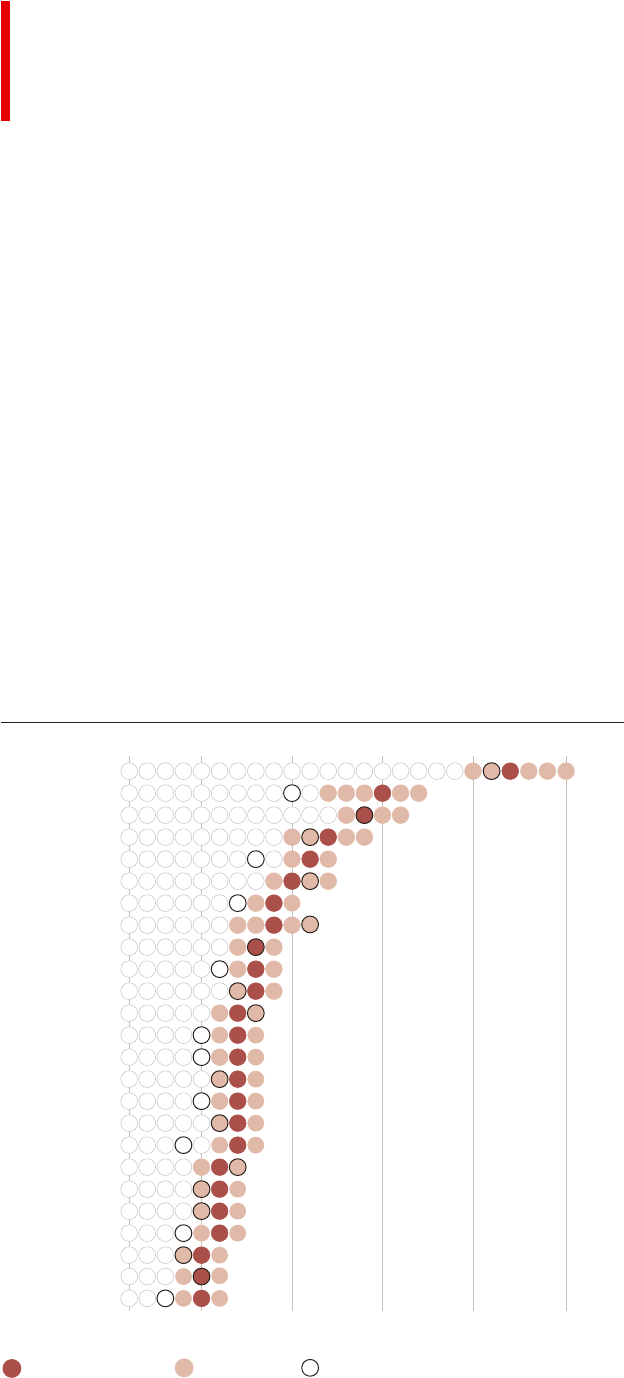

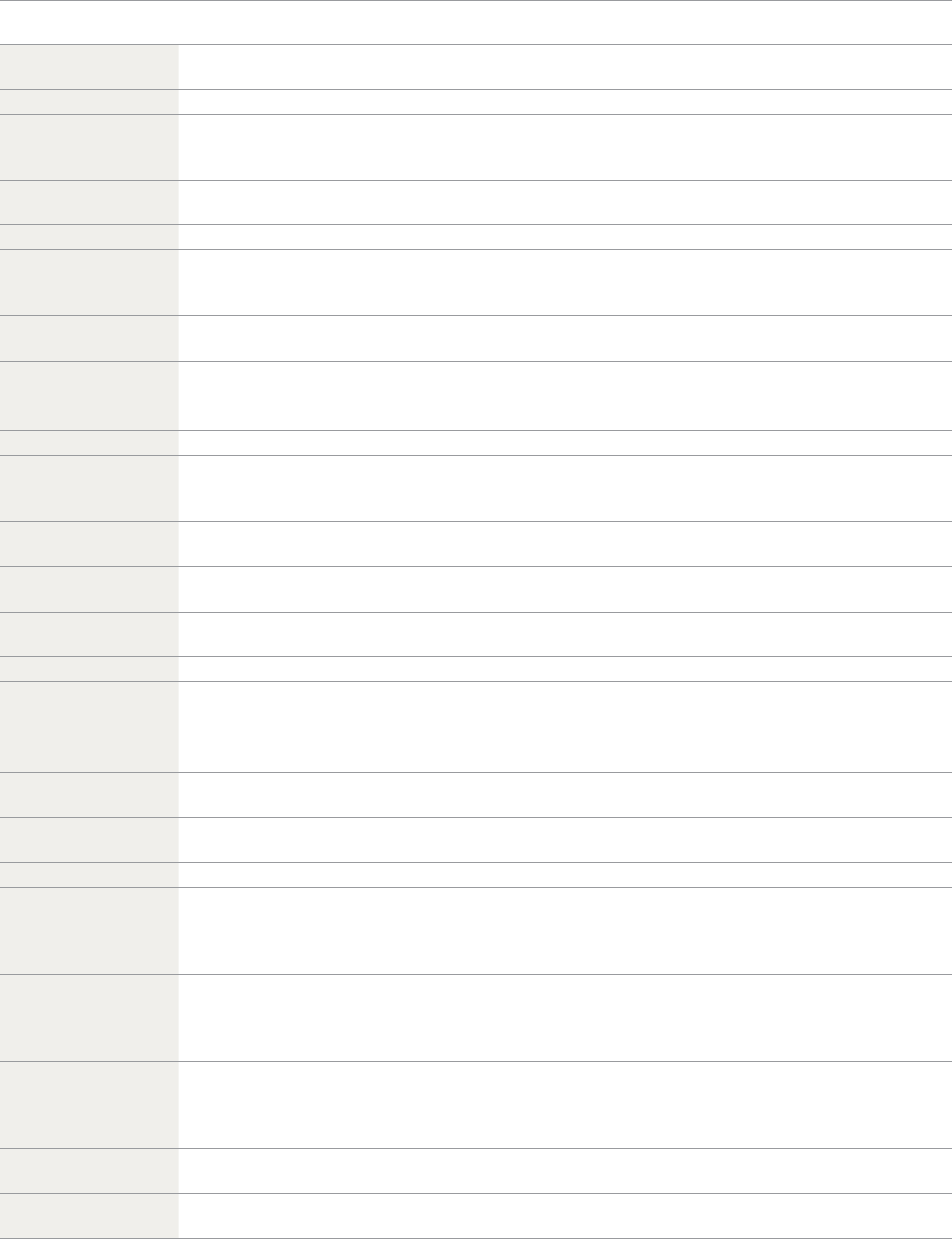

Zurich

Tokyo

Miami

Munich

Frankfurt

Hong Kong

Toronto

Geneva

Los Angeles

London

Tel Aviv

Vancouver

Amsterdam

Stockholm

Paris

Sydney

Milan

New York

Singapore

Madrid

Boston

San Francisco

Dubai

São Paulo

Warsaw

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

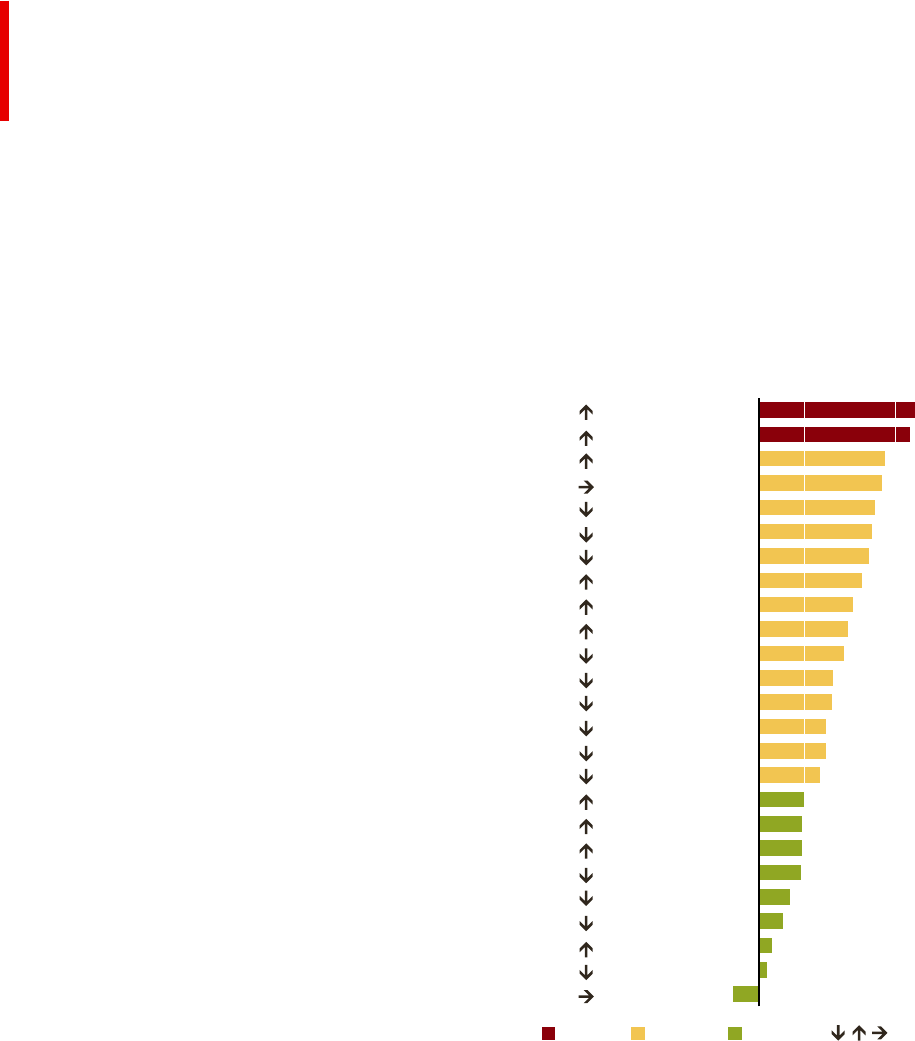

Bubble risk

(>1.5)

Overvalued

(0.5 to 1.5)

Fair-valued

(–0.5 to 0.5)

Rank change

vs. 2022

UBS Global Real Estate Bubble Index

Index scores for the housing markets of select cities, 2023

Source: UBS

For an explanation, see the section on Methodology & data on page 23.

1.71

1.65

1.38

1.35

1.27

1.24

1.21

1.13

1.03

0.98

0.93

0.81

0.80

0.73

0.67

0.49

0.47

0.47

0.46

0.34

0.27

0.14

0.09

0.74

–0.28

–0.5 0.00.5 1.01.5

Deflating bubbles

Deating bubbles

6 UBS Global Real Estate Bubble Index 2023

Fundamentals supported by inflation

The widespread decrease in imbalances was not only a

consequence of falling house prices but was supported

by robust market fundamentals and declining household

leverage. As buying aordability has deteriorated signi-

cantly, renting has boomed. Apart from cities in the US,

nominal rental growth has accelerated markedly since

mid-2022 and has been positive in all locations analyzed.

The sharpest rises in rents were recorded in Singapore

and Dubai.

In the wake of general ination, nominal household

incomes have continued to grow at a solid pace com-

pared to the previous decade. And as mortgage lending

growth halved in the last four quarters, aggregate house-

hold debt to economic output has been declining, espe-

cially in Europe.

Demand shows green shoots

As unemployment rates in all the countries covered have

remained well below their ten-year averages, the ensu-

ing high level of job security has partly cushioned the

impact of rising nancing costs on housing demand.

But ination-driven income growth and price corrections

have not been enough to meaningfully improve aord-

ability. On average, the amount of living space that is

nancially aordable for a skilled service worker is still

40% lower than before the pandemic began. More

downside in prices—at least in real terms—is likely if

interest rates remain at their current elevated levels.

In some cities, however, the seeds for the next property

price boom have already been planted. Housing remains

undersupplied in most cities as hybrid working has not

weakened demand for city-living in a sustained manner.

In places where the number of building permits has

been declining signicantly in recent quarters—most

notably in European urban centers—the housing short-

age will likely intensify even more. Hence, housing

demand is piling up and prices may soar again as

soon as nancial conditions for households improve.

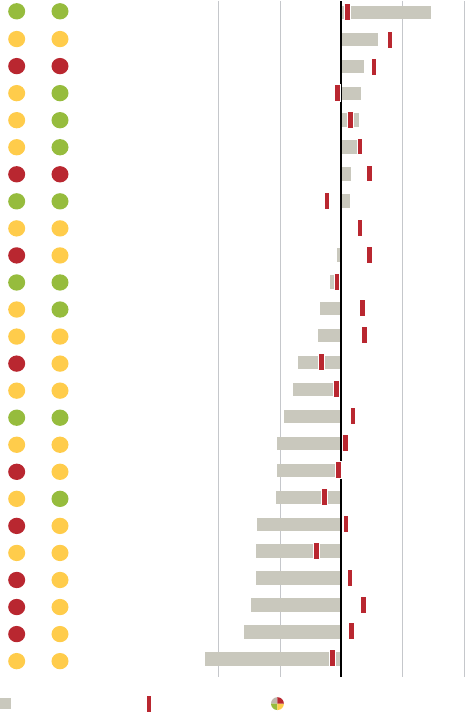

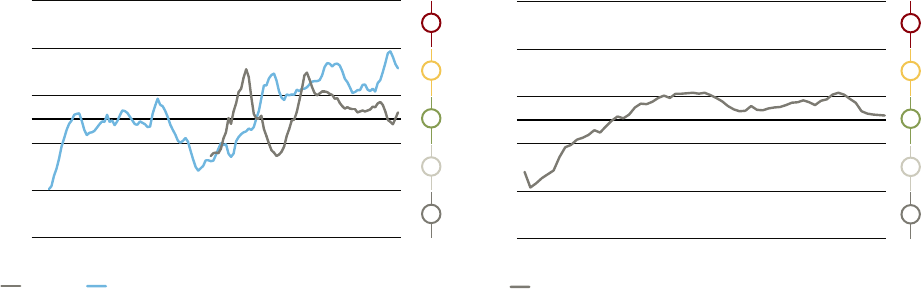

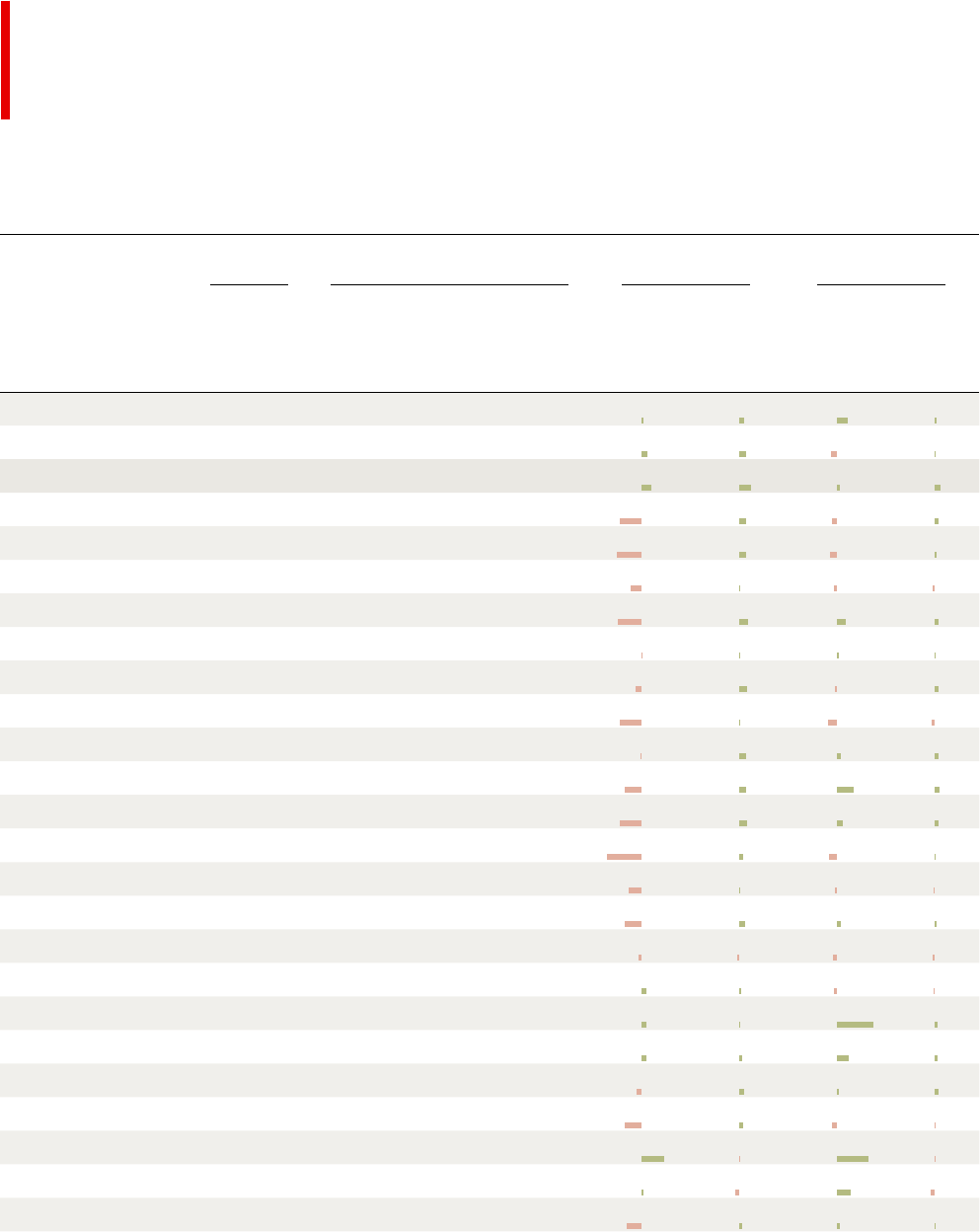

20100–10–20

Dubai

Miami

Tokyo

New York

Madrid

Singapore

Zurich

São Paulo

Geneva

Tel Aviv

Milan

Boston

Los Angeles

Hong Kong

Paris

Warsaw

Sydney

Vancouver

San Francisco

Munich

London

Amsterdam

Toronto

Frankfurt

Stockholm

2022 2023

Last 4 quarters Last 5 years

Housing market risk assessment

Falling prices

Residential real price growth rates, as of 2

nd

quarter 2023, annualized in %

Sources: See page 24.

7 UBS Global Real Estate Bubble Index 2023

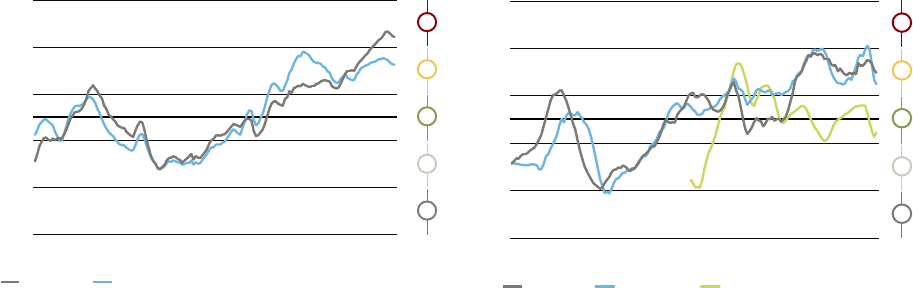

Eurozone

The house price level in both German cities analyzed, Frankfurt

and Munich, doubled between 2012 and 2022, which was

the strongest growth of all cities included in the study. Solid

economic and employment growth, falling mortgage rates,

strong investment demand, and supply shortages supported

higher prices. But prices have been overshooting, in our view.

Rate hikes and high ination triggered a revaluation. Peaking

in early 2022, real prices in Frankfurt have corrected by almost

20% since then (see spotlight Frankfurt p. 17), and by 15% in

Munich. Both cities have le the bubble risk zone, but remain

highly overvalued. The correction is still ongoing.

Prices in Amsterdam rallied by almost 20% in ination-

adjusted terms between 2020 and mid-2022 alone, decou-

pling from local rents and incomes. The UBS Global Real Estate

Bubble Index was ashing warning lights. Over the last four

quarters, prices have fallen by 14%—the strongest annual

correction since the 1980s. Several factors have simultaneously

weighed on owner-occupied demand: worsening nancing

conditions, ination diminishing households’ purchasing

power, and their willingness to buy a home, as well as the

reduction of the gi allowance for home ownership. More-

over, a higher transfer tax and prohibition of renting out aer

the purchase have decreased investment demand. The market

is now in overvalued territory, accroding to the index.

Falling mortgage rates and strong international demand were

the main drivers of a 30% real house price increase in Paris

between 2015 and 2020. The city became less aordable

and bigger ats for families were in short supply. People le

France’s capital city, rendering its population 5% lower than

a decade ago. Prices started falling in 2021. The decline has

accelerated in recent quarters as higher mortgage rates, lending

restrictions, and a property tax hike dampened buyer activity.

Overall, real prices corrected by 8% over the last four quarters,

the strongest decline in almost three decades, pushing the city

into overvalued territory.

Madrid’s housing market is in fair value territory. Compared

to other Eurozone cities, the Spanish capital has remained

aordable as measured by the price-to-income ratio. Aer

a three-year period of stagnation, prices increased by 3% in

ination-adjusted terms over the last four quarters. Overall,

they remain 25% below the all-time high in 2007. Demand

is shiing to the rental market as higher interest rates reduce

the attractiveness of purchasing property. More build-to-rent

developments are expected, keeping the market in balance.

Milan’s housing market has recorded rising prices since 2018.

Falling mortgage rates, a robust economy, new developments,

and a favorable tax regime supported housing demand.

Though nominal prices continued to rise between mid-2022

and mid-2023, they could not keep up with ination. Real

prices dropped by 2%, in line with local real rental and income

growth. We think the market remains fairly valued, virtually

unchanged from last year. Solid prospects for the local

economy, an extension of the underground railway, and

the upcoming 2026 Olympic Winter Games all contribute

to sustaining valuations in nominal terms.

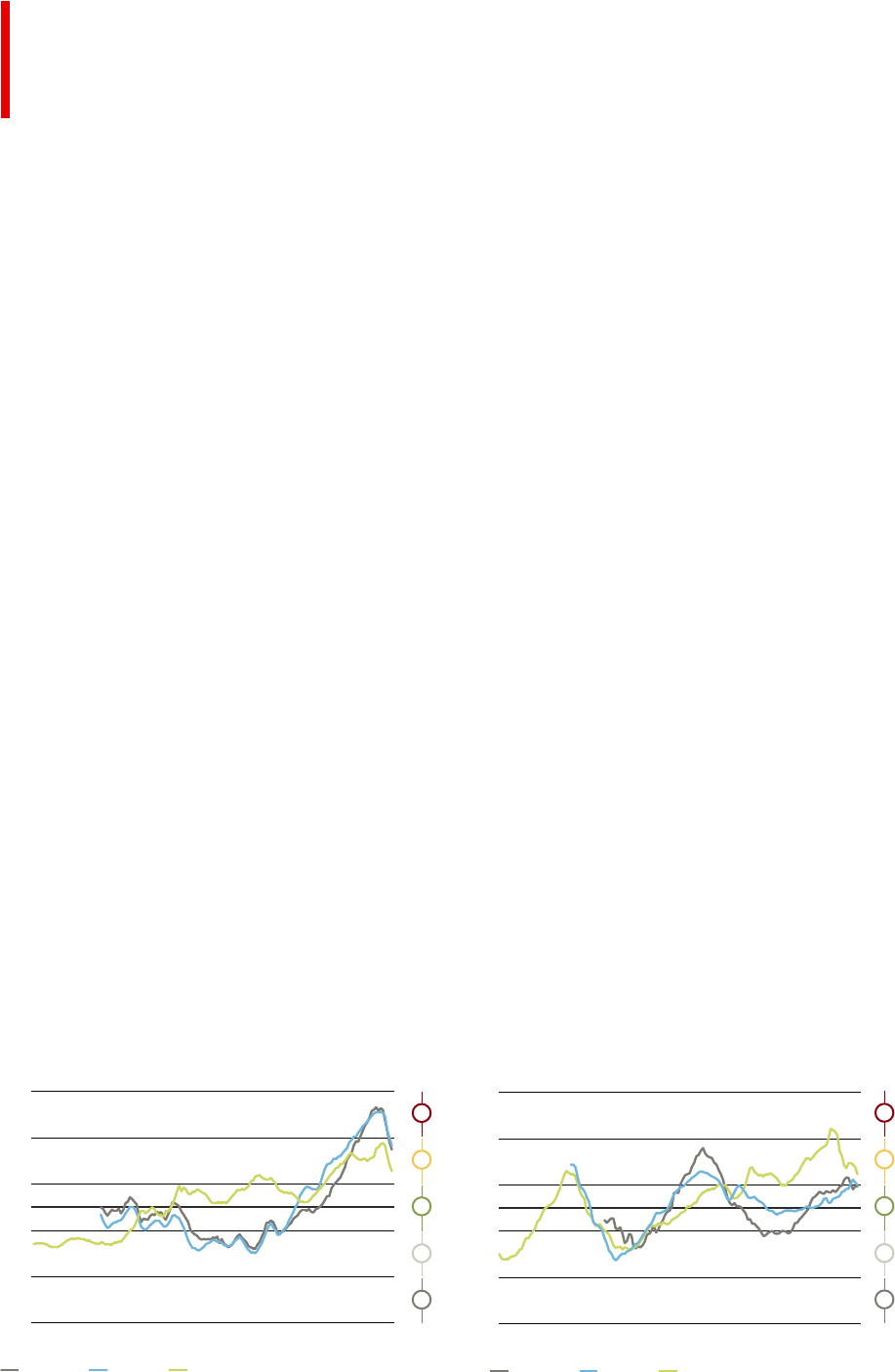

2.5

1.5

0.5

–0.5

–1.5

–2.5

83 87 91 95 99 03 07 11 15 19 23

Frankfurt

Munich Amsterdam

#N/A

#N/A

Sour

ce: UBS

83 87 91 95 99 03 07 11 15 19 23

bubble risk

overvalued

fair-valued

undervalued

depressed

Madrid

Milan Paris

Source: UBS

Regional focus

Historical development of index scores

Regional focus

8 UBS Global Real Estate Bubble Index 2023

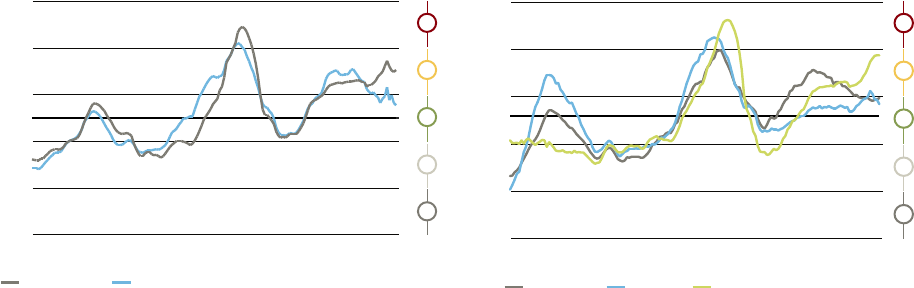

Rest of Europe

Buying owner-occupied real estate in Zurich now costs over

50% more than a decade ago in nominal terms. An increasing

number of high-income earners and ultra-low interest rates

supported rising prices. The price level has not yet adapted

to increased nancing costs. The market is in the bubble risk

zone (see spotlight Zurich p. 16).

By contrast, house prices in Geneva are less than 20% higher

than ten years ago. Between mid-2022 and mid-2023, real

prices stagnated. The risk score is far lower than in 2013,

when the market was in bubble risk territory. Although the

Rhone-city benets from its international status, the economic

outlook is mixed, and population growth remains subdued as

out-migration to more aordable regions is signicant. How-

ever, new building permits are only about half their 10-year

average, supporting price levels in the medium term.

Real prices in London’s housing market have been on a

downward path since Brexit in 2016. Despite structural supply

shortages, prices have lagged the nationwide average. In the

absence of strong international demand, house prices remain

under pressure as—due to high mortgage rates—local aord-

ability is at its worst since 2007. Additionally, demand for buy-

to-let investments has abated: Although rents have increased

in nominal terms, they could not oset rising nancings costs.

The market remains in overvalued territory, in our view (see

spotlight London p. 18).

Between 2008 and 2021, falling mortgage rates have sup-

ported demand for owner-occupied homes and led to a sharp

rise in Stockholm’s real housing prices by almost 70%. The

surge was much faster than that of local incomes and rents,

as well as housing prices in other parts of the country. Exces-

sive housing valuations and a high reliance on variable-rate

mortgages turned out to be a dangerous cocktail. Currently,

aordability is stretched and as a result, between mid-2022

and mid-2023, ination-adjusted prices corrected by over

20%—more than in any other city analyzed. The market slid

from bubble risk to overvalued territory. That said, demand for

owner-occupied housing is likely to shoot up again as soon as

aordability improves. The overregulated and undersupplied

rental market is not a viable alternative for many prospective

owners.

Real house prices in Warsaw increased by almost 40%

between 2012 and 2022. The city attracted new citizens

and buy-to-let investors alike. Strong employment prospects,

a subway expansion, and modern housing developments

kept the market attractive. Against a backdrop of strong

and persistent ination, mortgage rates spiked, reducing

households’ willingness to pay for homes. This has led ina-

tion-adjusted prices to decline about 10% within a year and

moved demand to the rental sector, which is seeing strong

growth. However, new mortgage subsidies are about to

trigger a buying frenzy.

2.5

1.5

0.5

–0.5

–1.5

–2.5

83 87 91 95 99 03 07 11 15 19 23

Zurich

Geneva

Source: UBS

London WarsawStockholm

bubble risk

overvalued

fair-valued

undervalued

depressed

Source: UBS

83 87 91 95 99 03 07 11 15 19 23

Historical development of index scores

Regional focus

9 UBS Global Real Estate Bubble Index 2023

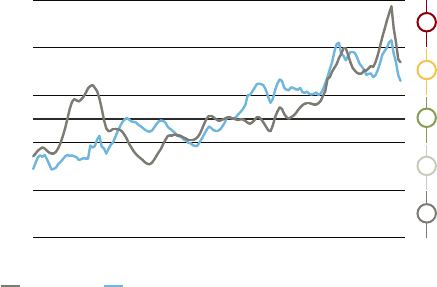

United States

As a result of the sharp rise in mortgage rates and record-low

aordability, housing demand has weakened signicantly in

the US cities we analyzed. But income growth, a lack of avail-

able for-sale inventory, and a strong labor market have pre-

vented a meaningful correction in home prices. Nevertheless,

ination-adjusted prices fell on average of all analyzed US cities

by 2% between mid-2022 and mid-2023, in stark contrast to

an increase of almost 10% a year ago. Additionally, real rental

growth slowed substantially as the pandemic-induced demand

receded, new supply was delivered in several markets, and

vacancy rates bottomed out.

While imbalances in Miami and New York increased over the

last four quarters, housing markets in Boston, San Francisco,

and Los Angeles recorded lower index scores.

Housing prices in Miami continued to increase faster than the

nationwide average. The price level has more than doubled

over the last 10 years. Miami is the main beneciary of the

increased attractivity of sun belt cities in the US. Demand is

bolstered by continued population inux and the still relatively

low absolute price level compared to incomes. Having said

that, sales numbers have dropped and the upward pressure

on prices has eased as mortgage rates went up.

New York is in the middle of a strong comeback following

the market’s signicant weakness during the pandemic’s

lockdowns as many inhabitants le the city for less dense,

more aordable areas. Aer multiple years of eroding

values, real prices in the city’s housing market increased

by 3% between mid-2022 and mid-2023, outpacing the

national average for the rst time since 2016 (see spotlight

New York p. 19).

Conversely, Boston’s housing market dynamics have weakened.

Ination-adjusted prices corrected slightly between mid-2022

and mid-2023 while rents remained roughly stable. The mar-

ket is less synchronized with the rest of the US due to its high

dependency on startups, technology, and healthcare—which

recently underperformed and thus were less supportive for

housing demand. Overall, the market is fairly valued, in our

view.

The rebound on the San Francisco real estate market was

short-lived. Since mid-2022, prices have fallen 10% and rents

dropped 3% in ination-adjusted terms. The market is now

fairly valued, in our view. San Francisco is under pressure from

quality-of-life issues, elevated hybrid work patterns, and com-

petition with sun belt cities that attract technology companies.

Building permits are at their lowest in a decade, but vacancy

rates have remained elevated.

Imbalances in the Los Angeles housing market have slightly

soened, but the market remains overvalued, in our view.

Los Angeles is suering from a broad loss of economic com-

petitivity due to its signicant exposure to the technology and

entertainment sectors, quality of life challenges, adverse tax

legislation, and high costs of living. As income growth disap-

pointed and housing aordability deteriorated, inventory levels

have begun to climb.

83 87 91 95 99 03 07 11 15 19 23

bubble risk

overvalued

fair-valued

undervalued

depressed

New York

Boston Miami

Source: UBS

Historical development of index scores

2.5

1.5

0.5

–0.5

–1.5

–2.5

83 87 91 95 99 03 07 11 15 19 23

Los Angeles

San Francisco

Source: UBS

Regional focus

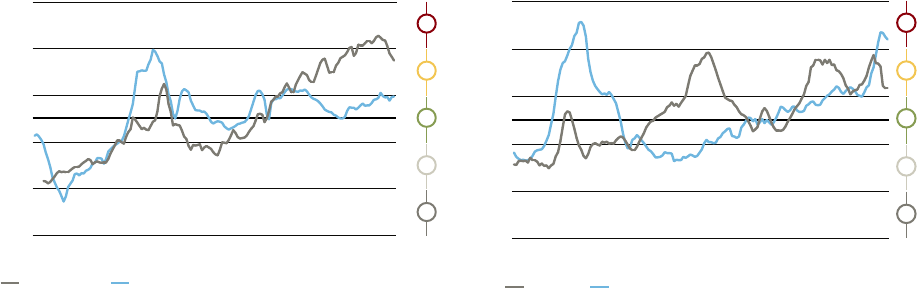

10 UBS Global Real Estate Bubble Index 2023

2.5

1.5

0.5

–0.5

–1.5

–2.5

83 87 91 95 99 03 07 11 15 19 23

bubble risk

overvalued

fair-valued

undervalued

depressed

Toronto

Vancouver

Source: UBS

Canada

A combination of strong population growth, attractive nanc-

ing conditions, high investment demand, and an urban supply

shortage have fueled the housing bonanza in Vancouver and

Toronto for almost a quarter of century. Real prices more than

tripled in these cities between 2000 and 2022. For years, both

markets were ashing warning signals as local price levels

decoupled from the countrywide average and clearly outpaced

rental growth. During the pandemic, the housing boom

became a countrywide phenomenon as strong income growth

supported upsizing and mortgage rates continued to trend

downward. Overall, between mid-2019 and mid-2022, real

prices in Vancouver increased by 25% and by almost 35%

in Toronto, while household leverage rose at a fast pace.

In such a heated market environment, it doesn’t take much

for sentiment to change quickly: A mix of increasing nancing

costs and higher mortgage stress test rates tipped the scales.

Outstanding mortgage growth in Canada has slowed to the

lowest level since the beginning of the boom in 2000. The

number of housing sales has dropped almost 40%, reaching

its low at the beginning of 2023. Price levels in Vancouver and

Toronto have corrected by more than 10% in ination-adjusted

terms since mid-2022. We now rank these markets in overval-

ued territory.

As demand for living space in these cities is rising steadily,

the pressure is shiing to the rental market. In Vancouver,

real rents have climbed around 10% compared to a year ago,

while they are a good 5% higher in Toronto. Both cities were

showing signs of housing market recovery in the spring with

increasing numbers of transactions and positive price growth.

Nevertheless, it is premature to speak of a turnaround against

the backdrop of recent interest rate hikes from the Bank of

Canada.

Historical development of index scores

Regional focus

11 UBS Global Real Estate Bubble Index 2023

Asia Pacic

Between 2003 and 2018, real house prices in Hong Kong

nearly quadrupled while incomes stagnated and rents

increased by just 50% in ination-adjusted terms. Housing is

barely aordable: A skilled service worker requires more than

20 times the average annual income to buy a 60 sqm at. The

city has constantly been at bubble risk levels since the rst edi-

tion of this study in 2015. Aer declining 7% between mid-

2022 and mid-2023, ination-adjusted house prices in Hong

Kong are back to levels last seen in 2017. Household leverage

stabilized and rents have been virtually unchanged in the last

four quarters as population inow increased. However, high

mortgage rates and a slow economic recovery in mainland

China put pressure on house demand. Overall, we now see

the city in overvalued territory. Rising inventories are a sign

that weakness on the housing market is going to persist in

the near future.

Singapore’s housing supply cannot keep up with strong local

and international demand, which began rising signicantly in

2018. Real prices have risen by 15% since then, despite regu-

latory tightening. However, this has been put into perspective

by rents, which have shot up by roughly 40% in the same

period. Overall, the housing market is fairly valued, in our

view (see spotlight Singapore p. 20).

Housing market imbalances in Tokyo have increased from

undervalued 20 years ago to bubble risk now. Real estate

prices have been rising almost continuously for over two

decades and decoupled from the rest of the country, bolstered

by attractive nancing conditions and population growth.

International investors have been attracted by the defensive

qualities of Tokyo’s residential market, heating up the price

growth. Moreover, as net immigration has weakened since

the pandemic, rents started to fall in 2020, aggravating imbal-

ances. Widespread home ofces and higher availability of

larger units made people leave the city center. Although

income growth could not keep pace with prices and mortgage

rates have increased (moderately) in recent quarters, nominal

house prices dynamics have not weakened.

The housing market in Sydney has been very volatile in recent

years. Aer a brief period of market weakness between 2018

and 2019, prices surged by almost 25% cumulatively across

2020 and 2021. Aggressive rate hikes by the Reserve Bank of

Australia more recently triggered a new sharp price correction.

Ination-adjusted prices are back to 2018 levels. Further

downside is limited though, as foreign demand has been

improving. Amid robust rental growth and lower household

leverage, imbalances have declined sharply. The market is

classied at the lower end of the overvalued territory.

2.5

1.5

0.5

–0.5

–1.5

–2.5

83 87 91 95 99 03 07 11 15 19 23

Hong Kong

Singapore

Source: UBS

TokyoSydney

bubble risk

overvalued

fair-valued

undervalued

depressed

83 87 91 95 99 03 07 11 15 19 23

Source: UBS

Historical development of index scores

Regional focus

12 UBS Global Real Estate Bubble Index 2023

Middle East

With housing prices sliding for seven straight years, the mar-

ket for owner-occupied housing in Dubai started recovering in

2021. The risk score has dropped signicantly over the course

of this 10-year period. In the last four quarters, housing prices

increased by a double-digit rate. Given strong income growth

and a red-hot rental market, with rental growth even surpass-

ing owner-occupied price growth, we see the market as fairly

valued. While Dubai is highly cyclical and prone to overbuild-

ing, price momentum should remain strong in the coming

quarters (see spotlight Dubai p. 21).

Between 2002 and 2022, real house prices in Tel Aviv tripled,

the highest growth of all cities we analyzed. Backed by falling

interest rates and accompanied by a housing shortage, the

housing price level in the city decoupled from the rental

market and prices in the rest of the country. Household

incomes could not keep up with prices, leading to stretched

aordability. It is no surprise, that rising mortgage rates during

2022 ended the party. Mortgage volume growth has more

than halved since last year. As a result, real price growth was

negative in the rst half of 2023. This moderate easing will

likely continue as there are no signs of a demand rebound.

Moreover, past eorts by the government to increase housing

supply may backre now, because unsold inventories have

been piling up amid a full construction pipeline.

Brazil

The period of sharply rising real estate prices in São Paulo

came to an abrupt halt in 2014. An economic recession,

strong housing supply expansion, and rising mortgage rates

triggered price declines. Since then, ination-adjusted housing

price growth has continuously remained in negative territory

and has stabilized only in recent quarters, roughly 25% below

the peak. While the willingness to pay has been supported by

a recovery of household incomes aer the pandemic, double-

digit mortgage rates have suocated demand for owner-

occupied housing. Hence, many have switched from owning

to renting, leading real rents to rise by almost 10% in the last

four quarters. This puts the market in fairly valued territory, in

our view. But the tide might be turning. Ination is coming

down and the central bank has already started a new period

of monetary easing. Although economic growth will likely

slow down, gradually improving nancing conditions could

boost the housing market in the coming quarters.

2.5

1.5

0.5

–0.5

–1.5

–2.5

Dubai Tel Aviv

87 91 95 99 03 07 11 15 19 23

Source: UBS

São Paulo

07 09 11 13 15 17 19 21 23

bubble risk

overvalued

fair-valued

undervalued

depressed

Source: UBS

Historical development of index scores

13 UBS Global Real Estate Bubble Index 2023

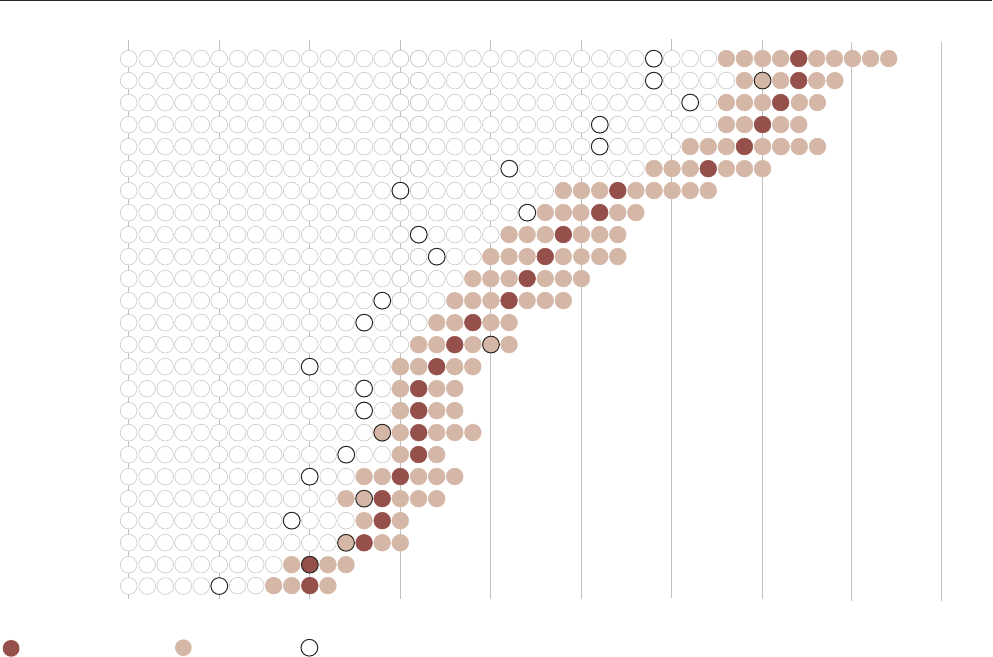

Although on average of the cities analyzed, house prices have

declined slightly and income growth has been relatively stable

over the last four quarters, aordability remains stretched in

many locations. Buying a 60 square meter (650 square foot)

apartment exceeds the budget of those who earn the average

annual income in the skilled service sector in most world cities.

In Hong Kong, even those earning twice this income would

struggle to aord an apartment of that size. House prices

remain decoupled from local incomes in Tokyo, Paris, Tel Aviv,

and London, where more than 10 times the annual income is

required to buy a 60 square meter at. Unaordable housing

oen signals strong foreign investment, tight zoning, and strict

rental market regulations. Weakening investment demand

increases the risk of a price correction and weighs on long-term

appreciation prospects.

By contrast, the average price-to-income ratio is much smaller

to purchase a small apartment in Miami, Madrid, and Toronto,

which makes the price level more sustainable in those cities.

Given relatively high incomes, purchasing a 60 square meter

apartment also looks relatively feasible for residents of Boston,

Los Angeles, Geneva, or Zurich.

For homebuyers, aordability depends primarily on mortgage

rates and amortization obligations. If interest and amortization

rates are relatively high, the burden on monthly income can be

heavy even in cities with low price-to-income multiples like

those in the US. Conversely, elevated purchase prices can be

sustained with relatively low interest rates and no requirement

of full amortization, as seen in Switzerland and the Netherlands.

The number of years a skilled service worker needs to work

to be able to buy a 60m

2

(650 sq) at near the city center

Hong Kong

To

kyo

Pari

s

Te

l Aviv

London

Singapor

e

Munic

h

São Paulo

New

York

Zurich

Geneva

Mila

n

Sydne

y

Amster

dam

Va

ncouver

Frankfurt

W

arsaw

Los Angele

s

Duba

i

Bosto

n

Stockholm

To

ronto

Madrid

San Francisc

o

Miami

Average value Range* Value in 2013

1 5 10 15 20 25 years

1 5 10 15 20 25 years

Source: UBS. Remark: For an explanation, see the section on Methodology & data on page 23.

The data is not comparable with previous years due to a comprehensive data revision.

* Uncertainty range due to differing data quality.

City benchmarks

Price-to-income

City benchmarks

14 UBS Global Real Estate Bubble Index 2023

Price-to-rent multiples declined on average compared to last

year, as rental growth outpaced price appreciation. That said,

almost a third of the cities covered have price-to-rent multiples

above or close to 30. The highest price-to-rent ratios are cur-

rently reported in Tel Aviv, Munich, and Hong Kong, followed

by Zurich, Geneva, and Frankfurt. Such high multiples come

from an excessive appreciation of housing prices in the wake

of previously low interest rates. House prices in all these cities

remain vulnerable to corrections should interest rates remain

elevated for longer or continue to rise further.

The US cities analyzed in the study exhibit some of the lowest

multiples among the markets analyzed. These reect, among

other things, above-average interest rates and relatively mildly

regulated rental markets. Conversely, rental laws in France,

Germany, and Sweden are strongly pro-tenant, keeping rents

below their true market levels, as reected in high price-to-

rent ratios.

However, elevated price-to-rent multiples may also show

expectations of rising prices, as is the case in Tel Aviv, Zurich,

or Munich. Investors expect to be compensated for very low

rental yields with capital gains. If these hopes do not material-

ize and expectations deteriorate, homeowners in markets with

high price-to-rent multiples are likely to suer signicant capi-

tal losses.

Price-to-rent

The number of years a at of the same size needs to be rented out to pay for the at

Tel Aviv

Hong Kong

Geneva

Zurich

Munich

Frankfurt

Tokyo

Paris

Sydney

Stockholm

Milan

Amsterdam

London

Singapore

Toronto

Vancouver

Boston

Madrid

New York

Los Angeles

São Paulo

San Francisco

Warsaw

Dubai

Miami

Average value Range* Value in 2013

5 10 15 20 25 30 35

5 10 15 20 25 30 35 40 45

40 45

50 years

50 years

Source: UBS. Remark: For an explanation, see the section on Methodology & data on page 23. The data is not comparable with previous years due to a comprehensive data revision.

* Uncertainty range due to differing data quality.

15 UBS Global Real Estate Bubble Index 2023

16 Zurich

17 Frankfurt

18 London

19 New York

20 Singapore

21 Dubai

City spotlights

16 UBS Global Real Estate Bubble Index 2023

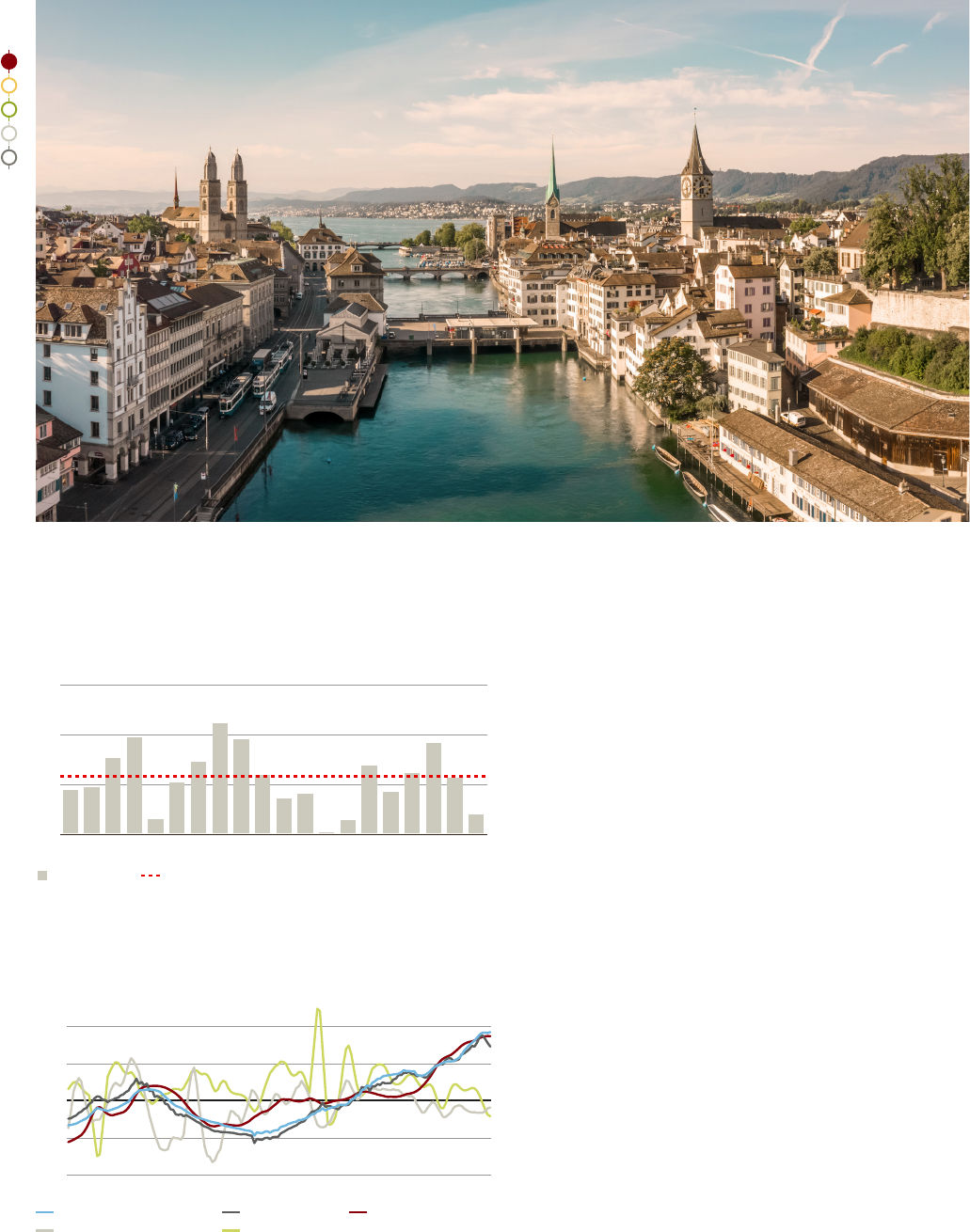

Zurich

Sticky prices

Home prices in Zurich continued to rise in 2023, albeit at a

slower pace than in previous years. Buyers of residential proper-

ties now pay 40% more in real terms than a decade ago. This

was signicantly more than on country average and stronger

than rents, which have risen by almost 12% since 2013. The

relationship between purchase prices and rents remains out of

balance—especially considering the higher interest rate environ-

ment. The market therefore stays in the bubble risk zone.

In recent quarters, however, imbalances have been slightly

reduced, as rental growth has accelerated sharply and nally

surpassed house price growth. At currently higher nancing

costs, purchasing a home only pays o nancially compared to

renting if its market value increases in the long run. Buy-to-let

investments have become unattractive. As a result, the supply of

available housing has climbed back to pre-pandemic levels and

the number of transactions has declined. For the coming quar-

ters, we do not expect to see any more price upside, contribut-

ing to lower imbalances.

A sharp price correction—as observed in other global nancial

centers—is generally rather unlikely. A signicant countrywide

drop in building permits supports the perception of property as

“concrete gold.” First, a persistently high share of money mar-

ket nancing suggests that many buyers expect interest rates to

decrease again in the mid-term. Second, the market size of the

owner-occupied housing segment is relatively small. And third,

the city is seeing strong employment growth in well-paying

industries. Hence, even though purchasing a home is nancially

not feasible for large parts of the local population, prices may

stay relatively elevated for longer.

Development of sub-indices

Standardized values

83 87 91 95 99 03 07 11 15 19 23

3.0

1.5

0

–1.5

–3.0

Price-income ratio

Price-rent ratio

Change in construction/GDP

Change in mortgage/GDP

City/country price ratio

Source: UBS

12

4

8

0

Annual house price growth rates

Nominal in %, as of 2

nd

quarter

year-over-year 20-year average

05 07 09 11 13 15 17 18 19 20 21 22 2304 06 08 10 12 14 16

Source: UBS

17 UBS Global Real Estate Bubble Index 2023

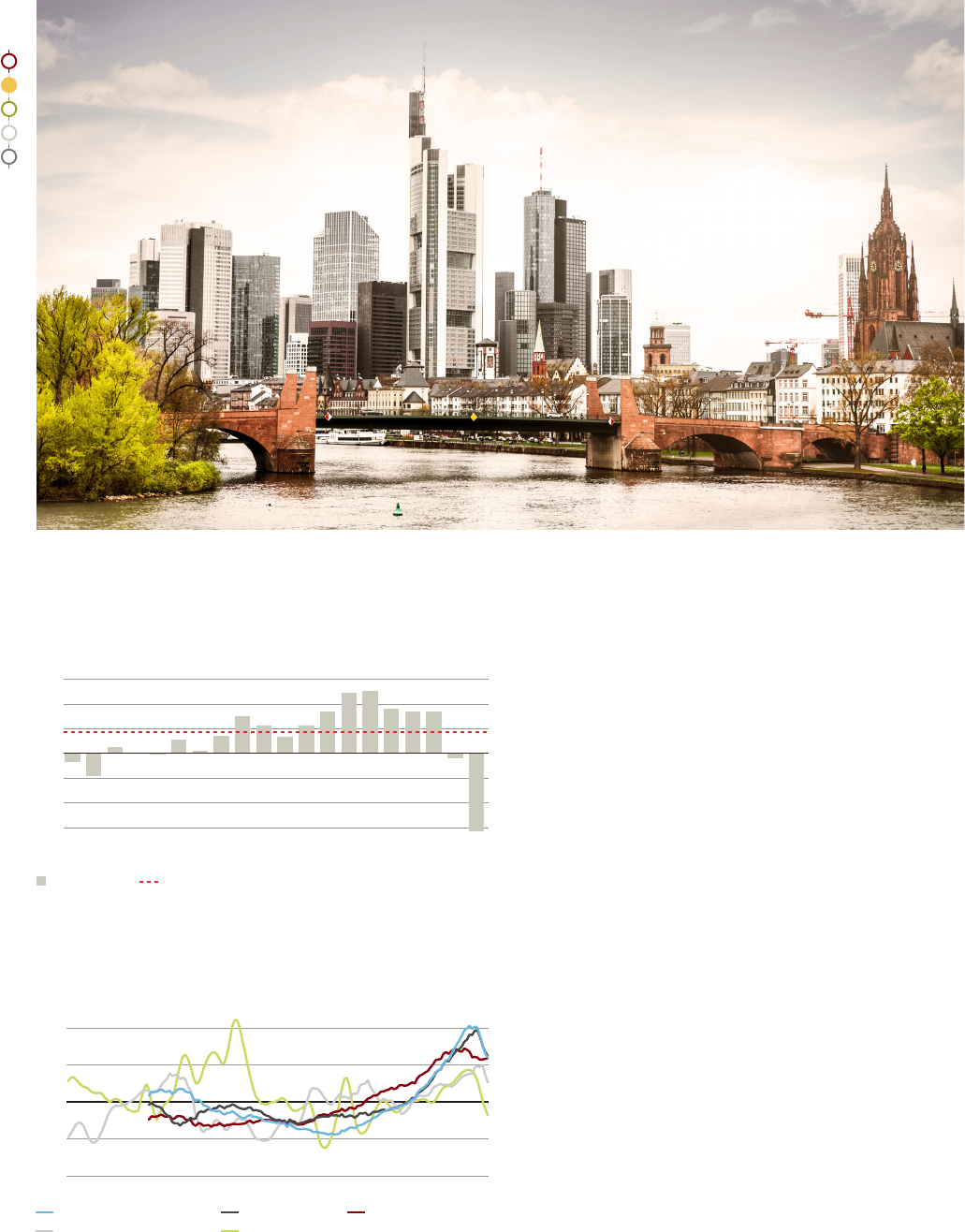

Frankfurt

Bottom not (yet) reached

According to the UBS Global Real Estate Bubble Index, Frank-

furt was among the cities with the highest real estate bubble

risk in recent years. But the sharp rise in mortgage interest

rates in Germany has abruptly ended that house price boom.

Adjusted for ination, prices have corrected by almost 20%

since the end of 2021. Higher nancing costs have also turned

buy-to-let purchases into lossmaking investments. Overall,

Frankfurt´s housing market is now in overvalued territory, in

our view.

The abrupt decline in the index score has two main causes.

First, rents and incomes have risen more sharply than house

prices in nominal terms, such that existing imbalances have

been reduced. Second, the growth of outstanding mortgage

volumes has slowed down.

The price correction is unlikely to be over yet, unless interest

rates fall again. Purchase prices are currently twice as high

as they were 10 years ago, while rents have risen “only”

40% during the same period. In fact, the sharp slowdown

in residential construction activity and the rising population

in Frankfurt suggest an exacerbated housing shortage as

well as accelerated rent increases in the future. But in view

of a weak economic outlook, additional demand is likely to

be concentrated in the lower-priced rental segment, at least

in the short term. Owners of old buildings may be confronted

with high renovation costs to improve energy efciency due

to nationwide regulatory requirements. This could lead to

additional discounts on property values.

Annual house price growth rates

Nominal in %, as of 2

nd

quarter

15

0

5

10

–15

–10

–5

year-over-year 20-year average

Source: UBS

05 07 09 11 13 15 17 18 19 20 21 22 2304 06 08 10 12 14 16

3.0

1.5

0

–1.5

–3.0

Sour

ce: UBS

83 87 91 95 99 03 07 11 15 19

23

Price-income ratio

Price-rent ratio

Change in construction/GDP

Change in mortgage/GDP

City/country price ratio

Development of sub-indices

Standar

dized values

18 UBS Global Real Estate Bubble Index 2023

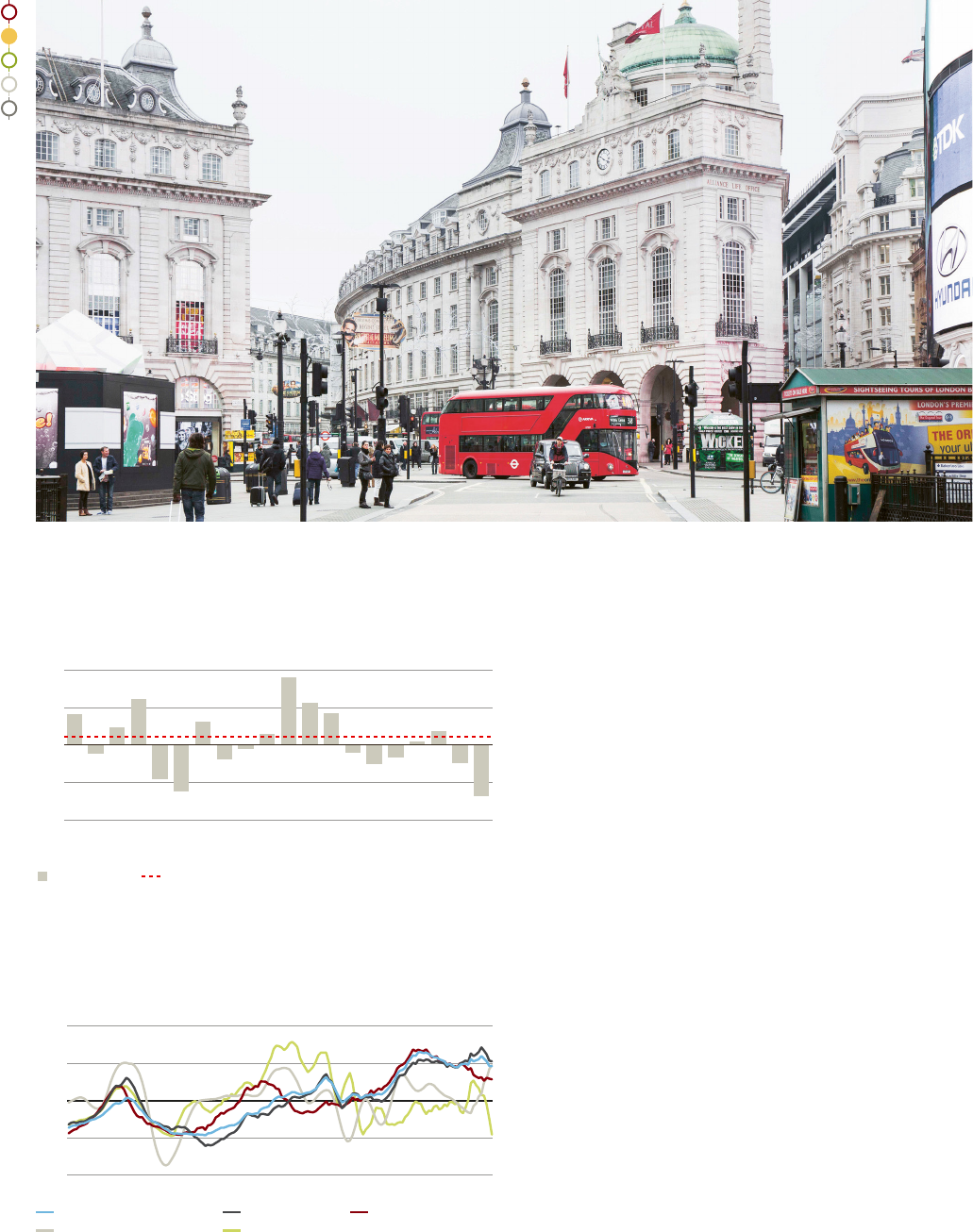

London

In no man’s land

Since reaching an all-time high in 2016, houses prices in Lon-

don have been falling in real terms, shedding a total of almost

25%. In the last four quarters alone, they declined by 14%,

which marks the strongest correction since the global nancial

crisis 15 years ago. As mortgage rates roughly tripled within a

few quarters, demand on the broad London housing market

has crumbled. The prime sector has been impacted to a lesser

degree by increasing mortgage rates as cash buyers dominate

the market. Nevertheless, prime prices were only just able to

hold their own without an inux of wealthy foreign buyers

and the pound sterling appreciating. Overall, the market risk

score according to the UBS Global Real Estate Bubble Index

has continued to fall, but remains in overvalued territory.

According to Nationwide, a building society, rst-time buyer

mortgage payments in UK’s capital city currently make up

roughly two-thirds of take-home pay—this value was less than

half only three years ago. Leveraged buy-to-let investments

have turned into lossmaking endeavors as landlords have not

been able to oset elevated nancing costs. Although rents

increased by 5% in nominal terms over the last four quarters,

they were outpaced by double-digit ination rates. Combined

with an economic slowdown, households have lost purchasing

power and are less willing to make long-term investments like

home purchases. Overall, the price correction to the higher

interest rate environment is not over yet. That said, the slow

expansion of housing supply keeps the market structurally

undersupplied, which limits the downside.

20

0

10

–20

–10

Annual house price growth rates

Nominal in %, as of 2

nd

quarter

year-over-year 20-year average

Source: UBS

05 07 09 11 13 15 17 18 19 20 21 22 2304 06 08 10 12 14 16

3.0

1.5

0

–1.5

–3.0

83 87 91 95 99 03 07 11 15 19 23

Price-income ratio

Price-rent ratio

Change in construction/GDP

Change in mortgage/GDP

City/country price ratio

Development of sub-indices

Standardized values

Source: UBS

19 UBS Global Real Estate Bubble Index 2023

New York

Surprise, surprise

The pandemic-induced rollercoaster ride of New York’s resi-

dential property market has largely come to an end. In 2021

and 2022, the Manhattan housing market recovered strongly

as restrictions were gradually lied and people came back

to the city. As supply is structurally tight and—more impor-

tantly—the market was not at bubble risk, the sharp interest

rate increases have only had a limited eect on local housing

prices. Between mid-2022 and mid-2023, for-sale prices

increased by more than 3% in ination-adjusted terms and

recouped all of the losses accumulated during the pandemic.

The luxury segment has also held up well, with sales prices rising

in nine of the past 10 quarters as the proliferation of all cash

buyers has helped bolster the market in the face of rising inter-

est rates. However, sales activity has signicantly declined since

the end of 2022 as the months of available supply and listing

discounts increased substantially, according to real estate rm

Douglas Elliman.

Overall, the New York residential property market is fairly

valued and expected to stay stable for the time being, in our

view. On the one hand, a combination of high interest rates,

economic uncertainty, and strained aordability limit upside

in the for-sale and for-rent segments over the coming quarters.

On the other, low vacancy rates and subdued construction

activity support current price and rental levels. This is unlikely

to change soon as expiration of tax incentive programs for

developers and elevated building costs combined with con-

cerns of additional adverse rent control legislation make new

development an unattractive risk-adjusted return proposition.

3.0

1.5

0

–1.5

–3.0

83 87 91 95 99 03 07 11 15 19 23

Price-income ratio

Price-rent ratio

Change in construction/GDP

Change in mortgage/GDP

City/country price ratio

Development of sub-indices

Standardized values

Source: UBS

15

0

5

10

–10

–5

Annual house price growth rates

Nominal in %, as of 2

nd

quarter

year-over-year 20-year average

Source: UBS

05 07 09 11 13 15 17 18 19 20 21 22 2304 06 08 10 12 14 16

20 UBS Global Real Estate Bubble Index 2023

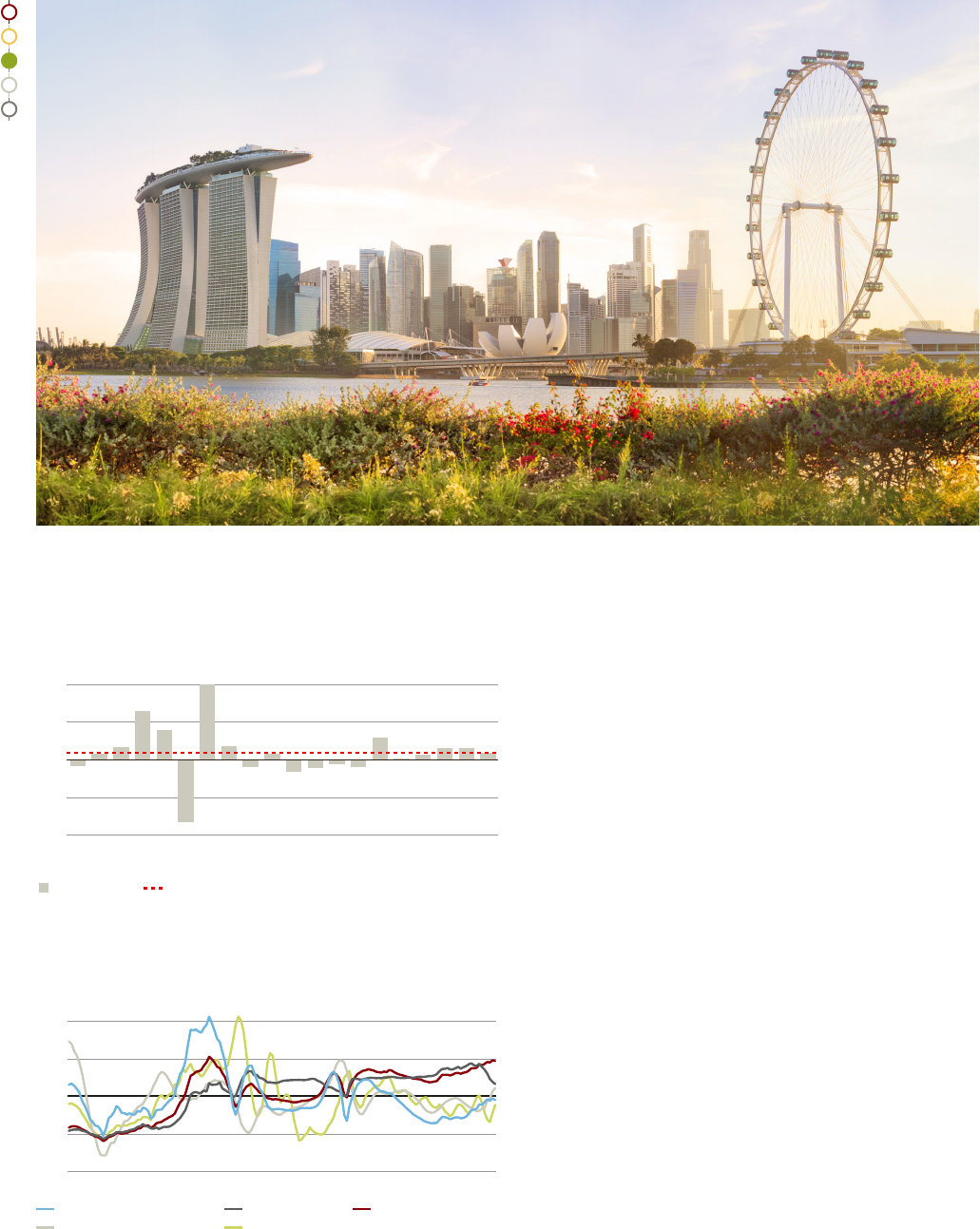

Singapore

Calmer waters ahead

Singapore’s private residential market continues to benet

from the city’s safe-haven reputation amid geopolitical ten-

sions attracting expats, wealthy investors, and new businesses.

Younger generations seek their own apartments, creating

additional housing needs. Despite strong demand for living

space, the housing market has le overvalued territory and

we newly classify it as fairly valued.

Rental growth has been accelerating since 2021 and is outpac-

ing house prices by now. Currently, tenants pay almost 25%

higher rents than a year ago, the highest ination-adjusted

increase among all cities analyzed. In contrast, price dynamics

in the private market have slowed down in recent quarters and

house prices increased by only 3% in ination-adjusted terms

between mid-2022 and mid-2023. That said, we expect rents

to soen going forward, as supply constraints induced by pan-

demic lockdowns ease and physical housing completions

grow. Rental demand should also moderate as the bulk of

post-pandemic international relocations is now behind us.

The housing market cooling measures introduced in recent

years are starting to take eect. Stamp duties for foreigners

have been raised to 60%—the highest globally—signicantly

curtailing foreign demand. Also locals are contending with

tighter policies: Lower loan-to-value ratios, tighter debt servicing

ratios, and rising mortgage rates have dampened both

demand and aordability. Going forward, we expect home

price growth to moderate and rents to fall as housing supply

ramps up and demand stabilizes. Buy-to-let investors must

keep regulatory risks in mind, as the government has not ruled

out rental market regulations in the future.

30

0

15

–30

–15

Annual house price growth rates

Nominal in %, as of 2

nd

quarter

year-over-year 20-year average

Source: UBS

05 07 09 11 13 15 17 18 19 20 21 22 2304 06 08 10 12 14 16

3.0

1.5

0

–1.5

–3.0

83 87 91 95 99 03 07 11 15 19 23

Price-income ratio

Price-rent ratio

Change in construction/GDP

Change in mortgage/GDP

Real price

Development of sub-indices

Standardized values

Source: UBS

Remark: The analysis refers to the private residential market only.

21 UBS Global Real Estate Bubble Index 2023

Dubai

Windfall prots

The seven-year long drought of falling real estate prices has

become a distant memory. Prices have been booming since

2021 and increased by 15% in ination-adjusted terms

between mid-2022 and mid-2023, the highest growth rate

among all cities analyzed in the study. Price increases in the

luxury segment were even stronger.

Dubai has attracted real estate investors globally. A new visa

program with looser residency requirements aimed at wealthy

and skilled individuals, no personal income tax, and early li-

ing of travel restrictions during the pandemic have stimulated

immigration. Moreover, supported by higher commodity

prices, Dubai has seen strong economic and household

income growth since 2021, topping other cities. Consequently,

residential transaction volumes have gone through the roof,

breaking all-time highs. Nevertheless, ination-adjusted prices

are around 25% below their 2014 peak. Furthermore, as many

newcomers rent before potentially buying in the future, rents

have increased by 20% in ination-adjusted terms over the

last four quarters. As a result, the market remains in fair value

territory, in our view.

We expect weakening momentum in the coming quarters.

Although the market is largely nanced by cash purchases,

increased mortgage interest rates will take their toll. An ongo-

ing strong expansion of supply—particularly of apartments—is

also likely to limit price growth. Finally, buyers’ willingness to

pay may abate against the backdrop of a global economic

slowdown. That said, the markets outlook remains dependent

on geopolitical developments.

30

0

15

–30

–15

Annual house price growth rates

Nominal in %, as of

2

nd

quarter

year-over-year 20-year average

Source: UBS

05 07 09 11 13 15 17 18 19 20 21 22 2304 06 08 10 12 14 16

03 05 07 09 11 13 15 17 19 21 23

3.0

1.5

0

–1.5

–3.0

Price-income ratio

Price-rent ratio

Change in construction/GDP

Change in mortgage/GDP

Real price

Development of sub-indices

Standardized values

Source: UBS

22 UBS Global Real Estate Bubble Index 2023

UBS Global Real Estate Bubble Index Real price growth Real rental growth

Total Sub-indices Annualized, in % Annualized, in %

Rank City

Score

Assessment

Price / Income

Price / Rent

City / Country

1

Mortgage

2

Construction

2

Last year

Last 10 years

Last year

Last 10 years

1 Zurich 1.71

l l l l l l

1.5 3.4 6.9 1.2

2

Tokyo

1.65

l l l l l l

3.6 4.8 –3.7 0.1

3

Miami

1.38

l l l l l l

6.0 7.6 2.0 3.8

4 Munich 1.35

l l l l l l

–13.8 4.6 –3.1 2.1

5 Frankfurt 1.27

l l l l l l

–15.9 4.8 –4.3 1.2

6

Hong Kong

1.24

l l l l l l

–7.1 0.8 –1.6 –1.2

7 Toronto 1.21

l l l l l l

–14.7 5.7 6.0 2.2

8 Geneva 1.13

l l l l l l

–0.1 1.1 1.1 –0.2

9 Los Angeles 1.03

l l l l l l

–3.7 5.0 –1.4 2.1

10

London

0.98

l l l l l l

–13.9 0.9 –5.2 –2.2

11

Tel Aviv

0.93

l l l l l l

–0.7 4.5 2.8 2.2

12 Vancouver 0.81

l l l l l l

–10.6 4.8 10.7 2.9

13 Amsterdam 0.80

l l l l l l

–14.0 5.2 4.1 2.1

14

Stockholm

0.74

l l l l l l

–22.1 2.4 –4.9 0.2

15 Paris 0.73

l l l l l l

–7.9 0.6 –1.3 –0.7

16 Sydney 0.67

l l l l l l

–10.5 3.9 2.8 0.9

17 Milan 0.49

l l l l l l

–1.9 –1.0 –2.4 –1.1

18 New York 0.47

l l l l l l

3.2 1.3 –1.5 –0.8

19

Singapore

0.47

l l l l l l

2.8 0.9 23.0 1.8

20 Madrid 0.46

l l l l l l

2.9 2.3 7.6 1.5

21 Boston 0.34

l l l l l l

–3.4 3.5 1.1 2.1

22

San Francisco

0.27

l l l l l l

–10.6 2.7 –3.1 –0.4

23 Dubai 0.14

l l l l l l

14.6 –0.1 20.3 –0.2

24 São Paulo 0.09

l l l l l l

1.4 –2.1 9.0 –2.5

25 Warsaw –0.28

l l l l l l

–9.3 1.8 2.0 0.4

l

Bubble risk (above 1.5 standard deviations)

l

Overvalued (between 0.5 and 1.5 standard deviations)

l

Fair-valued (between –0.5 and 0.5 standard deviations)

lUndervalued (below –0.5 standard deviations)

1

Price ratio. For Hong Kong, Singapore and Dubai real prices.

2

Compared to GDP, annual change

Source: UBS

City overview

23 UBS Global Real Estate Bubble Index 2023

Methodology & data

The UBS Global Real Estate Bubble Index traces the funda-

mental valuation of housing markets and the valuation of

cities in relation both to their country and to economic distor-

tions (lending and building booms). Tracking current values,

the index uses the following risk-based classications:

depressed (score below –1.5), undervalued (–1.5 to –0.5),

fair-valued (–0.5 to 0.5), overvalued (0.5 to 1.5), and bubble

risk (above 1.5). This classication is aligned with historical

bubble episodes. We cannot predict if or when a correction

will hap pen. Hence, “bubble risk” refers to the preva lence of

a high risk of a large price correction.

The index score is a weighted average of the following ve

standardized city sub-indices: price-to-income and price-to-

rent ratios (fundamental valuation), change in mortgage-to-

GDP ratio and change in construction-to-GDP ratio (economic

distortion), and city-to-country price ratio. The city-to-country

price ratio in Singapore, Hong Kong, and Dubai is replaced by

an ination-adjusted price index. The approach cannot fully

account for the complexity of the bubble phenomenon.

The sub-indices are constructed from specic city-level data,

except for mortgage-to-GDP and construction-to-GDP ratios,

which are calculated on the country level. In most cases, pub-

licly available data is used. But in a few cases, the data consists

of, or is supplemented by additional sources, including the

results of the UBS Prices and Earnings survey. The index length

varies by city depending on data availability. The longest data

series starts in 1980, the shortest in 2009. For time series

shorter than 30 years, the coefcient of variation of an

equivalent indicator on the country level is used as a oor

value to calculate the volatility of the city-level indicator

(subject to availability). We also took into account the availability

of data when deciding which cities to include in the index.

We considered the importance of the city for global nancial

markets and residential real estate investments. Please see the

description of data sources on page 24.

The weights of the sub-indices are determined using factor

analysis, as recommended by the OECD Handbook on

Constructing Composite Indicators (2008). Factor analysis

weights the sub-indices to capture as much of the common

underlying bubble risk information as possible. As the drivers

of bubbles vary across cities, this method results in city-specic

weights on sub-indices. To prevent overweighting country level

variables and to increase the comparability of cities, the devia-

tion from the average weight across all cities is limited.

Weights adjusted this way approximate the average factor

analysis weight of single indices across the cities and comple-

ment the calculation. The nal weights are subject to minor

changes when new data enters the calculation or past data

is revised.

Benchmarking

The analysis is complemented by a city benchmarking using

current price-to-income and price-to-rent ratios. The price-to-

income ratio indicates how many years a skilled service worker

needs to work to be able to buy a 60 square meter (650

square foot) at near the city center. The price-to-rent ratio

signals how expensive owner-occupied homes are relative to

rental apartments. The higher the ratios, the more expensive

buying becomes. Earnings data is taken primarily from the

UBS Prices and Earnings survey and from ofcial statistical

sources. Real estate prices and rents vary widely near the city

center. Our estimates are cross-checked, validated using dier-

ent sources, and are updated and challenged on an annual

basis. However, we also specify an uncertainty range due to

the diering quality of data sources.

Methodology & data

24 UBS Global Real Estate Bubble Index 2023

Data sources

Price Index

(City)

Rent Index

(City)

Income Index

(City)

Price Index

(Country)

Mortgage, Construction,

GDP, Ination (Country)

Amsterdam 2023Q2 CBS, Maastricht

University

NVM, UBS P&E UBS P&E, CBS CBS, FED Dallas DNB, CBS, EUKLEMS,

Bloomberg

Boston 2023Q2 FHFA, S&P/Shiller CBRE, FED St. Louis BEA FHFA FED, BEA, Bloomberg

Dubai 2023Q2 Reidin, BIS Reidin, UBS P&E UBS P&E, Morgan

Stanley, Bloomberg

– Central Bank UAE, Dubai

Statistics Center,

Morgan Stanley, Bloomberg

Frankfurt 2023Q2 Bulwiengesa Bulwiengesa, OECD Destatis, UBS P&E,

OECD

FED Dallas Deutsche Bundesbank,

Destatis, EUKLEMS, Bloomberg

Geneva 2023Q2 Wüest Partner Statistique Genève FTA, FSO Wüest Partner SNB, SECO, FSO

Hong Kong 2023Q2 RVD RVD Census and Statistics

Department Hong

Kong, Bloomberg

– Census and Statistics Depart-

ment Hong Kong, HKMA,

Macrobond, Bloomberg

London 2023Q2 Nationwide ONS, UBS P&E ONS Nationwide BoE, ONS, EUKLEMS,

Bloomberg

Los Angeles 2023Q2 FHFA, S&P/Shiller CBRE, FED St. Louis BEA FHFA FED, BEA, Bloomberg

Madrid 2023Q2 BoS Ayuntamiento de

Madrid

INE BoS INE, BoS, EUKLEMS, Bloomberg

Miami 2023Q2 FHFA, S&P/Shiller CBRE, FED St. Louis BEA FHFA FED, BEA, Bloomberg

Milan 2023Q2 Nomisma Nomisma, OECD Dipartimento delle

Finanze, UBS P&E

FED Dallas Banca d’Italia, Hypostat, Istat,

EUKLEMS, Macrobond,

Bloomberg

Munich 2023Q2 Bulwiengesa Bulwiengesa, OECD Destatis, UBS P&E,

OECD

FED Dallas Deutsche Bundesbank,

Destatis, EUKLEMS, Bloomberg

New York 2023Q2 FHFA, S&P/Shiller CBRE, CoStar, FED

St. Louis

BEA FHFA FED, BEA, Bloomberg

Paris 2023Q2 BIS, CGEDD Insee Insee, Bloomberg,

UBS P&E

FED Dallas BdF, Insee, EUKLEMS, Macro-

bond, Bloomberg

San Francisco 2023Q2 FHFA, S&P/Shiller CBRE, FED St. Louis BEA FHFA FED, BEA, Bloomberg

São Paulo 2023Q2 Fipe Fipe Fundação Seade Fipe Banco do Brasil, IBGE,

Bloomberg

Singapore 2023Q2 Government of

Singapore

Government of

Singapore, UBS P&E

Government

of Singapore

– Government of Singapore,

Bloomberg

Stockholm 2023Q2 Statistics Sweden,

Valueguard

Statistics Sweden,

UBS P&E

Statistics Sweden,

UBS P&E

Statistics Sweden Statistics Sweden, Bloomberg

Sydney 2023Q2 REIA, ABS REIA, NSW Govern-

ment, UBS P&E

ABS, UBS P&E FED Dallas ABS, RBA, Bloomberg

Tel Aviv 2023Q2 CBS CBS, UBS P&E CBS, UBS P&E FED Dallas BoI, Bloomberg

Tokyo 2023Q2 The Real Estate

Transaction Promo-

tion Center, Haver

Analytics

Miki Syoji, Ofcial

Statistics of Japan

INDB, Tokyo Metro-

politan Government,

UBS P&E

FED Dallas ESRI, EUKLEMS, Bloomberg

Toronto 2023Q2 Sauder School

of Business UBC,

Bloomberg

Canadian Housing

Observer, Sauder

School of Business

UBC

Statistics Canada FED Dallas Statistics Canada, BoC,

Bloomberg

Vancouver 2023Q2 Sauder School

of Business UBC,

Bloomberg

Canadian Housing

Observer, Sauder

School of Business

UBC

Statistics Canada,

Government

of British Columbia

FED Dallas Statistics Canada, BoC,

Bloomberg

Warsaw 2023Q2 National Bank

of Poland

National Bank of

Poland

Statistics Poland National Bank

of Poland

National Bank of Poland,

Statistics Poland, Bloomberg

Zurich 2023Q2 Wüest Partner Statistik Stadt

Zürich

FTA, FSO Wüest Partner SNB, SECO, FSO

25 UBS Global Real Estate Bubble Index 2023

Disclaimer

UBS Chief Investment Ofce’s (“CIO”) investment views are prepared and published by the Global Wealth Management business

of UBS Switzerland AG (regulated by FINMA in Switzerland) or its afliates (“UBS”), part of UBS Group AG (“UBS Group”). UBS

Group includes Credit Suisse AG, its subsidiaries, branches and afliates. Additional disclaimer relevant to Credit Suisse Wealth

Management follows at the end of this section.

The investment views have been prepared in accordance with legal requirements designed to promote the independence of

investment research.

Generic investment research – Risk information:

This publication is for your information only and is not intended as an oer, or a solicitation of an oer, to buy or sell any invest-

ment or other specic product. The analysis contained herein does not constitute a personal recommendation or take into account

the particular investment objectives, investment strategies, nancial situation and needs of any specic recipient. It is based on

numerous assumptions. Dierent assumptions could result in materially dierent results. Certain services and products are subject

to legal restrictions and cannot be oered worldwide on an unrestricted basis and/or may not be eligible for sale to all investors.

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but

no representation or warranty, express or implied, is made as to its accuracy or completeness (other than disclosures relating to

UBS). All information and opinions as well as any forecasts, estimates and market prices indicated are current as of the date of this

report, and are subject to change without notice. Opinions expressed herein may dier or be contrary to those expressed by other

business areas or divisions of UBS as a result of using dierent assumptions and/or criteria.

In no circumstances may this document or any of the information (including any forecast, value, index or other calculated amount

(“Values”)) be used for any of the following purposes (i) valuation or accounting purposes; (ii) to determine the amounts due or

payable, the price or the value of any nancial instrument or nancial contract; or (iii) to measure the performance of any nancial

instrument including, without limitation, for the purpose of tracking the return or performance of any Value or of dening the asset

allocation of portfolio or of computing performance fees. By receiving this document and the information you will be deemed to

represent and warrant to UBS that you will not use this document or otherwise rely on any of the information for any of the above

purposes. UBS and any of its directors or employees may be entitled at any time to hold long or short positions in investment

instruments referred to herein, carry out transactions involving relevant investment instruments in the capacity of principal or agent,

or provide any other services or have ofcers, who serve as directors, either to/for the issuer, the investment instrument itself or to/

for any company commercially or nancially afliated to such issuers. At any time, investment decisions (including whether to buy,

sell or hold securities) made by UBS and its employees may dier from or be contrary to the opinions expressed in UBS research

publications. Some investments may not be readily realizable since the market in the securities is illiquid and therefore valuing the

investment and identifying the risk to which you are exposed may be difcult to quantify. UBS relies on information barriers to

control the ow of information contained in one or more areas within UBS, into other areas, units, divisions or afliates of UBS.

Futures and options trading is not suitable for every investor as there is a substantial risk of loss, and losses in excess of an initial

investment may occur. Past performance of an investment is no guarantee for its future performance. Additional information will

be made available upon request. Some investments may be subject to sudden and large falls in value and on realization you may

receive back less than you invested or may be required to pay more. Changes in foreign exchange rates may have an adverse eect

on the price, value or income of an investment. The analyst(s) responsible for the preparation of this report may interact with trad-

ing desk personnel, sales personnel and other constituencies for the purpose of gathering, synthesizing and interpreting market

information.

Dierent areas, groups, and personnel within UBS Group may produce and distribute separate research products independently

of each other. For example, research publications from CIO are produced by UBS Global Wealth Management. UBS Global

Research is produced by UBS Investment Bank. Credit Suisse Global CIO Ofce Research is produced by Credit Suisse Wealth

Management. Credit Suisse Securities Research is produced by Credit Suisse operating under its Securities Research function

within the Investment Banking Division. Research methodologies and rating systems of each separate research organiza-

tion may dier, for example, in terms of investment recommendations, investment horizon, model assumptions, and valuation

methods. As a consequence, except for certain economic forecasts (for which UBS CIO and UBS Global Research may collaborate),

investment recommendations, ratings, price targets, and valuations provided by each of the separate research organizations may

be dierent, or inconsistent. You should refer to each relevant research product for the details as to their methodologies and rating

system. Not all clients may have access to all products from every organization. Each research product is subject to the policies and

procedures of the organization that produces it.

The compensation of the analyst(s) who prepared this report is determined exclusively by research management and senior man-

agement (not including investment banking). Analyst compensation is not based on investment banking, sales and trading or

principal trading revenues, however, compensation may relate to the revenues of UBS Group as a whole, of which investment

banking, sales and trading and principal trading are a part.

Tax treatment depends on the individual circumstances and may be subject to change in the future. UBS does not provide legal or

tax advice and makes no representations as to the tax treatment of assets or the investment returns thereon both in general or with

reference to specic client’s circumstances and needs. We are of necessity unable to take into account the particular investment

objectives, nancial situation and needs of our individual clients and we would recommend that you take nancial and/or tax advice

as to the implications (including tax) of investing in any of the products mentioned herein.

This material may not be reproduced or copies circulated without prior authority of UBS. Unless otherwise agreed in writing UBS

expressly prohibits the distribution and transfer of this material to third parties for any reason. UBS accepts no liability whatsoever

for any claims or lawsuits from any third parties arising from the use or distribution of this material. This report is for distribution

26 UBS Global Real Estate Bubble Index 2023

Disclaimer

only under such circumstances as may be permitted by applicable law. For information on the ways in which CIO manages conicts

and maintains independence of its investment views and publication oering, and research and rating methodologies, please visit

www.ubs.com/research-methodology. Additional information on the relevant authors of this publication and other CIO publica-

tion(s) referenced in this report; and copies of any past reports on this topic; are available upon request from your client advisor.

Important Information About Sustainable Investing Strategies: Sustainable investing strategies aim to consider and incorpo-

rate environmental, social and governance (ESG) factors into investment process and portfolio construction. Strategies across

geographies approach ESG analysis and incorporate the ndings in a variety of ways. Incorporating ESG factors or Sustainable

Investing considerations may inhibit UBS’s ability to participate in or to advise on certain investment opportunities that otherwise

would be consistent with the Client’s investment objectives. The returns on a portfolio incorporating ESG factors or Sustainable

Investing considerations may be lower or higher than portfolios where ESG factors, exclusions, or other sustainability issues are not

considered by UBS, and the investment opportunities available to such portfolios may dier.

External Asset Managers / External Financial Consultants: In case this research or publication is provided to an External Asset

Manager or an External Financial Consultant, UBS expressly prohibits that it is redistributed by the External Asset Manager or the

External Financial Consultant and is made available to their clients and/or third parties.

USA: Distributed to US persons only by UBS Financial Services Inc. or UBS Securities LLC, subsidiaries of UBS AG. UBS Switzerland

AG, UBS Europe SE, UBS Bank, S.A., UBS Brasil Administradora de Valores Mobiliarios Ltda, UBS Asesores Mexico, S.A. de C.V., UBS

SuMi TRUST Wealth Management Co., Ltd., UBS Wealth Management Israel Ltd and UBS Menkul Degerler AS are afliates of UBS

AG. UBS Financial Services Inc. accepts responsibility for the content of a report prepared by a non-US afliate when it

distributes reports to US persons. All transactions by a US person in the securities mentioned in this report should be

eected through a US-registered broker dealer afliated with UBS, and not through a non-US afliate. The contents

of this report have not been and will not be approved by any securities or investment authority in the United States

or elsewhere. UBS Financial Services Inc. is not acting as a municipal advisor to any municipal entity or obligated per-

son within the meaning of Section 15B of the Securities Exchange Act (the “Municipal Advisor Rule”) and the opinions

or views contained herein are not intended to be, and do not constitute, advice within the meaning of the Municipal

Advisor Rule

For country information, please visit ubs.com/cio-country-disclaimer-gr or ask your client advisor for the full disclaimer.

Additional Disclaimer relevant to Credit Suisse Wealth Management

You receive this document in your capacity as a client of Credit Suisse Wealth Management. Your personal data will be processed

in accordance with the Credit Suisse privacy statement accessible at your domicile through the ofcial Credit Suisse website

https://www.credit-suisse.com. In order to provide you with marketing materials concerning our products and services, UBS Group

AG and its subsidiaries may process your basic personal data (i.e. contact details such as name, e-mail address) until you notify us

that you no longer wish to receive them. You can optout from receiving these materials at any time by informing your Relationship

Manager.

Except as otherwise specied herein and/or depending on the local Credit Suisse entity from which you are receiving this report,

this report is distributed by Credit Suisse AG, authorised and regulated by the Swiss Financial Market Supervisory Authority (FINMA).

Credit Suisse AG is a UBS Group company.

Version C/2023. CIO82652744

© UBS 2023. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.