The Rate of Return on Everything, 1870–2015

?

`

Oscar Jord

`

a

†

Katharina Knoll

‡

Dmitry Kuvshinov

§

Moritz Schularick

¶

Alan M. Taylor

z

March 2019

Abstract

What is the aggregate real rate of return in the economy? Is it higher than the growth

rate of the economy and, if so, by how much? Is there a tendency for returns to fall in

the long-run? Which particular assets have the highest long-run returns? We answer

these questions on the basis of a new and comprehensive dataset for all major asset

classes, including housing. The annual data on total returns for equity, housing, bonds,

and bills cover 16 advanced economies from 1870 to 2015, and our new evidence reveals

many new findings and puzzles.

Keywords: return on capital, interest rates, yields, dividends, rents, capital gains, risk

premiums, household wealth, housing markets.

JEL classification codes: D31, E44, E10, G10, G12, N10.

?

This work is part of a larger project kindly supported by research grants from the Bundesministerium

f

¨

ur Bildung und Forschung (BMBF) and the Institute for New Economic Thinking (INET). We are indebted

to a large number of researchers who helped with data on individual countries. We are especially grateful

to Francisco Amaral for outstanding research assistance, and would also like to thank Felix Rhiel, Mario

Richarz, Thomas Schwarz, Lucie Stoppok, and Yevhenii Usenko for research assistance on large parts of the

project. For their helpful comments we thank the editors and referees, along with Roger Farmer, John Fernald,

Philipp Hofflin, David Le Bris, Clara Mart

´

ınez-Toledano, Emi Nakamura, Thomas Piketty, Matthew Rognlie,

J

´

on Steinsson, Johannes Stroebel, and Stijn Van Nieuwerburgh. We likewise thank conference participants

at the NBER Summer Institute EFG Program Meeting, the Brevan Howard Centre for Financial Analysis at

Imperial College Business School, the CEPR Housing Conference, and CEPR ESSIM at the Norges Bank, as

well as seminar participants at Banca d’Italia, the Bank of England, Reserve Bank of New Zealand, Cornell

University, New York University, University of Illinois at Urbana-Champaign, University of Chicago Booth

School of Business, UC Berkeley, UCLA Anderson, Research Center SAFE, SciencesPo, and the Paris School

of Economics. All errors are our own. The views expressed herein are solely the responsibility of the authors

and should not be interpreted as reflecting the views of the Federal Reserve Bank of San Francisco, the Board

of Governors of the Federal Reserve System, or the Deutsche Bundesbank.

†

Federal Reserve Bank of San Francisco; and Department of Economics, University of California, Davis

(oscar[email protected]; ojorda@ucdavis.edu).

‡

§

¶

z

Department of Economics and Graduate School of Management, University of California, Davis; NBER;

and CEPR (amtaylor@ucdavis.edu).

I. Introduction

What is the rate of return in an economy? It is a simple question, but hard to answer. The rate

of return plays a central role in current debates on inequality, secular stagnation, risk premiums,

and the decline in the natural rate of interest, to name a few. A main contribution of our paper is

to introduce a large new dataset on the total rates of return for all major asset classes, including

housing—the largest, but oft ignored component of household wealth. Our data cover most

advanced economies—sixteen in all—starting in the year 1870.

Although housing wealth is on average roughly one half of national wealth in a typical economy

(Piketty, 2014), data on total housing returns (price appreciation plus rents) has been lacking (Shiller,

2000, provides some historical data on house prices, but not on rents). In this paper we build on more

comprehensive work on house prices (Knoll, Schularick, and Steger, 2017) and newly constructed

data on rents (Knoll, 2017) to enable us to track the total returns of the largest component of the

national capital stock.

We further construct total returns broken down into investment income (yield) and capital gains

(price changes) for four major asset classes, two of them typically seen as relatively risky—equities

and housing—and two of them typically seen as relatively safe—government bonds and short-term

bills. Importantly, we compute actual asset returns taken from market data and therefore construct

more detailed series than returns inferred from wealth estimates in discrete benchmark years for a

few countries as in Piketty (2014).

We also follow earlier work in documenting annual equity, bond, and bill returns, but here

again we have taken the project further. We re-compute all these measures from original sources,

improve the links across some important historical market discontinuities (e.g., market closures and

other gaps associated with wars and political instability), and in a number of cases we access new

and previously unused raw data sources. In all cases, we have also brought in auxiliary sources to

validate our data externally, and 100+ pages of online material documents our sources and methods.

Our work thus provides researchers with the first broad non-commercial database of historical

equity, bond, and bill returns—and the only database of housing returns—with the most extensive

coverage across both countries and years.

1

Our paper aims to bridge the gap between two related strands of the academic literature. The

first strand is rooted in finance and is concerned with long-run returns on different assets. Dimson,

Marsh, and Staunton (2009) probably marked the first comprehensive attempt to document and

analyze long-run returns on investment for a broad cross-section of countries. Meanwhile, Homer

and Sylla (2005) pioneered a multi-decade project to document the history of interest rates.

The second related strand of literature is the analysis of comparative national balance sheets over

time, as in Goldsmith (1985a). More recently, Piketty and Zucman (2014) have brought together data

1

For example, our work complements and extends the database on equity returns by Dimson, Marsh, and

Staunton (2009). Their dataset is commercially available, but has a shorter coverage and does not break down

the yield and capital gain components.

1

from national accounts and other sources tracking the development of national wealth over long

time periods. They also calculate rates of return on capital by dividing aggregate capital income in

the national accounts by the aggregate value of capital, also from national accounts.

Our work is both complementary and supplementary to theirs. It is complementary as the asset

price perspective and the national accounts approach are ultimately tied together by accounting

rules and identities. Using market valuations, we are able to corroborate and improve the estimates

of returns on capital that matter for wealth inequality dynamics. Our long-run return data are

also supplementary to the work of Piketty and Zucman (2014) in the sense that we greatly extend

the number of countries for which we can calculate real rates of return back to the late nineteenth

century.

The new evidence we gathered can shed light on active research debates, reaching from asset

pricing to inequality. For example, in one contentious area of research, the accumulation of capital,

the expansion of capital’s share in income, and the growth rate of the economy relative to the rate

of return on capital all feature centrally in the current debate sparked by Piketty (2014) on the

evolution of wealth, income, and inequality. What do the long-run patterns on the rates of return on

different asset classes have to say about these possible drivers of inequality?

In many financial theories, preferences over current versus future consumption, attitudes toward

risk, and covariation with consumption risk all show up in the premiums that the rates of return

on risky assets carry over safe assets. Returns on different asset classes and their correlations with

consumption sit at the core of the canonical consumption-Euler equation that underpins textbook

asset pricing theory (see, e.g., Mehra and Prescott, 1985). But tensions remain between theory and

data, prompting further explorations of new asset pricing paradigms including behavioral finance.

Our new data add another risky asset class to the mix, housing, and with it, new challenges.

In another strand of research triggered by the financial crisis, Summers (2014) seeks to revive the

secular stagnation hypothesis first advanced in Alvin Hansen’s (1939) AEA Presidential Address.

Demographic trends are pushing the world’s economies into uncharted territory as the relative

weight of borrowers and savers is changing and with it the possibility increases that the interest rate

will fall by an insufficient amount to balance saving and investment at full employment. What is the

evidence that this is the case?

Lastly, in a related problem within the sphere of monetary economics, Holston, Laubach, and

Williams (2017) show that estimates of the natural rate of interest in several advanced economies have

gradually declined over the past four decades and are now near zero. What historical precedents

are there for such low real rates that could inform today’s policymakers, investors, and researchers?

The common thread running through each of these broad research topics is the notion that the

rate of return is central to understanding long-, medium-, and short-run economic fluctuations.

But which rate of return? And how do we measure it? For a given scarcity of funding supply, the

risky rate is a measure of the profitability of private investment; in contrast, the safe rate plays an

important role in benchmarking compensation for risk, and is often tied to discussions of monetary

policy settings and the notion of the natural rate. Below, we summarize our main findings.

2

Main findings We present four main findings:

1. On risky returns, r

risky

In terms of total returns, residential real estate and equities have shown very similar and

high real total gains, on average about 7% per year. Housing outperformed equities before

WW2. Since WW2, equities have outperformed housing on average, but had much higher

volatility and higher synchronicity with the business cycle. The observation that housing

returns are similar to equity returns, but much less volatile, is puzzling. Like Shiller (2000),

we find that long-run capital gains on housing are relatively low, around 1% p.a. in real

terms, and considerably lower than capital gains in the stock market. However, the rental

yield component is typically considerably higher and more stable than the dividend yield of

equities so that total returns are of comparable magnitude.

Before WW2, the real returns on housing and equities (and safe assets) followed remarkably

similar trajectories. After WW2 this was no longer the case, and across countries equities then

experienced more frequent and correlated booms and busts. The low covariance of equity and

housing returns reveals that there could be significant aggregate diversification gains (i.e., for

a representative agent) from holding the two asset classes.

2. On safe returns, r

sa f e

We find that the real safe asset return (bonds and bills) has been very volatile over the long-run,

more so than one might expect, and oftentimes even more volatile than real risky returns.

Each of the world wars was (unsurprisingly) a moment of very low safe rates, well below

zero. So was the 1970s stagflation. The peaks in the real safe rate took place at the start of our

sample, in the interwar period, and during the mid-1980s fight against inflation. In fact, the

long decline observed in the past few decades is reminiscent of the secular decline that took

place from 1870 to WW1. Viewed from a long-run perspective, the past decline and current

low level of the real safe rate today is not unusual. The puzzle may well be why was the safe

rate so high in the mid-1980s rather than why has it declined ever since.

Safe returns have been low on average in the full sample, falling in the 1%–3% range for most

countries and peacetime periods. While this combination of low returns and high volatility

has offered a relatively poor risk-return trade-off to investors, the low returns have also eased

the pressure on government finances, in particular allowing for a rapid debt reduction in the

aftermath of WW2.

3. On the risk premium, r

risky

− r

sa f e

Over the very long run, the risk premium has been volatile. Our data uncover substantial

swings in the risk premium at lower frequencies that sometimes endured for decades, and

which far exceed the amplitudes of business-cycle swings.

3

In most peacetime eras, this premium has been stable at about 4%–5%. But risk premiums

stayed curiously and persistently high from the 1950s to the 1970s, long after the conclusion

of WW2. However, there is no visible long-run trend, and mean reversion appears strong.

Interestingly, the bursts of the risk premium in the wartime and interwar years were mostly a

phenomenon of collapsing safe returns rather than dramatic spikes in risky returns.

In fact, the risky return has often been smoother and more stable than the safe return,

averaging about 6%–8% across all eras. Recently, with safe returns low and falling, the risk

premium has widened due to a parallel but smaller decline in risky returns. But these shifts

keep the two rates of return close to their normal historical range. Whether due to shifts in

risk aversion or other phenomena, the fact that safe returns seem to absorb almost all of these

adjustments seems like a puzzle in need of further exploration and explanation.

4. On returns minus growth, r

wealth

− g

Piketty (2014) argued that, if investors’ return to wealth exceeded the rate of economic growth,

rentiers would accumulate wealth at a faster rate and thus worsen wealth inequality. Using

a measure of portfolio returns to compute “

r

minus

g

” in Piketty’s notation, we uncover an

important finding. Even calculated from more granular asset price returns data, the same fact

reported in Piketty (2014) holds true for more countries, more years, and more dramatically:

namely “r g.”

In fact, the only exceptions to that rule happen in the years in or around wartime. In peacetime,

r

has always been much greater than

g

. In the pre-WW2 period, this gap was on average 5%

(excluding WW1). As of today, this gap is still quite large, about 3%–4%, though it narrowed

to 2% in the 1970s before widening in the years leading up to the Global Financial Crisis.

One puzzle that emerges from our analysis is that while “

r

minus

g

” fluctuates over time, it

does not seem to do so systematically with the growth rate of the economy. This feature of the

data poses a conundrum for the battling views of factor income, distribution, and substitution

in the ongoing debate (Rognlie, 2015). The fact that returns to wealth have remained fairly

high and stable while aggregate wealth increased rapidly since the 1970s, suggests that capital

accumulation may have contributed to the decline in the labor share of income over the recent

decades (Karabarbounis and Neiman, 2014). In thinking about inequality and several other

characteristics of modern economies, the new data on the return to capital that we present

here should spur further research.

II. A new historical global returns database

In this section, we will discuss the main sources and definitions for the calculation of long-run

returns. A major innovation is the inclusion of housing. Residential real estate is the main asset in

most household portfolios, as we shall see, but so far very little has been known about long-run

4

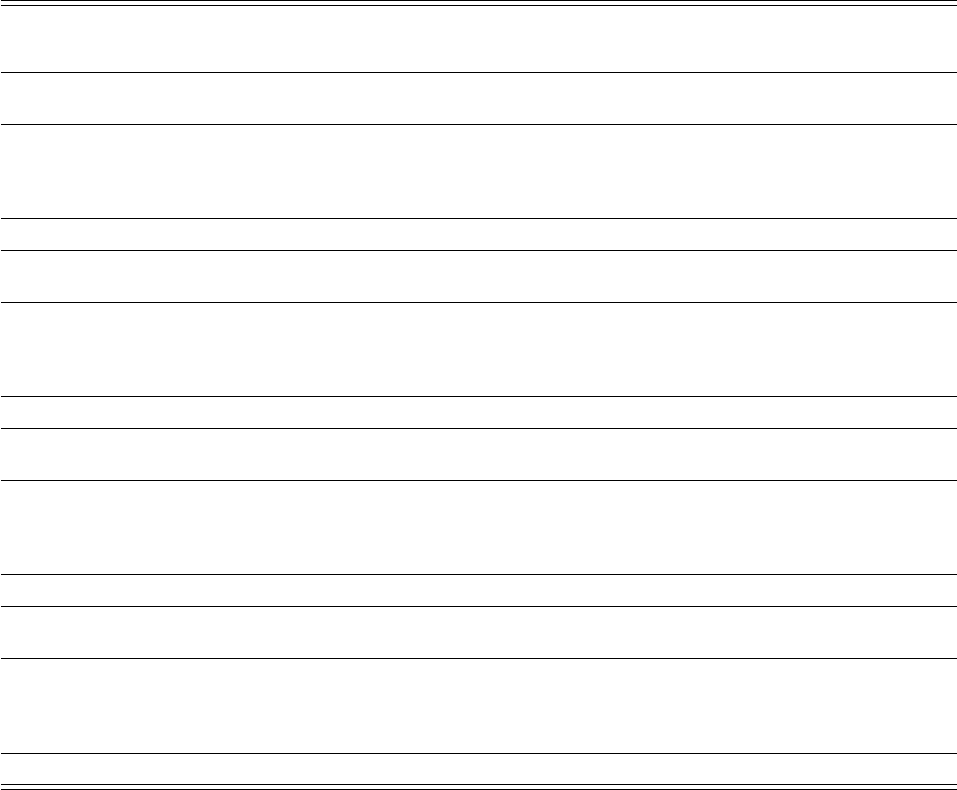

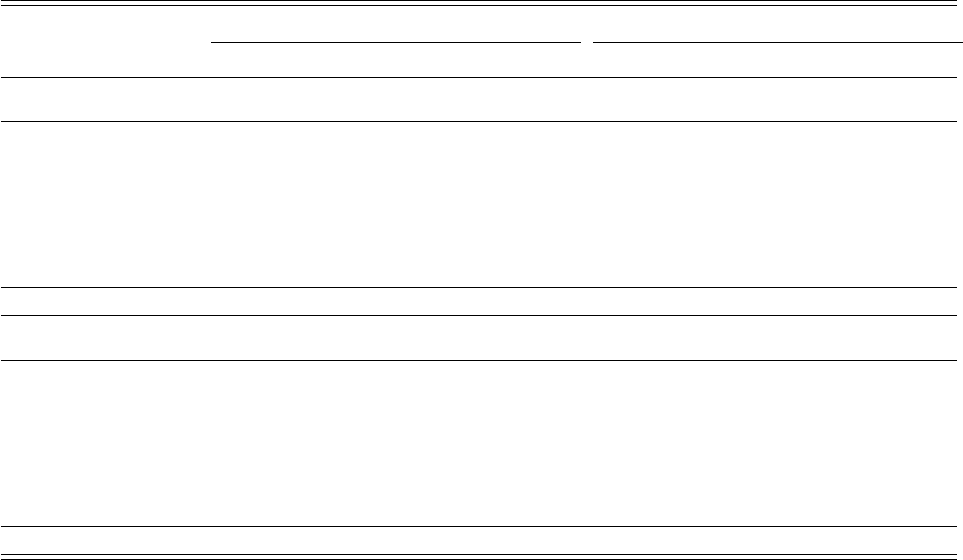

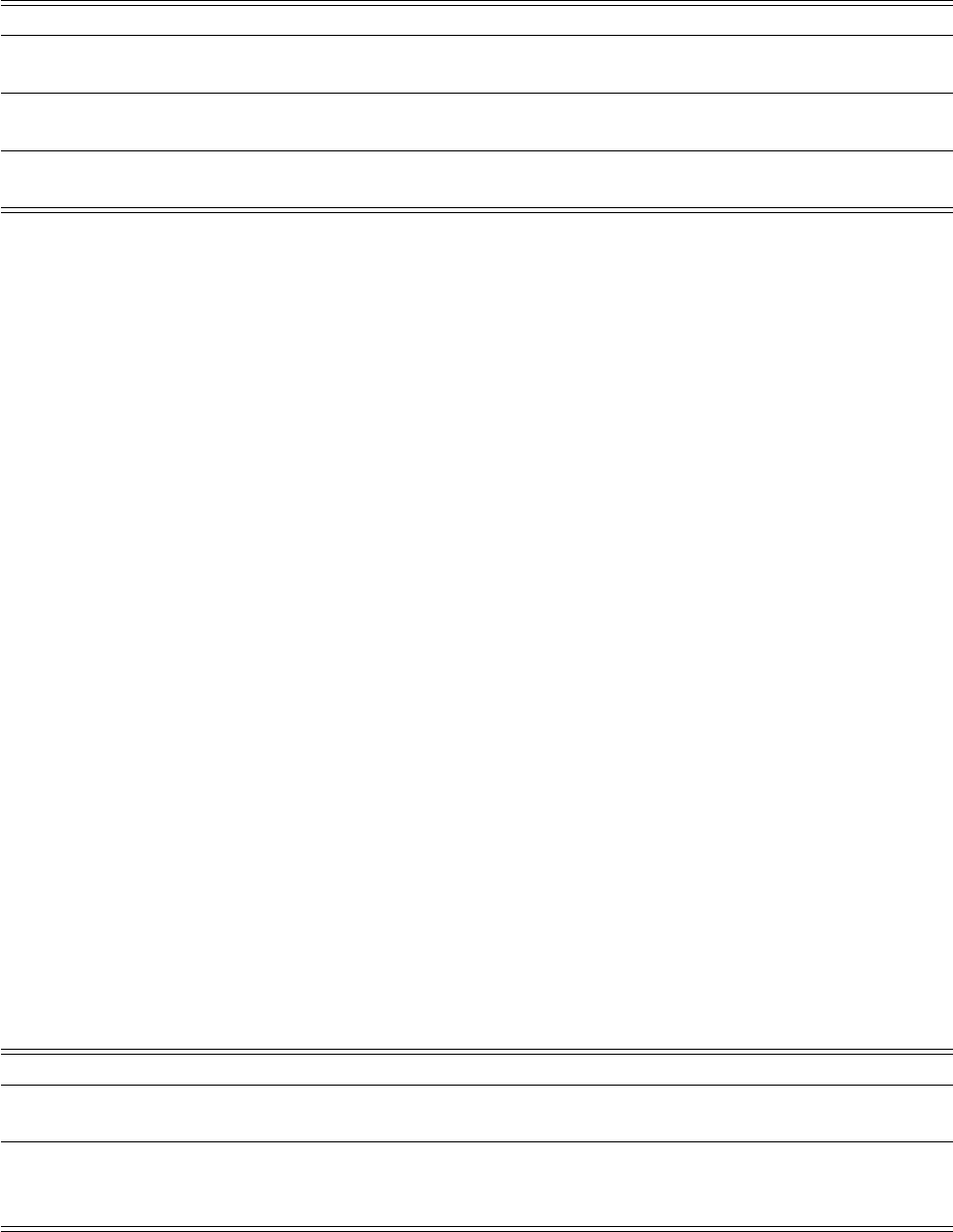

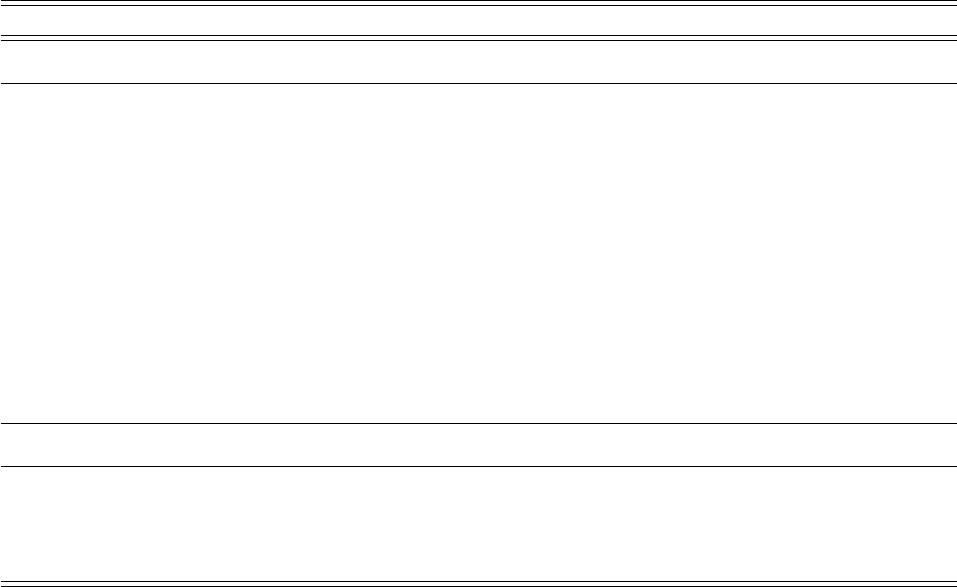

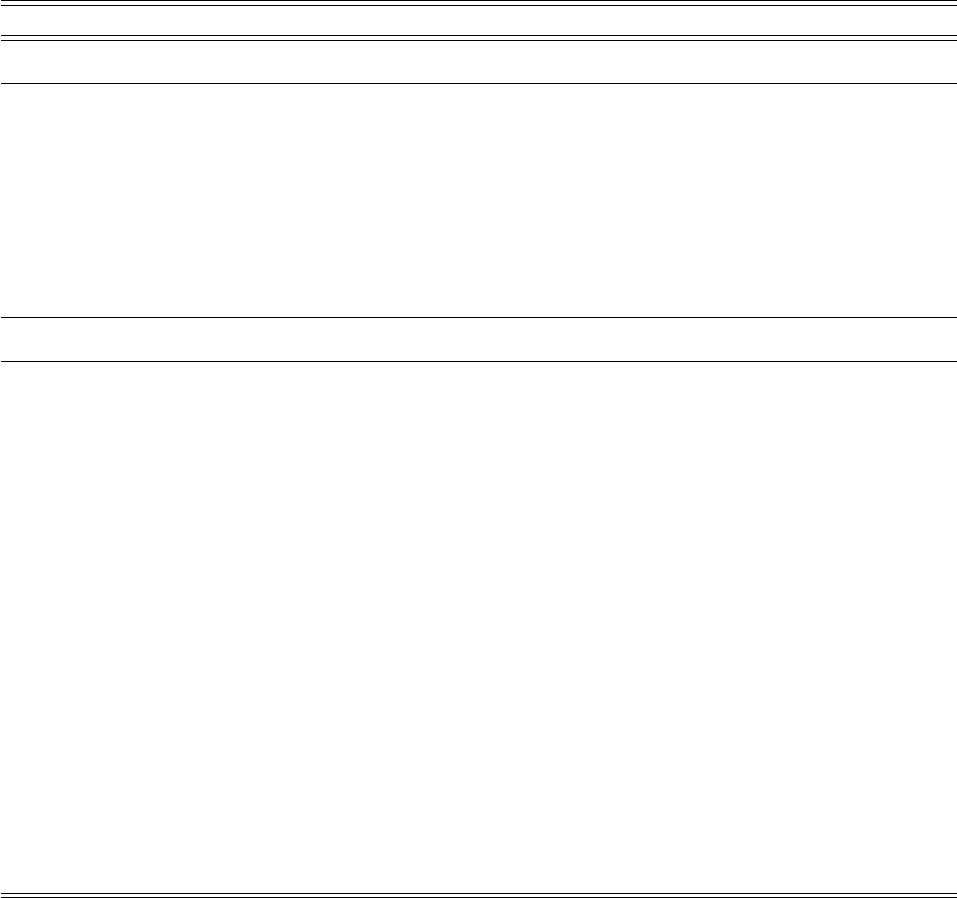

Table I: Data coverage

Country Bills Bonds Equity Housing

Australia 1870–2015 1900–2015 1870–2015 1901–2015

Belgium 1870–2015 1870–2015 1870–2015 1890–2015

Denmark 1875–2015 1870–2015 1873–2015 1876–2015

Finland 1870–2015 1870–2015 1896–2015 1920–2015

France 1870–2015 1870–2015 1870–2015 1871–2015

Germany 1870–2015 1870–2015 1870–2015 1871–2015

Italy 1870–2015 1870–2015 1870–2015 1928–2015

Japan 1876–2015 1881–2015 1886–2015 1931–2015

Netherlands 1870–2015 1870–2015 1900–2015 1871–2015

Norway 1870–2015 1870–2015 1881–2015 1871–2015

Portugal 1880–2015 1871–2015 1871–2015 1948–2015

Spain 1870–2015 1900–2015 1900–2015 1901–2015

Sweden 1870–2015 1871–2015 1871–2015 1883–2015

Switzerland 1870–2015 1900–2015 1900–2015 1902–2015

UK 1870–2015 1870–2015 1871–2015 1896–2015

USA 1870–2015 1871–2015 1872–2015 1891–2015

returns on housing. Our data on housing returns will cover capital gains, and imputed rents to

owners and renters, the sum of the two being total returns.

2

Equity return data for publicly-traded

equities will then be used, as is standard, as a proxy for aggregate business equity returns.

3

The data include nominal and real returns on bills, bonds, equities, and residential real estate

for Australia, Belgium, Denmark, Finland, France, Germany, Italy, Japan, the Netherlands, Norway,

Portugal, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The sample

spans 1870 to 2015. Table I summarizes the data coverage by country and asset class.

Like most of the literature, we examine returns to national aggregate holdings of each asset

class. Theoretically, these are the returns that would accrue for the hypothetical representative-agent

investor holding each country’s portfolio. An advantage of this approach is that it captures indirect

holdings much better, although it leads to some double-counting thereby boosting the share of

financial assets over housing somewhat. The differences are described in Appendix O.

4

2

Since the majority of housing is owner-occupied, and housing wealth is the largest asset class in the

economy, owner-occupier returns and imputed rents also form the lion’s share of the total return on housing,

as well as the return on aggregate wealth.

3

Moskowitz and Vissing-Jørgensen (2002) compare the returns on listed and unlisted U.S. equities over the

period 1953–1999 and find that in aggregate, the returns on these two asset classes are similar and highly

correlated, but private equity returns exhibit somewhat lower volatility. Moskowitz and Vissing-Jørgensen

(2002) argue, however, that the risk-return tradeoff is worse for private compared to public equities, because

aggregate data understate the true underlying volatility of private equity, and because private equity portfolios

are typically much less diversified.

4

Within country heterogeneity is undoubtedly important, but clearly beyond the scope of a study covering

nearly 150 years of data and 16 advanced economies.

5

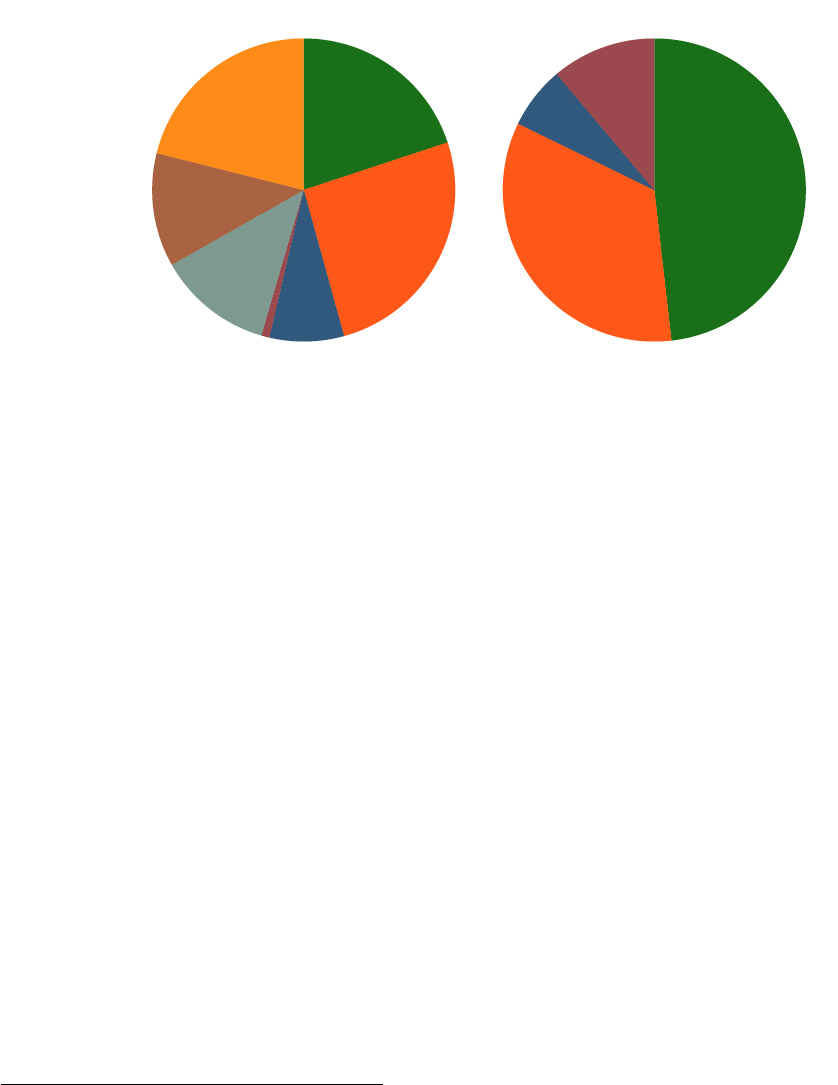

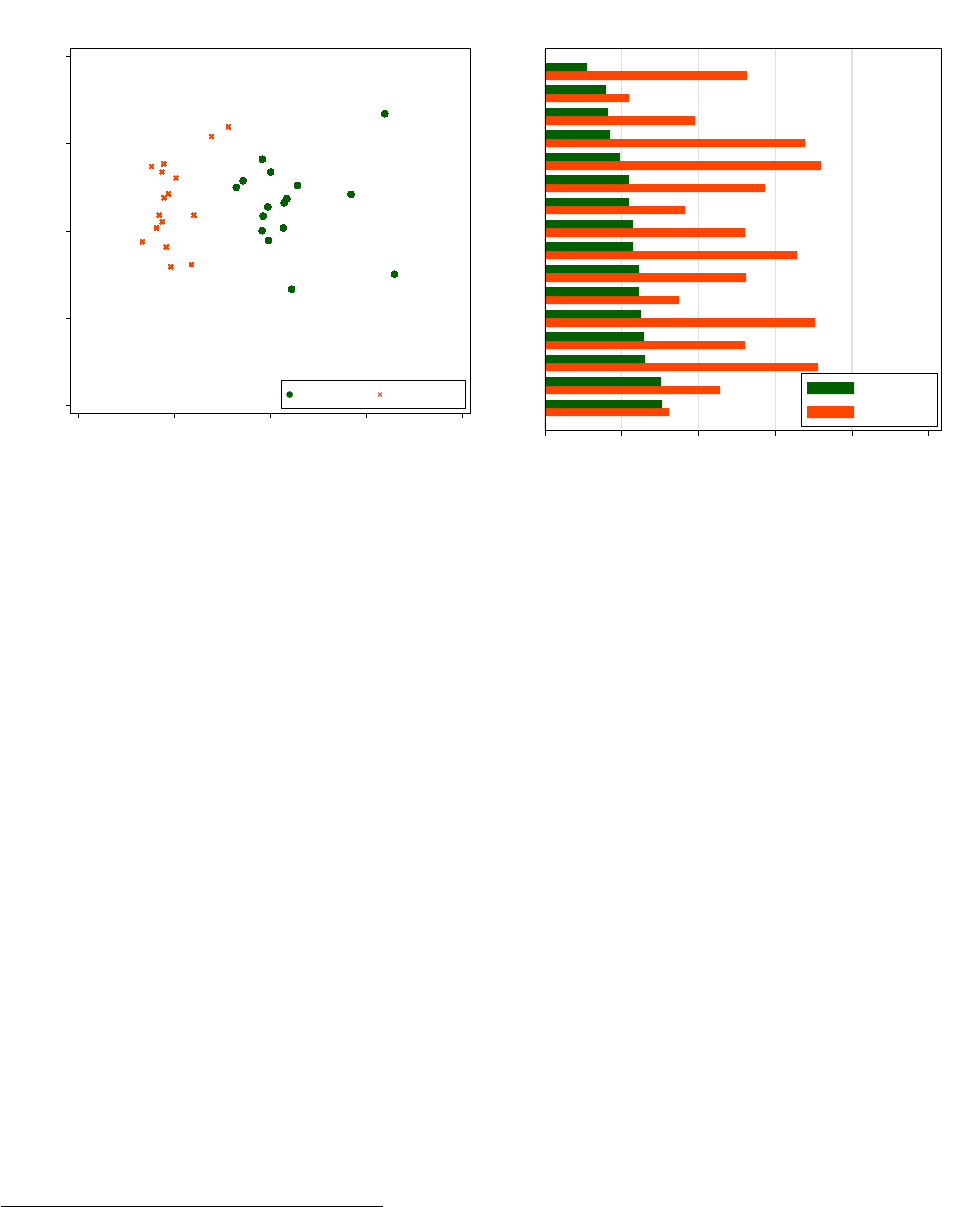

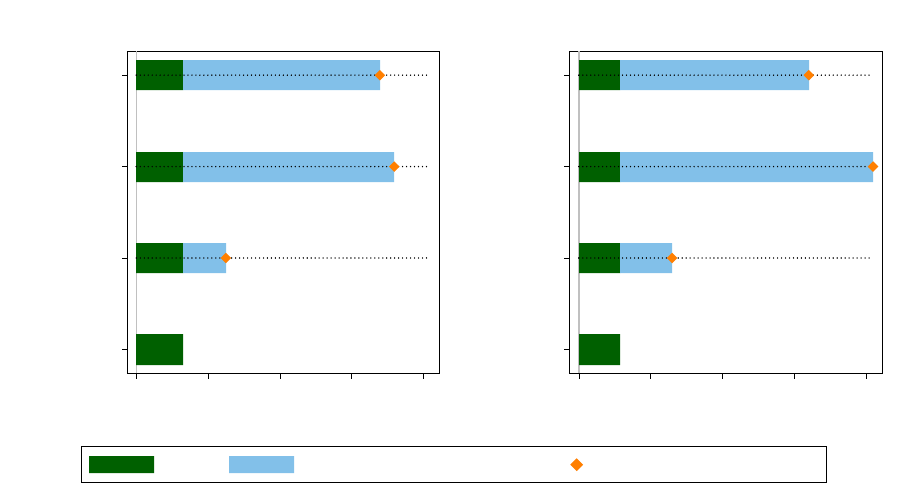

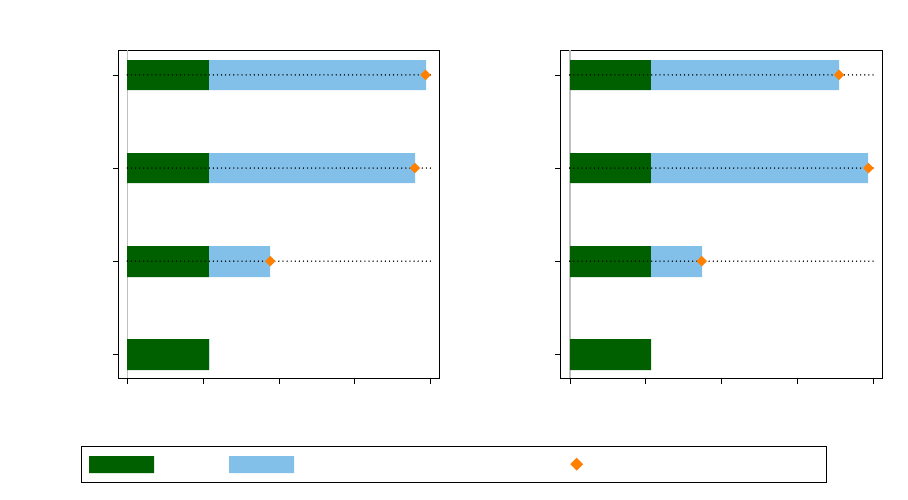

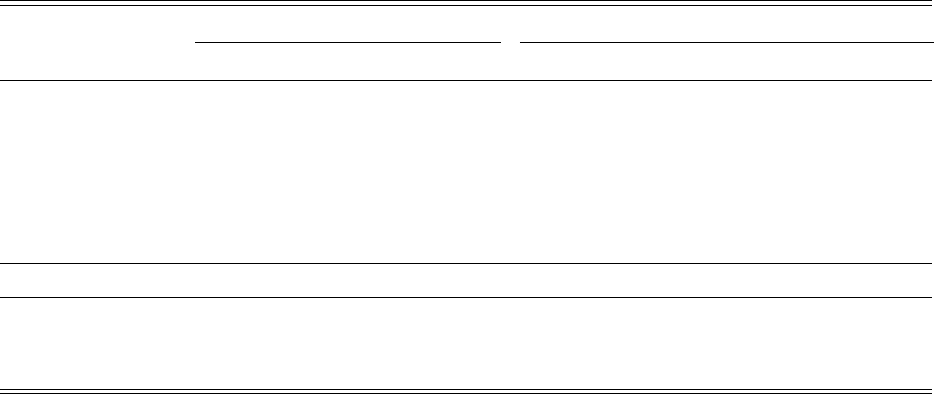

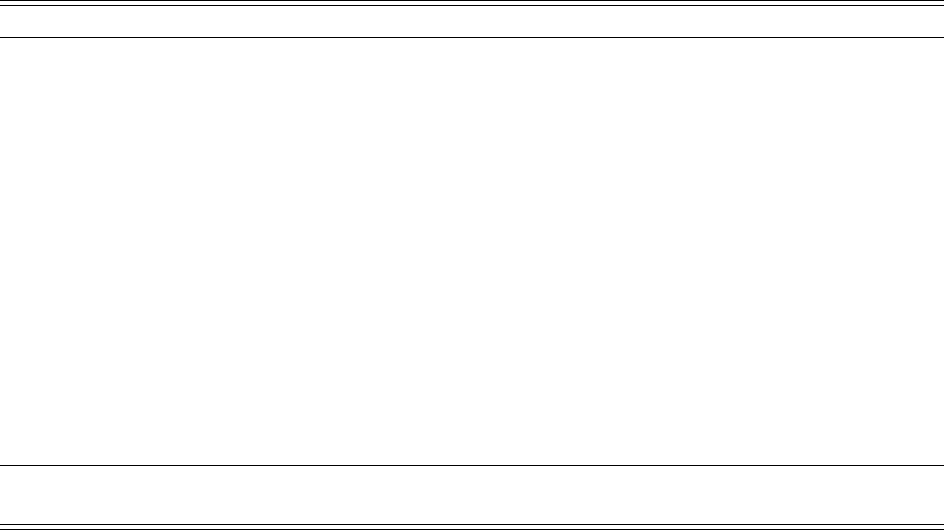

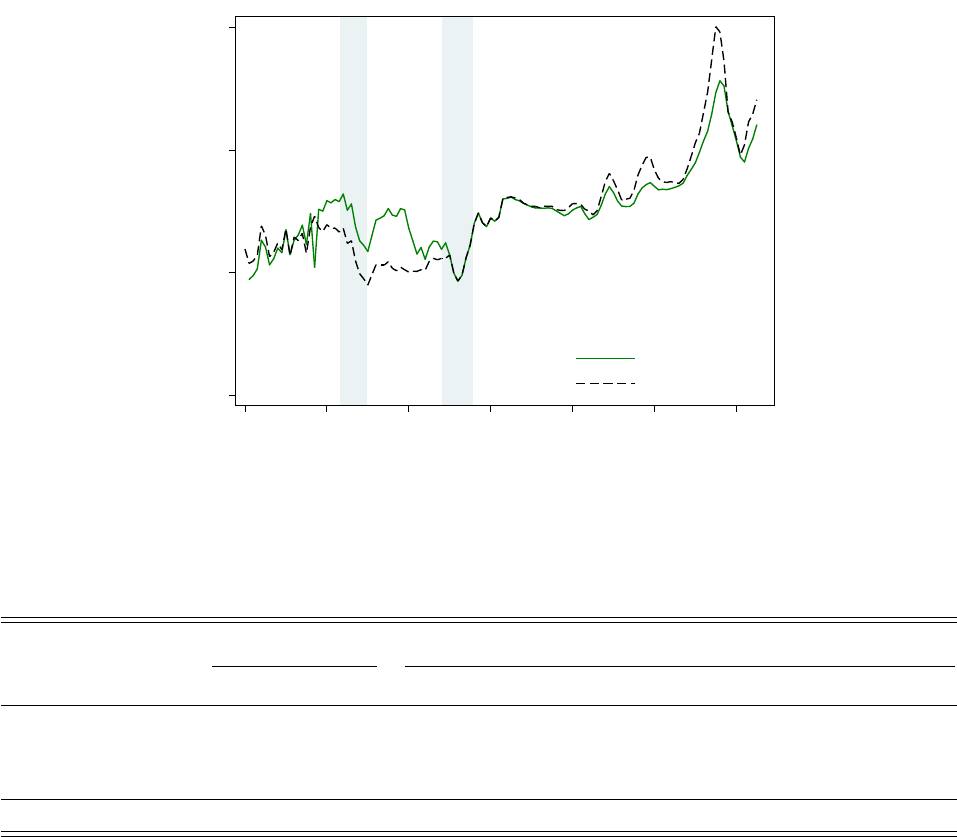

II.A. The composition of wealth

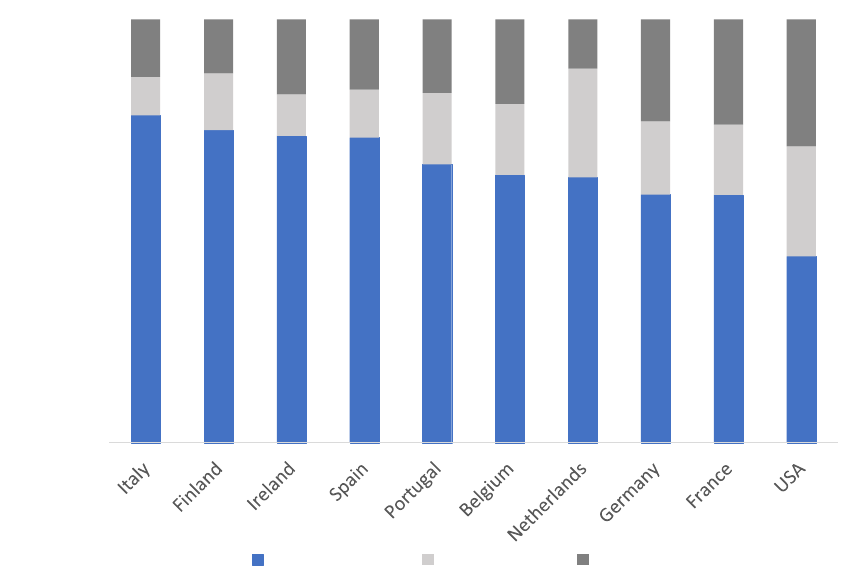

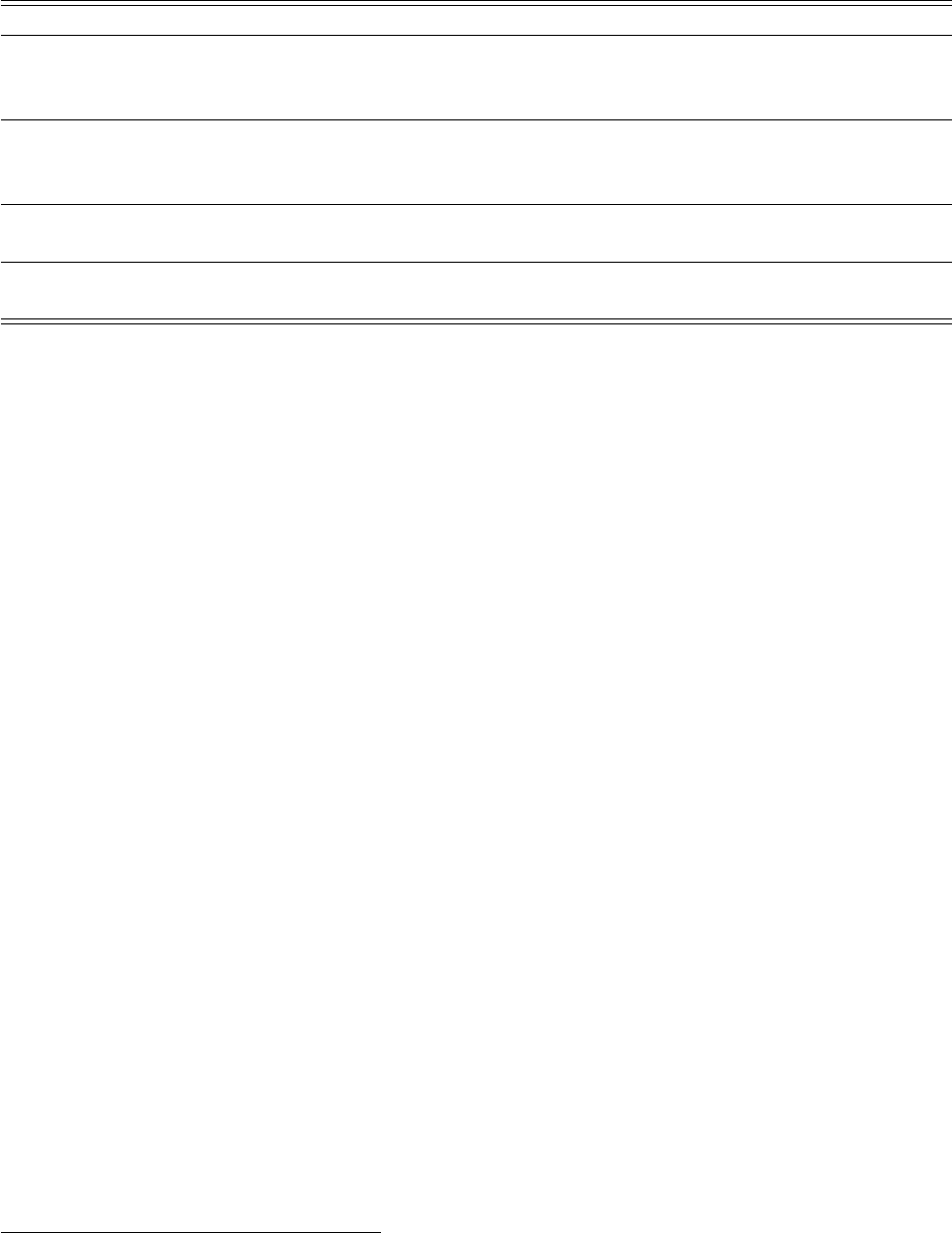

Figure I shows the decomposition of economy-wide investible assets and capital stocks, based on

data for five major economies at the end of 2015: France, Germany, Japan, UK and US.

5

Investible

assets shown in the left panel of Figure I (and in Table A.23) exclude assets that relate to intra-

financial holdings and cannot be held directly by investors, such as loans, derivatives (apart from

employee stock options), financial institutions’ deposits, insurance and pension claims. Other

financial assets mainly consist of corporate bonds and asset-backed securities. Other non-financial

assets are other buildings, machinery and equipment, agricultural land, and intangible capital.

The capital stock is business capital plus housing. Other capital is mostly made up of intangible

capital and agricultural land. Data are sourced from national accounts and national wealth estimates

published by the countries’ central banks and statistical offices.

6

Housing, equity, bonds, and bills comprise over half of all investible assets in the advanced

economies today, and nearly two-thirds if deposits are included. The right-hand side panel of

Figure I shows the decomposition of the capital stock into housing and various other non-financial

assets. Housing is about one half of the outstanding stock of capital. In fact, housing and equities

alone represent over half of total assets in household balance sheets (see Figures A.5 and A.6).

The main asset categories outside the direct coverage of this study are: commercial real estate,

business assets, and agricultural land; corporate bonds; pension and insurance claims; and deposits.

But most of these assets represent claims of, or are closely related to, assets that we do cover. For

example, pension claims tend to be invested in stocks and bonds; listed equity is a levered claim

on business assets of firms; land and commercial property prices tend to co-move with residential

property prices; and deposit rates are either included in, or very similar to, our bill rate measure.

7

Our data also exclude foreign assets. Even though the data on foreign asset holdings are

relatively sparse, the evidence that we do have—presented in Appendix O.4—suggests that foreign

assets have, through history, only accounted for a small share of aggregate wealth, and the return

differentials between domestic and foreign asset holdings are, with few exceptions, not that large.

Taken together, this means that our dataset almost fully captures the various components of the

return on overall household wealth.

II.B. Historical returns data

Bill returns

The canonical risk-free rate is taken to be the yield on Treasury bills, i.e., short-term,

fixed-income government securities. The yield data come from the latest vintage of the long-run

5

Individual country data are shown Appendix Tables A.23 and A.24.

6

Both decompositions also exclude human capital, which cannot be bought or sold. Lustig, Van Nieuwer-

burgh, and Verdelhan (2013) show that for a broader measure of aggregate wealth that includes human

capital, the size of human wealth is larger than of non-human wealth, and its return dynamics are similar to

those of a long-term bond.

7

Moreover, returns on commercial real estate are captured by the levered equity returns of the firms that

own this real estate, and hence are indirectly proxied by our equity return data.

6

Figure I: Composition of investible assets and capital stock in the major economies

Housing

Equity

Bonds

Bills

Deposits

Other financial

Other non-financial

Investable Assets

Housing

Other buildings

Machinery

Other

Capital Stock

Note: Composition of total investible assets and capital stock. Average of the individual asset shares of France,

Germany, Japan, UK, and US, as of end-2015. Investible assets are defined as the gross total of economy-wide

assets excluding loans, derivatives, financial institutions’ deposits, insurance, and pension claims. Other

financial assets mainly consist of corporate bonds and asset-backed securities. Other non-financial assets are

other buildings, machinery and equipment, agricultural land, and intangible capital. The capital stock is

business capital plus housing. Other capital is mostly made up by intangible capital and agricultural land.

Data are sourced from national accounts and national wealth estimates published by the countries’ central

banks and statistical offices.

macrohistory database (Jord

`

a, Schularick, and Taylor, 2017).

8

Whenever data on Treasury bill

returns were unavailable, we relied on either money market rates or deposit rates of banks from

Zimmermann (2017). Since short-term government debt was rarely used and issued in the earlier

historical period, much of our bill rate data before the 1960s actually consist of deposit rates.

9

Bond returns

These are conventionally the total returns on long-term government bonds. Unlike

earlier cross-country studies, we focus on the bonds listed and traded on local exchanges and

denominated in local currency. This focus makes bond returns more comparable with the returns

of bills, equities, and housing. Moreover, this results in a larger sample of bonds, and on bonds

that are more likely to be held by the representative household in the respective country. For some

countries and periods we have made use of listings on major global exchanges to fill gaps where

domestic markets were thin, or local exchange data were not available (for example, Australian

bonds listed in New York or London). Throughout the sample we target a maturity of around

10 years. For the second half of the 20th century, the maturity of government bonds is generally

8

www.macrohistory.net/data

9

In general, it is difficult to compute the total returns on deposits because of uncertainty about losses

during banking crises, and we stick to the more easily measurable government bill and bond returns where

these data are available. Comparisons with the deposit rate data in Zimmermann (2017), however, indicate

that the interest rate differential between deposits and our bill series is very small, with deposit rates on

average roughly 0.7 percentage points below bills—a return close to zero in real terms. The returns on

government bills and deposits are also highly correlated over time.

7

accurately defined. For the pre-WW2 period we sometimes had to rely on data for perpetuals, i.e.,

very long-term government securities (such as the British consol). Although as a convention we

refer here to government bills and bonds as “safe” assets, both are naturally exposed to inflation

and default risk, for example. In fact, real returns on these assets fluctuate substantially over time as

we shall see (specifically, Sections V and VI).

Equity returns

These returns come from a broad range of sources, including articles in economic

and financial history journals, yearbooks of statistical offices and central banks, stock exchange

listings, newspapers, and company reports. Throughout most of the sample, we aim to rely

on indices weighted by market capitalization of individual stocks, and a stock selection that is

representative of the entire stock market. For some historical time periods in individual countries,

however, we also make use of indices weighted by company book capital, stock market transactions,

or weighted equally, due to limited data availability.

Housing returns

We combine the long-run house price series introduced by Knoll, Schularick,

and Steger (2017) with a novel dataset on rents drawn from the unpublished PhD thesis of Knoll

(2017). For most countries, the rent series rely on the rent components of the cost of living of

consumer price indices constructed by national statistical offices. We then combine them with

information from other sources to create long-run series reaching back to the late 19th century. To

proxy the total return on the residential housing stock, our returns include both rented housing

and owner-occupied properties.

10

Specifically, wherever possible we use house price and rental

indices that include the prices of owner-occupied properties, and the imputed rents on these houses.

Imputed rents estimate the rent that an owner-occupied house would earn on the rental market,

typically by using rents of similar houses that are rented. This means that, in principle, imputed

rents are similar to market rents, and are simply adjusted for the portfolio composition of owner-

occupied as opposed to rented housing. Imputed rents, however, are not directly observed and

hence less precisely measured than market rents, and are typically not taxed.

11

To the best of our

knowledge, we are the first to calculate total returns to housing in the literature for as long and as

comprehensive a cross section of economies as we report.

Composite returns

We compute the rate of return on safe assets, risky assets, and aggregate

wealth, as weighted averages of the individual asset returns. To obtain a representative return from

the investor’s perspective, we use the outstanding stocks of the respective asset in a given country as

weights. To this end, we make use of new data on equity market capitalization (from Kuvshinov and

Zimmermann, 2018) and housing wealth for each country and period in our sample, and combine

10

This is in line with the treatment of housing returns in the existing literature on returns to aggregate

wealth—see, for example, Piketty et al. (2018) and Rognlie (2015).

11

We discuss the issues around imputed rents measurement, and our rental yield series more generally in

Section III.C.

8

them with existing estimates of public debt stocks to obtain the weights for the individual assets. A

graphical representation of these asset portfolios, and further description of their construction is

provided in the Appendix O.3. Tables A.28 and A.29 present an overview of our four asset return

series by country, their main characteristics and coverage. The paper comes with an extensive data

appendix that specifies the sources we consulted and discusses the construction of the series in

greater detail (see the Data Appendix, Sections U, V, and W for housing returns, and Section X for

equity and bond returns).

II.C. Calculating returns

The total annual return on any financial asset can be divided into two components: the capital gain

from the change in the asset price

P

, and a yield component

Y

, that reflects the cash-flow return on

an investment. The total nominal return R for asset j in country i at time t is calculated as:

Total return: R

j

i,t

=

P

j

i,t

− P

j

i,t−1

P

j

i,t−1

+ Y

j

i,t

. (1)

Because of wide differences in inflation across time and countries, it is helpful to compare returns

in real terms. Let

π

i,t

= (CPI

i,t

− CPI

i,t−1

) /CPI

i,t−1

be the realized consumer price index (

CPI

)

inflation rate in a given country

i

and year

t

. We calculate inflation-adjusted real returns

r

for each

asset class as,

Real return: r

j

i,t

= (1 + R

j

i,t

) /(1 + π

i,t

) − 1 . (2)

These returns will be summarized in period average form, by country, or for all countries.

Investors must be compensated for risk to invest in risky assets. A measure of this “excess

return” can be calculated by comparing the real total return on the risky asset with the return on a

risk-free benchmark—in our case, the government bill rate,

r

bill

i,t

. We therefore calculate the excess

return ER for the risky asset j in country i as

Excess return: ER

j

i,t

= r

j

i,t

− r

bill

i,t

. (3)

In addition to individual asset returns, we also present a number of weighted “composite”

returns aimed at capturing broader trends in risky and safe investments, as well as the “overall

return” or “return on wealth.” Appendix O.3 provides further details on the estimates of country

asset portfolios from which we derive country-year specific weights.

For safe assets, we assume that total public debt is divided equally into bonds and bills since

there are no data on their market shares (only for total public debt) over our full sample. As a result,

we compute the safe asset return as:

Safe return: r

sa f e

i,t

=

r

bill

i,t

+ r

bond

i,t

2

. (4)

9

The risky asset return is calculated as a weighted average of the returns on equity and on

housing. The weights

w

represent the share of asset holdings of equity and of housing stocks in

the respective country

i

and year

t

, scaled to add up to 1. We use stock market capitalization and

housing wealth to calculate each share and hence compute risky returns as:

Risky return: r

risky

i,t

= r

equity

i,t

× w

equity

i,t

+ r

housing

t

× w

housing

i,t

. (5)

The difference between our risky and safe return measures then provides a proxy for the

aggregate risk premium in the economy:

Risk premium: RP

i,t

= r

risky

i,t

− r

sa f e

i,t

. (6)

The “return on wealth” measure is a weighted average of returns on risky assets (equity and

housing) and safe assets (bonds and bills). The weights

w

here are the asset holdings of risky and

safe assets in the respective country i and year t, scaled to add to 1.

12

Return on wealth: r

wealth

i,t

= r

risky

i,t

× w

risky

i,t

+ r

sa f e

i,t

× w

sa f e

i,t

. (7)

Finally, we also consider returns from a global investor perspective in Appendix I. There we

measure the returns from investing in local markets in U.S. dollars (USD). These returns effectively

subtract the depreciation of the local exchange rate vis-a-vis the dollar from the nominal return:

USD return: R

j,USD

i,t

= (1 + R

j

i,t

) /(1 +

ˆ

s

i,t

) − 1 , (8)

where

ˆ

s

i,t

is the rate of depreciation of the local currency versus the U.S. dollar in year t.

The real USD returns are then computed net of U.S. inflation π

US,t

:

Real USD return: r

j,USD

i,t

= (1 + R

j,USD

i,t

) /(1 + π

US,t

) − 1 . (9)

II.D. Constructing housing returns using the rent-price approach

This section briefly describes our methodology to calculate total housing returns. We provide

further details as needed later in Section III.C and in Appendix U. We construct estimates for total

returns on housing using the rent-price approach. This approach starts from a benchmark rent-price

ratio (

RI

0

/HPI

0

) estimated in a baseline year (

t = 0

). For this ratio we rely on net rental yields

from the Investment Property Database (IPD).

13

We can then construct a time series of returns by

12

For comparison, Appendix P provides information on the equally-weighted risky return, and the equally-

weighted rate of return on wealth, both calculated as simple averages of housing and equity, and housing,

equity and bonds respectively.

13

These net rental yields use rental income net of maintenance costs, ground rent, and other irrecoverable

expenditure. These adjustments are discussed exhaustively in the next section. We use net rather than gross

yields to improve comparability with other asset classes.

10

combining separate information from a country-specific house price index series (

HPI

t

/HPI

0

) and

a country-specific rent index series (

RI

t

/RI

0

). For these indices we rely on prior work on housing

prices (Knoll, Schularick, and Steger, 2017) and new data on rents (Knoll, 2017). This method

assumes that the indices cover a representative portfolio of houses. Under this assumption, there is

no need to correct for changes in the housing stock, and only information about the growth rates in

prices and rents is necessary.

Hence, a time series of the rent-price ratio can be derived from forward and back projection as

RI

t

HPI

t

=

(

RI

t

/RI

0

)

(

HPI

t

/HPI

0

)

RI

0

HPI

0

. (10)

In a second step, returns on housing can then be computed as:

R

housing

t+1

=

RI

t+1

HPI

t

+

HPI

t+1

− HPI

t

HPI

t

. (11)

Our rent-price approach is sensitive to the choice of benchmark rent-price-ratios and cumulative

errors from year-by-year extrapolation. We verify and adjust rent-price approach estimates using a

range of alternative sources. The main source for comparison is the balance sheet approach to rental

yields, which calculates the rent-price ratio using national accounts data on total rental income and

housing wealth. The “balance sheet” rental yield

RY

BS

t

is calculated as the ratio of total net rental

income to total housing wealth:

RY

BS

t

= Net rental income

t

/Housing Wealth

t

, (12)

This balance sheet rental yield estimate can then be added to the capital gains series in order to

compute the total return on housing from the balance sheet perspective. We also collect additional

point-in-time estimates of net rental yields from contemporary sources such as newspaper adver-

tisements. These measures are less sensitive to the accumulated extrapolation errors in equation

(10)

, but are themselves measured relatively imprecisely.

14

Wherever the rent-price approach es-

timates diverge from these historical sources, we make adjustments to benchmark the rent-price

ratio estimates to these alternative historical measures of the rental yield. We also construct two

additional housing return series—one benchmarked to all available alternative yield estimates, and

another using primarily the balance sheet approach. The results of this exercise are discussed in

Section III.C. Briefly, all the alternative estimates are close to one another, and the differences have

little bearing on any of our results.

14

We discuss the advantages and disadvantages of these different approaches in Section III.C. Broadly

speaking, the balance sheet approach can be imprecise due to measurement error in total imputed rent and

national housing wealth estimates. Newspaper advertisements are geographically biased and only cover

gross rental yields, so that the net rental yields have to be estimated.

11

III. Rates of return: Aggregate trends

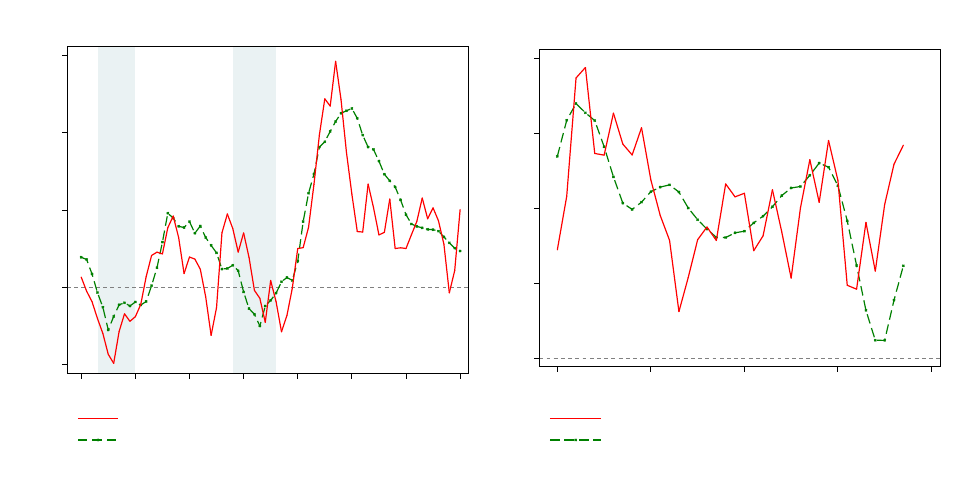

Our headline summary data appear in Table II and Figure II. The top panel of Table II shows the full

sample (1870–2015) results whereas the bottom panel of the table shows results for the post-1950

sample. Note that here, and throughout the paper, rates of return are always annualized. Units are

always expressed in percent per year, for raw data as well as for means and standard deviations.

All means are arithmetic means, except when specifically referred to as geometric means.

15

Data

are pooled and equally-weighted, i.e., they are raw rather than portfolio returns. We will always

include wars so that results are not polluted by bias from omitted disasters. We do, however, exclude

hyperinflation years (but only a few) in order to focus on the underlying trends in returns, and to

avoid biases from serious measurement errors in hyperinflation years, arising from the impossible

retrospective task of matching within-year timing of asset and CPI price level readings which can

create a spurious, massive under- or over-statement of returns in these episodes.

16

The first key finding is that residential real estate, not equity, has been the best long-run

investment over the course of modern history. Although returns on housing and equities are similar,

the volatility of housing returns is substantially lower, as Table II shows. Returns on the two asset

classes are in the same ballpark—around 7%—but the standard deviation of housing returns is

substantially smaller than that of equities (

10%

for housing versus

22%

for equities). Predictably,

with thinner tails, the compounded return (using the geometric average) is vastly better for housing

than for equities—

6.6%

for housing versus

4.7%

for equities. This finding appears to contradict one

of the basic tenets of modern valuation models: higher risks should come with higher rewards.

Differences in asset returns are not driven by unusual events in the early pre-WW2 part of the

sample. The bottom panel of Table II makes this point. Compared to the full sample results in

the top panel, the same clear pattern emerges: stocks and real estate dominate in terms of returns.

Moreover, average returns post–1950 are similar to those for the full sample even though the postwar

subperiod excludes the devastating effects of the two world wars. Robustness checks are reported in

Figures A.1, A.2, and A.3. Briefly, the observed patterns are not driven by the smaller European

countries in our sample. Figure A.1 shows average real returns weighted by country-level real

GDP, both for the full sample and post–1950 period. Compared to the unweighted averages, equity

performs slightly better, but the returns on equity and housing remain very similar, and the returns

15

In what follows we focus on conventional average annual real returns. In addition, we often report

period-average geometric mean returns corresponding to the annualized return that would be achieved

through reinvestment or compounding. For any sample of years

T

, geometric mean returns are calculated as

∏

t∈T

(1 + r

j

i,t

)

!

1

T

− 1.

Note that the arithmetic period-average return is always larger than the geometric period-average return,

with the difference increasing with the volatility of the sequence of returns.

16

Appendix G and Table A.12 do, however, provide some rough proxies for returns on different asset

classes during hyperinflations.

12

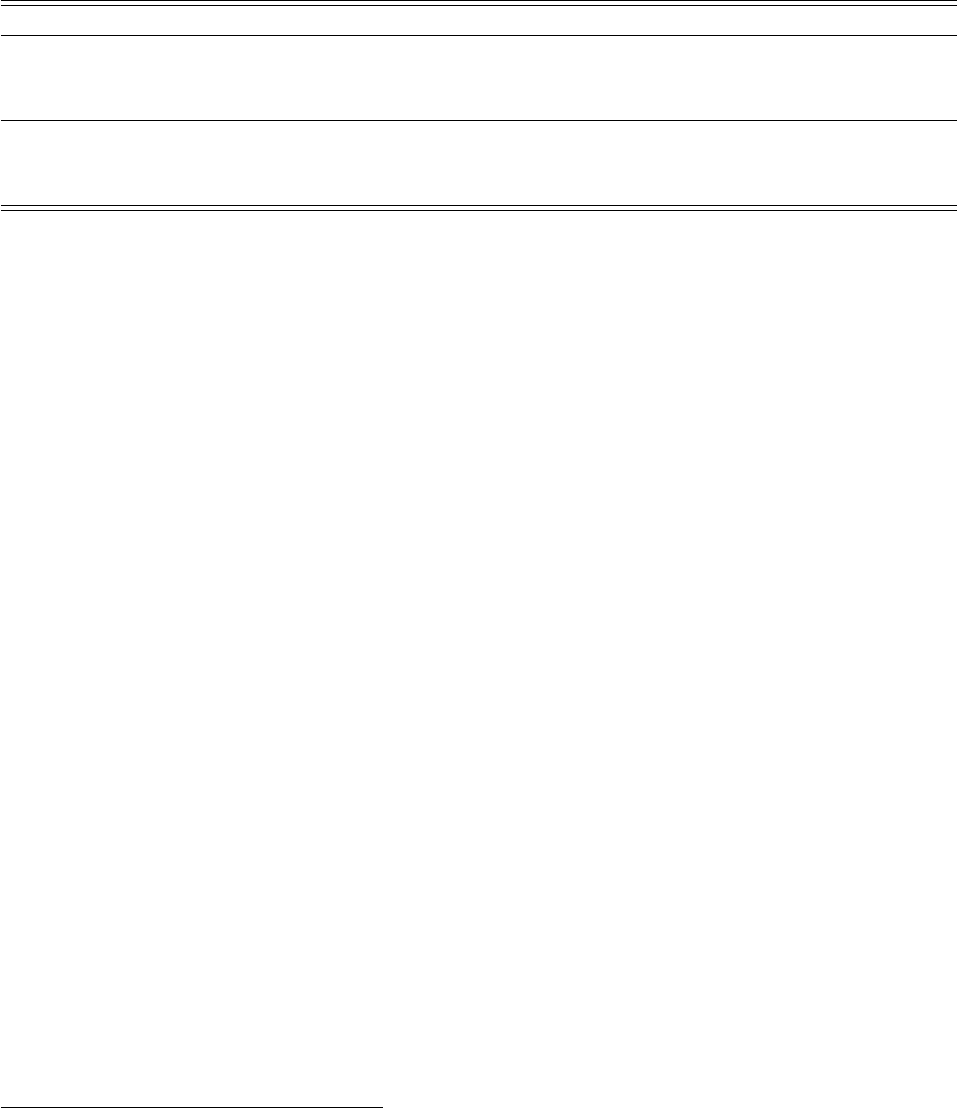

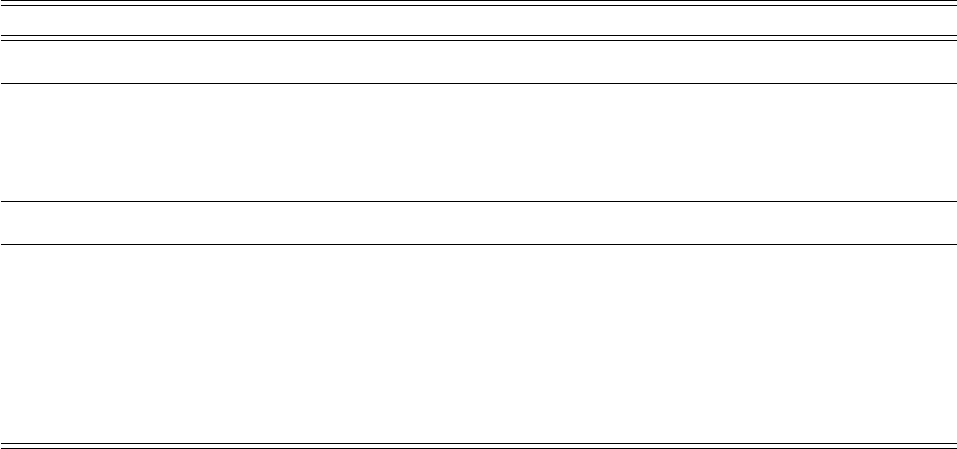

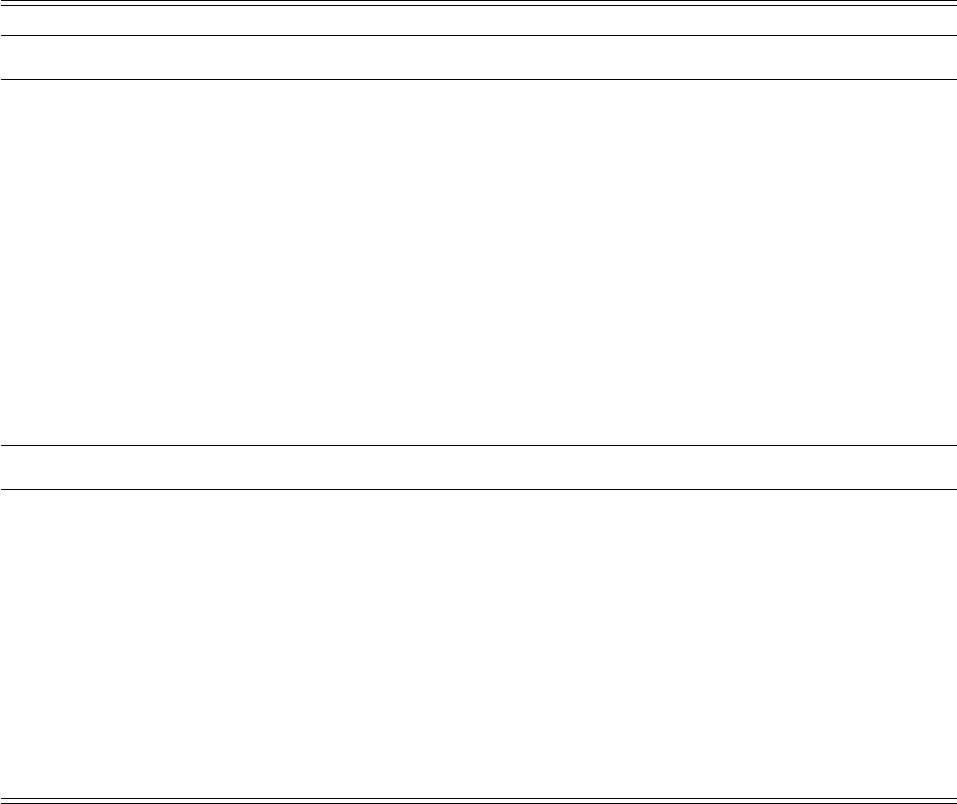

Table II: Global real returns

Real returns Nominal Returns

Bills Bonds Equity

Housing

Bills Bonds Equity

Housing

Full sample:

Mean return p.a. 1.03 2.53 6.88 7.06 4.58 6.06 10.65 11.00

Standard deviation 6.00 10.69 21.79 9.93 3.32 8.88 22.55 10.64

Geometric mean 0.83 1.97 4.66 6.62 4.53 5.71 8.49 10.53

Mean excess return p.a. . 1.51 5.85 6.03

Standard deviation . 8.36 21.27 9.80

Geometric mean . 1.18 3.77 5.60

Observations 1767 1767 1767 1767 1767 1767 1767 1767

Post-1950:

Mean return p.a. 0.88 2.79 8.30 7.42 5.39 7.30 12.97 12.27

Standard deviation 3.42 9.94 24.21 8.87 4.03 9.81 25.03 10.14

Geometric mean 0.82 2.32 5.56 7.08 5.31 6.88 10.26 11.85

Mean excess return p.a. . 1.91 7.42 6.54

Standard deviation . 9.21 23.78 9.17

Geometric mean . 1.51 4.79 6.18

Observations 1022 1022 1022 1022 1022 1022 1022 1022

Note: Annual global returns in 16 countries, equally weighted. Period coverage differs across countries.

Consistent coverage within countries: each country-year observation used to compute the statistics in this

table has data for all four asset returns. Excess returns are computed relative to bills.

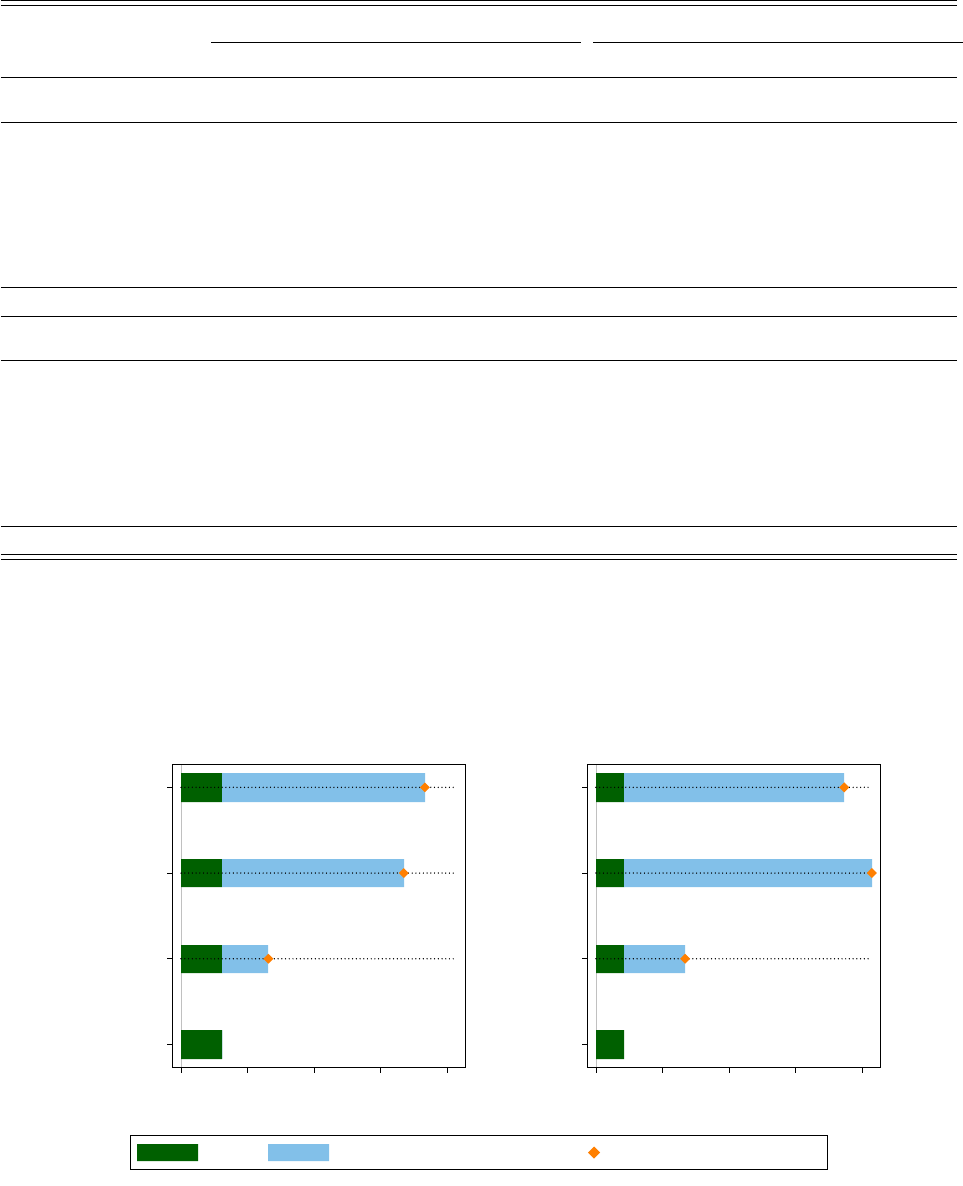

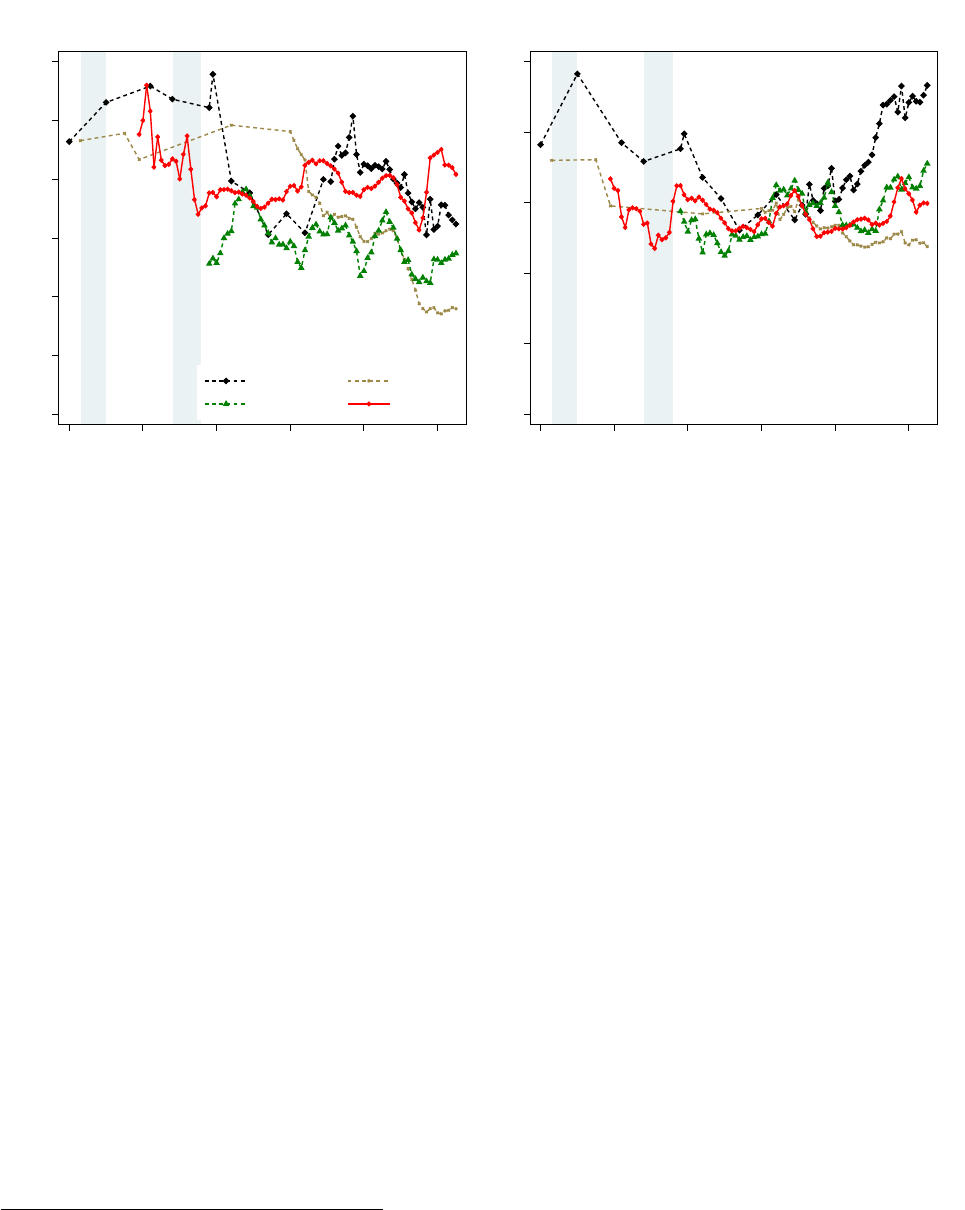

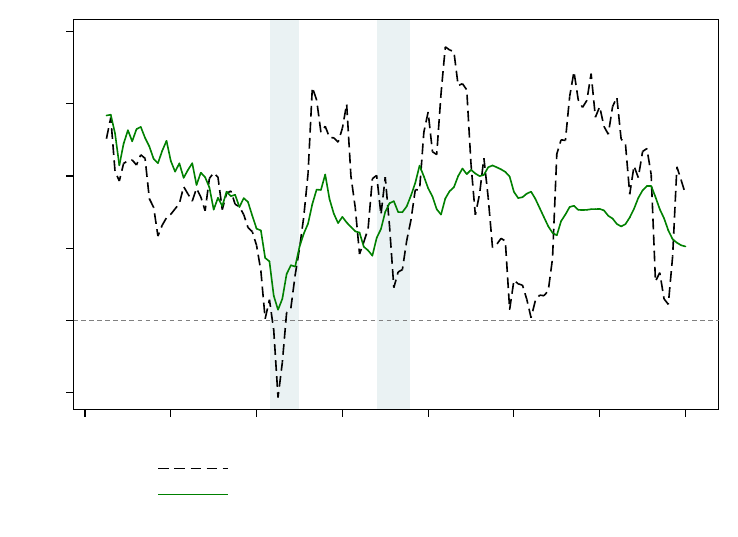

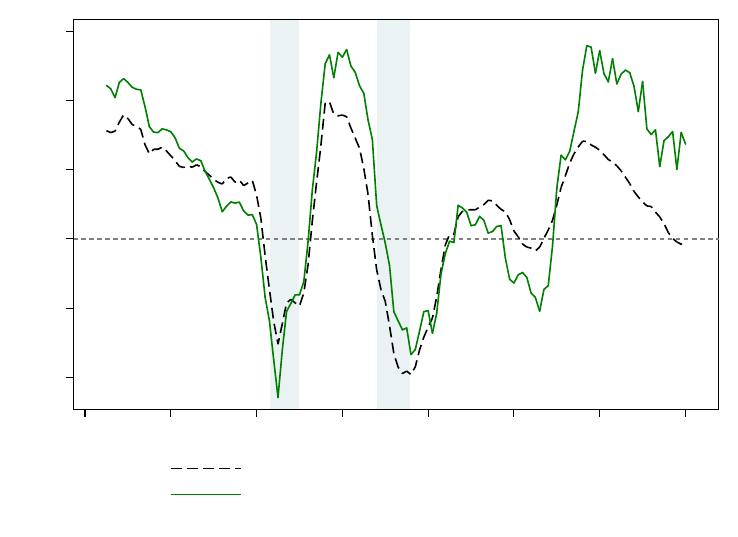

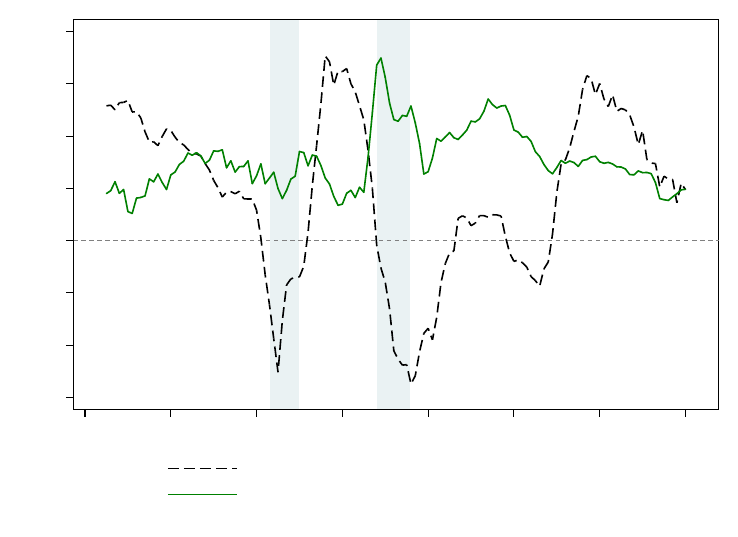

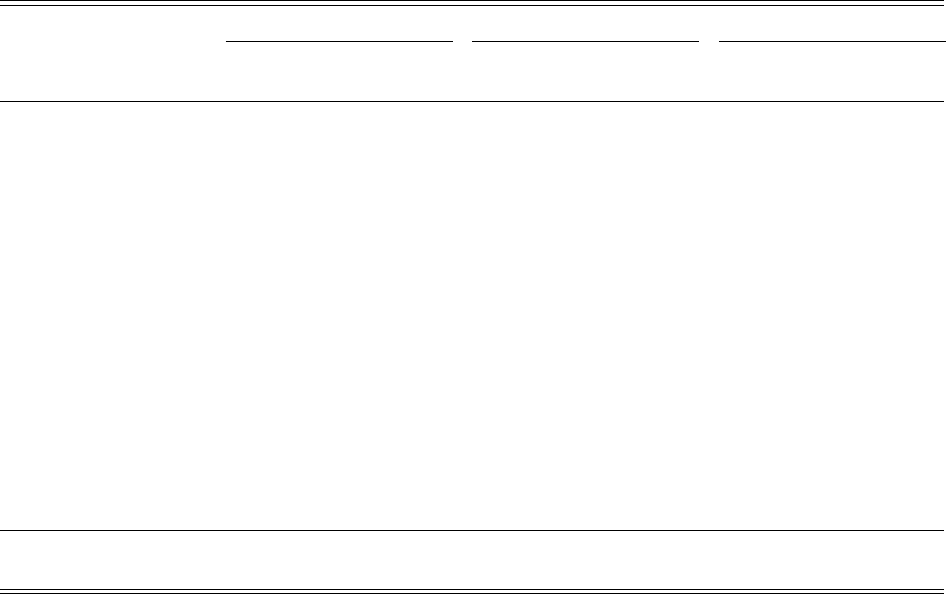

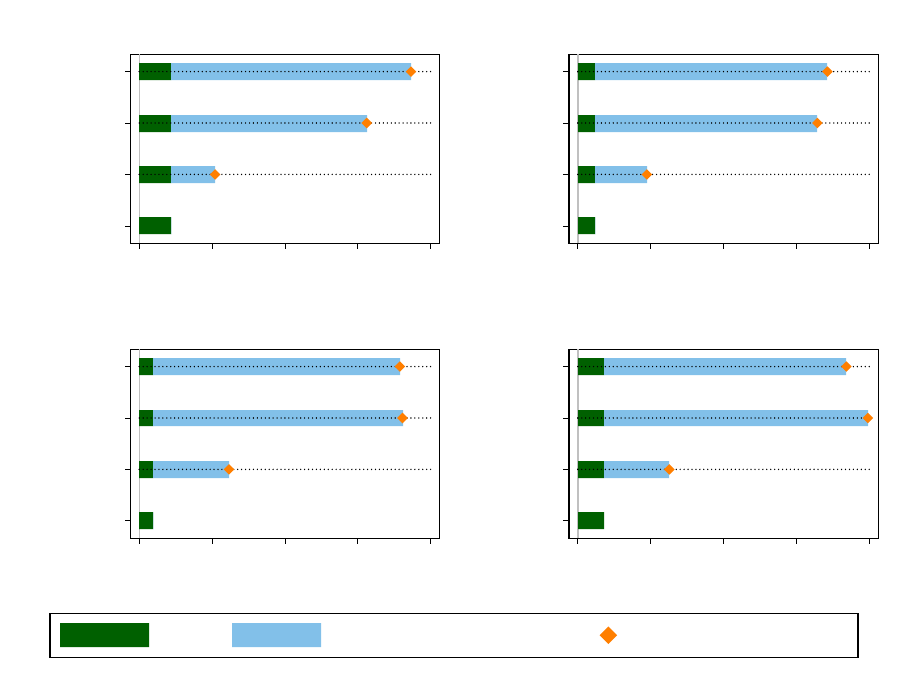

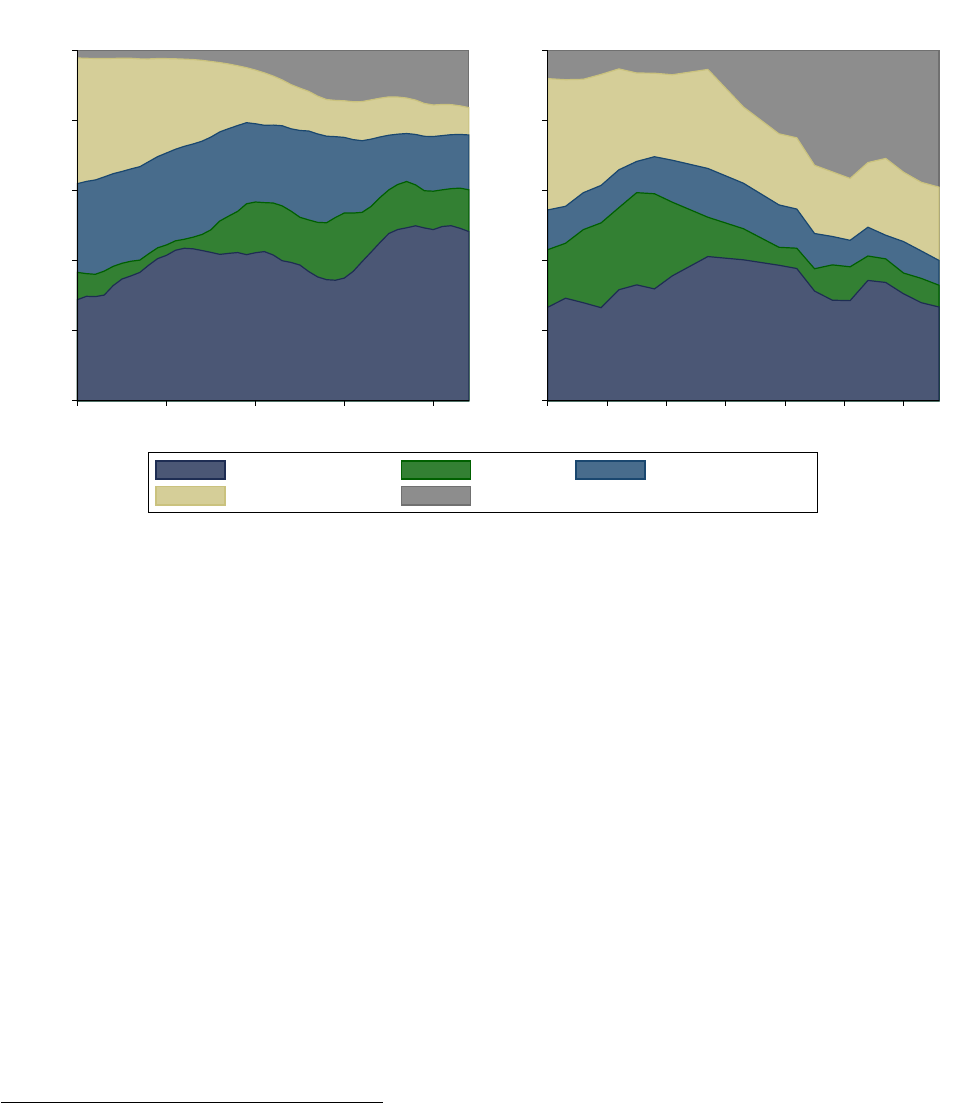

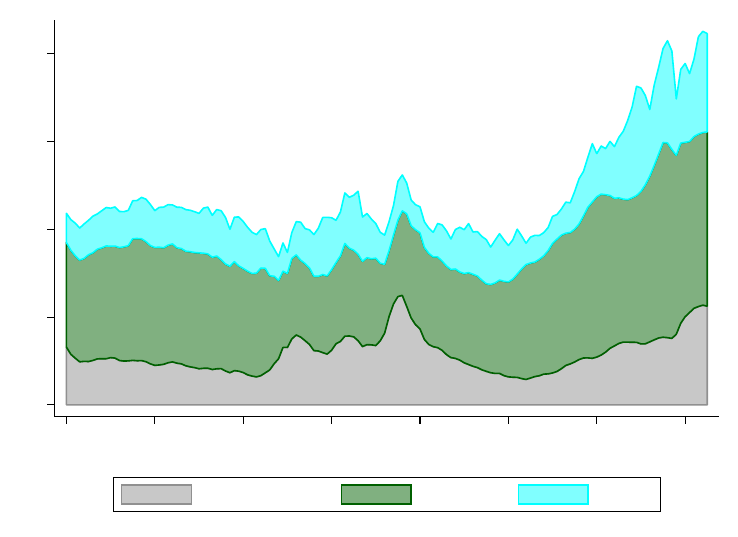

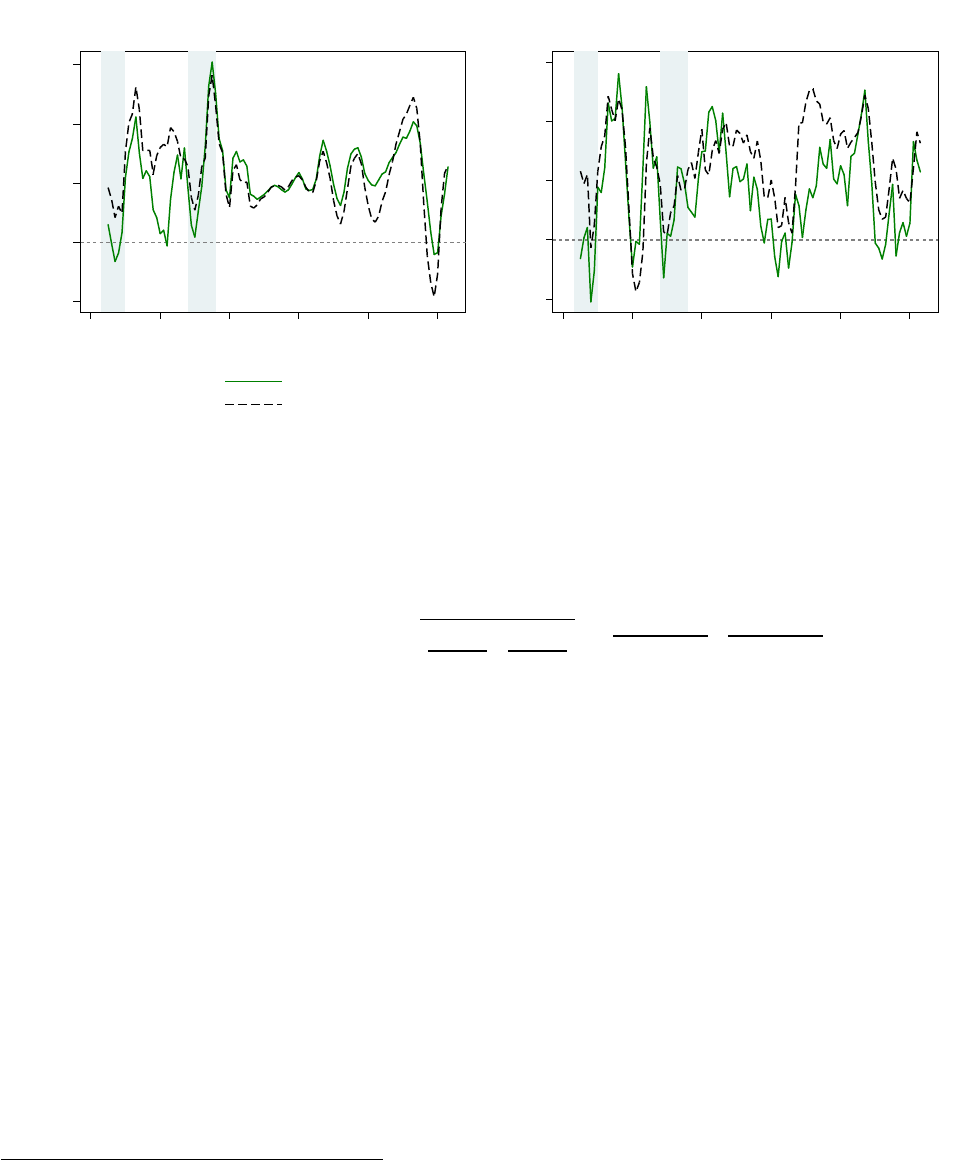

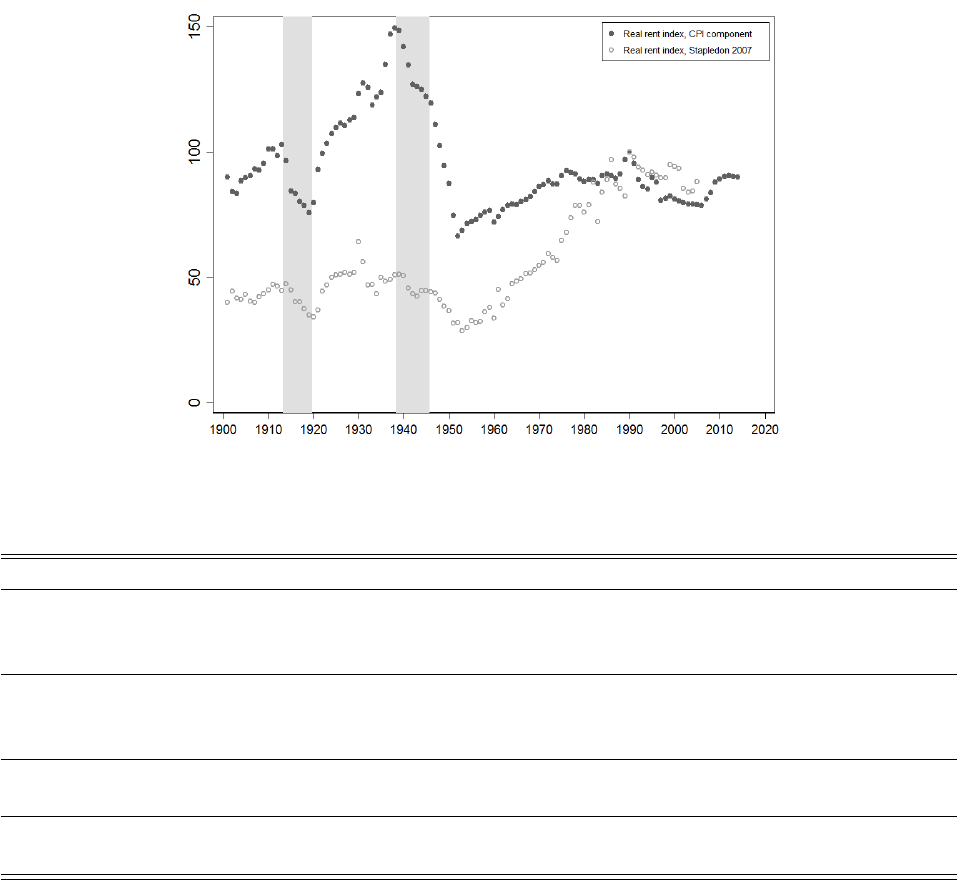

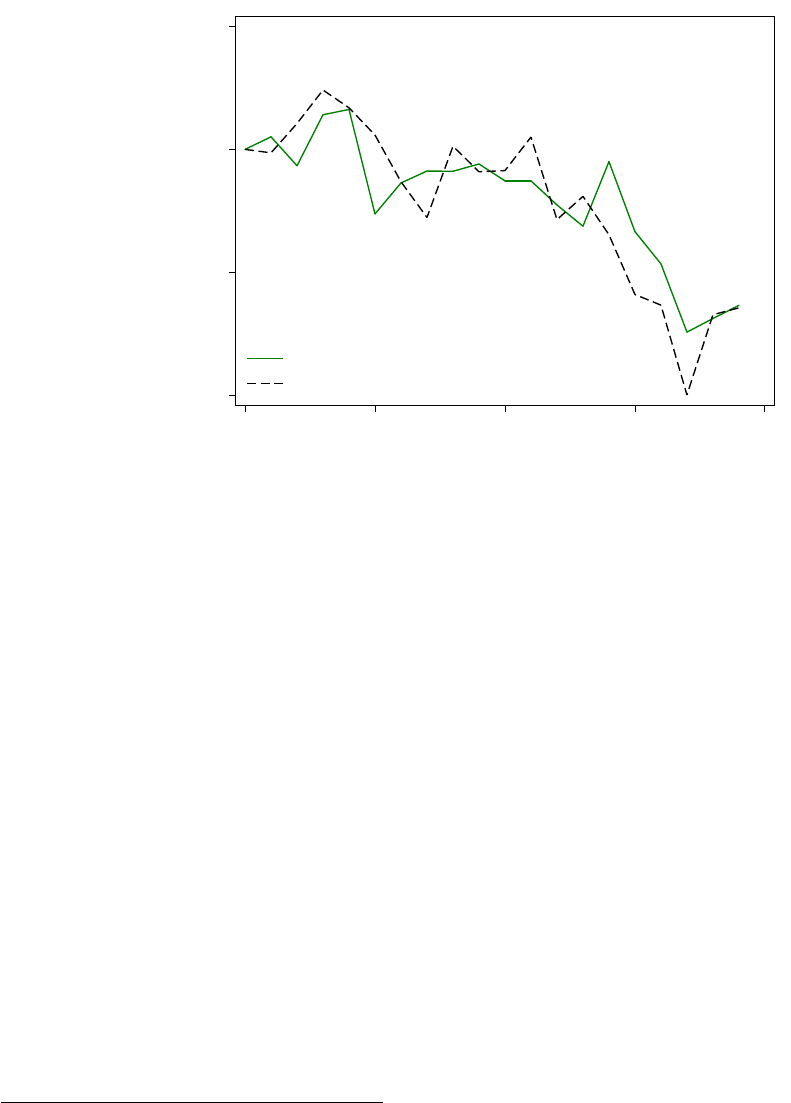

Figure II: Global real rates of return

Bills

Bonds

Equity

Housing

0 2 4 6 8

Mean annual return, per cent

Full sample

Bills

Bonds

Equity

Housing

0 2 4 6 8

Mean annual return, per cent

Post-1950

Bills Excess Return vs Bills Mean Annual Return

Notes: Arithmetic average real returns p.a., unweighted, 16 countries. Consistent coverage within each

country: each country-year observation used to compute the average has data for all four asset returns.

13

and riskiness of all four asset classes are very close to the unweighted series in Table II.

The results could be biased due to the country composition of the sample at different dates given

data availability. Figure A.2 plots the average returns for sample-consistent country groups, starting

at benchmark years—the later the benchmark year, the more countries we can include. Again, the

broad patterns discussed above are largely unaffected.

We also investigate whether the results are biased due to the world wars. Figure A.3 plots the

average returns in this case. The main result remains largely unchanged. Appendix Table A.3 also

considers the risky returns during wartime in more detail, to assess the evidence for rare disasters

in our sample. Returns during both wars were indeed low and often negative, although returns

during WW2 in a number of countries were relatively robust.

Finally, our aggregate return data take the perspective of a domestic investor in a representative

country. Appendix Table A.14 instead takes the perspective of a global USD-investor, and assesses

the USD value of the corresponding returns. The magnitude and ranking of returns are similar to

those reported in Table II, although the volatilities are substantially higher. This is to be expected

given that the underlying asset volatility is compounded by the volatility in the exchange rate. We

also find somewhat higher levels of USD returns, compared to those in local currency.

What comes next in our discussion of raw rates of return? We will look more deeply at risky

rates of return, and delve into their time trends and the decomposition of housing and equity

returns into the capital gain and yield components in greater detail in Section IV. We will do the

same for safe returns in Section V. But first, to justify our estimates, since these are new data,

we have to spend considerable time to explain our sources, methods, and calculations. We next

compare our data to other literature in Section III.A. We subject the equity returns and risk premium

calculation to a variety of accuracy checks in Section III.B. We also subject the housing returns and

risk premium calculation to a variety of accuracy checks in Section III.C. Section III.D then discusses

the comparability of the housing and equity return series. For the purposes of our paper, these very

lengthy next four subsections undertake the necessary due diligence and discuss the various quality

and consistency checks we undertook to make our data a reliable source for future analysis—and

only after that is done do we proceed with analysis and interpretation based on our data.

However, we caution that all these checks may be as exhausting as they are exhaustive and a

time-constrained reader eager to confront our main findings may jump to the end of this section

and resume where the analytical core of the paper begins at the start of Section IV on page 33.

III.A. Comparison to existing literature

Earlier work on asset returns has mainly focused on equities and the corresponding risk premium

over safe assets (bills or bonds), starting with Shiller’s analysis of historical US data (Shiller, 1981),

later extended to cover post-1920 Sweden and the UK (Campbell, 1999), and other advanced

economies back to 1900 (Dimson, Marsh, and Staunton, 2009), or back to 1870 (Barro and Urs

´

ua,

2008). The general consensus in this literature is that equities earn a large premium over safe assets.

14

The cross-country estimates of this premium vary between 7% in Barro and Urs

´

ua (2008) and 6% in

Dimson, Marsh, and Staunton (2009) using arithmetic means. Campbell (1999) documents a 4.7%

geometric mean return premium instead.

We find a similarly high, though smaller, equity premium using our somewhat larger and more

consistent historical dataset. Our estimate of the risk premium stands at 5.9% using arithmetic

means, and 3.8% using geometric means (see Table II). This is lower than the estimates by Campbell

(1999) and Barro and Urs

´

ua (2008). The average risk premium is similar to that found by Dimson,

Marsh, and Staunton (2009), but our returns tend to be slightly lower for the overlapping time

period.

17

Details aside, our data do confirm the central finding of the literature on equity market

returns: stocks earn a large premium over safe assets.

Studies on historical housing returns, starting with the seminal work of Robert Shiller (see

Shiller, 2000, for a summary), have largely focused on capital gains. The rental yield component

has received relatively little attention, and in many cases is missing entirely. Most of the literature

pre-dating our work has therefore lacked the necessary data to calculate, infer, or discuss the total

rates of return on housing over the long run. The few studies that take rents into account generally

focus on the post-1970s US sample, and often on commercial real estate. Most existing evidence

either places the real estate risk premium between equities and bonds, or finds that it is similar to

that for equities (see Favilukis, Ludvigson, and Van Nieuwerburgh, 2017; Francis and Ibbotson, 2009;

Ilmanen, 2011; Ruff, 2007). Some studies have even found that over the recent period, real estate

seems to outperform equities in risk-adjusted terms (Cheng, Lin, and Liu, 2008; Shilling, 2003).

The stylized fact from the studies on long-run housing capital appreciation is that over long

horizons, house prices only grow a little faster than the consumer price index. But again, note

that this is only the capital gain component in

(1)

. Low levels of real capital gains to housing was

shown by Shiller (2000) for the US, and is also true, albeit to a lesser extent, in other countries, as

documented in Knoll, Schularick, and Steger (2017). Our long-run average capital appreciation data

for the US largely come from Shiller (2000), with two exceptions. For the 1930s, we use the more

representative index of Fishback and Kollmann (2015) that documents a larger fall in prices during

the Great Depression. From 1975 onwards, we use a Federal Housing Finance Agency index, which

has a slightly broader coverage. Appendix M compares our series with Shiller’s data and finds that

switching to Shiller’s index has no effect on our results for the US. See also the Online Appendix of

Knoll et al. (2017) for further discussion.

However, our paper turns this notion of low housing returns on its head—because we show

that including the yield component in

(1)

in the housing return calculation generates a housing risk

premium roughly as large as the equity risk premium. Prior to our work on historical rental yields

this finding could not be known. Coincidentally, in our long-run data we find that most of the real

17

Our returns are substantially lower for France and Portugal (see Appendix Table A.18). These slightly

lower returns are largely a result of more extensive consistency and accuracy checks that eliminate a number

of upward biases in the series, and better coverage of economic disasters. We discuss these data quality issues

further in Section III.B. Appendix L compares our equity return estimates with the existing literature on a

country basis.

15

equity return also comes from the dividend yield rather than from real equity capital gains which

are low, especially before the 1980s. Thus the post-1980 observation of large capital gain components

in both equity and housing total returns is completely unrepresentative of the normal long-run

patterns in the data, another fact underappreciated before now.

Data on historical returns for all major asset classes allow us to compute the return on aggregate

wealth (see equation 7). In turn, this return can be decomposed into various components by

asset class, and into capital gains and yields, to better understand the drivers of aggregate wealth

fluctuations. This connects our study to the literature on capital income, and the stock of capital (or

wealth) from a national accounts perspective. Even though national accounts and national balance

sheet estimates have existed for some time (see Goldsmith, 1985b; Kuznets, 1941), it is only recently

that scholars have systematized and compared these data to calculate a series of returns on national

wealth.

18

Piketty, Saez, and Zucman (2018) compute balance sheet returns on aggregate wealth and for

individual asset classes using post-1913 US data. Balance sheet return data outside the US are sparse,

although Piketty and Zucman (2014) provide historical estimates at benchmark years for three more

countries, and, after 1970, continuous data for an additional five countries. Appendix R compares

our market-based return estimates for the US with those of Piketty et al. (2018). Housing returns are

very similar. However, equity returns are several percentage points above our estimates, and those

in the market-based returns literature more generally. Part of this difference reflects the fact that

balance sheet returns are computed to measure income before corporate taxes, whereas our returns

take the household perspective and are therefore net of corporate tax. Another explanation for the

difference is likely to come from some measurement error in the national accounts data.

19

When it

comes to housing, our rental yield estimates are broadly comparable and similar to those derived

using the balance sheet approach, for a broad selection of countries and historical time spans.

20

Our dataset complements the market-based return literature by increasing the coverage in terms

of assets, return components, countries, and years; improving data consistency and documentation;

and making the dataset freely available for future research. This comprehensive coverage can also

help connect the market-based return estimates to those centered around national accounts concepts.

We hope that eventually, this can improve the consistency and quality of both market-based returns

and national accounts data.

18

The return on an asset from a national accounts perspective, or the “balance sheet approach” to returns,

r

BS

t

is the sum of the yield, which is capital income (such as rents or profits) in relation to wealth, and capital

gain, which is the change in wealth not attributable to investment. See Appendix R and equation

(13)

for

further details.

19

See Appendix R for more detail. In brief, the main conceptual difference between the two sets of estimates,

once our returns are grossed up for corporate tax, is the inclusion of returns on unlisted equities in the

national accounts data. But existing evidence suggests that these return differentials are not large (Moskowitz

and Vissing-Jørgensen, 2002), and the size of the unlisted sector not sufficiently large to place a large weight

of this explanation, which leads us to conjecture that there is some measurement error in the national income

and wealth estimates that is driving the remaining difference.

20

See Section III.C and Appendix U for more detail.

16

III.B. Accuracy of equity returns

The literature on equity returns has highlighted two main sources of bias in the data: weighting

and sample selection. Weighting biases arise when the stock portfolio weights for the index do

not correspond with those of a representative investor, or a representative agent in the economy.

Selection biases arise when the selection of stocks does not correspond to the portfolio of the

representative investor or agent. This second category also includes issues of survivorship bias and

missing data bias arising from stock exchange closures and restrictions.

We consider how each of these biases affect our equity return estimates in this section. An

accompanying Appendix Table A.29 summarizes the construction of the equity index for each

country and time period, with further details provided in Appendix X.

Weighting bias

The best practice when weighting equity indices is to use market capitalization

of individual stocks. This approach most closely mirrors the composition of a hypothetical represen-

tative investor’s portfolio. Equally-weighted indices are likely to overweight smaller firms, which

tend to carry higher returns and higher volatility.

The existing evidence from historical returns on the Brussels and Paris stock exchanges suggests

that using equally-weighted indices biases returns up by around 0.5 percentage points, and their

standard deviation up by 2–3 percentage points (Annaert, Buelens, Cuyvers, De Ceuster, Deloof,

and De Schepper, 2011; Le Bris and Hautcoeur, 2010). The size of the bias, however, is likely

to vary across across markets and time periods. For example, Grossman (2017) shows that the

market-weighted portfolio of UK stocks outperformed its equally-weighted counterpart over the

period 1869–1929.

To minimize this bias, we use market-capitalization-weighted indices for the vast majority of our

sample (see Appendix Table A.29 and Appendix X). Where market-capitalization weighting was not

available, we have generally used alternative weights such as book capital or transaction volumes,

rather than equally-weighted averages. For the few equally-weighted indices that remain in our

sample, the overall impact on aggregate return estimates ought to be negligible.

Selection and survivorship bias

Relying on an index whose selection does not mirror the

representative investor’s portfolio carries two main dangers. First, a small sample may be unrep-

resentative of overall stock market returns. And second, a sample that is selected ad-hoc, and

especially ex-post, is likely to focus on surviving firms, or successful firms, thus overstating invest-

ment returns. This second bias extends not only to stock prices but also to dividend payments, as

some historical studies only consider dividend-paying firms.

21

The magnitude of survivorship bias

has generally been found to be around 0.5 to 1 percentage points (Annaert, Buelens, and De Ceuster,

21

As highlighted by Brailsford, Handley, and Maheswaran (2012), this was the case with early Australian

data, and the index we use scales down the series for dividend-paying firms to proxy the dividends paid by

all firms, as suggested by these authors.

17

2012; Nielsen and Risager, 2001), but in some time periods and markets it could be larger (see

Le Bris and Hautcoeur, 2010, for France).

As a first best, we always strive to use all-share indices that avoid survivor and selection biases.

For some countries and time periods where no such indices were previously available, we have

constructed new weighted all-share indices from original historical sources (e.g., early historical data

for Norway and Spain). Where an all-share index was not available or newly constructed, we have

generally relied on “blue-chip” stock market indices. These are based on an ex-ante value-weighted

sample of the largest firms on the market. It is updated each year and tends to capture the lion’s

share of total market capitalization. Because the sample is selected ex-ante, it avoids ex-post selection

and survivorship biases. And because historical equity markets have tended to be quite concentrated,

“blue-chip” indices have been shown to be a good proxy for all-share returns (see Annaert, Buelens,

Cuyvers, De Ceuster, Deloof, and De Schepper, 2011). Finally, we include non-dividend-paying

firms in the dividend yield calculation.

Stock market closures and trading restrictions

A more subtle form of selection bias arises

when the stock market is closed and no market price data are available. One way of dealing with

closures is to simply exclude them from the baseline return comparisons. But this implicitly assumes

that the data are “missing at random”—i.e., that stock market closures are unrelated to underlying

equity returns. Existing research on rare disasters and equity premiums shows that this is unlikely

to be true (Nakamura, Steinsson, Barro, and Urs

´

ua, 2013). Stock markets tend to be closed precisely

at times when we would expect returns to be low, such as periods of war and civil unrest. Return

estimates that exclude such rare disasters from the data will thus overstate stock returns.

To guard against this bias, we include return estimates for the periods of stock market closure in

our sample. Where possible, we rely on alternative data sources to fill the gap, such as listings of

other exchanges and over-the-counter transactions—for example, in the case of WW1 Germany we

use the over-the-counter index from Ronge (2002) and for WW2 France we use the newspaper index

from Le Bris and Hautcoeur (2010). In cases where alternative data are not available, we interpolate

the prices of securities listed both before and after the exchange was closed to estimate the return (if

no dividend data are available, we also assume no dividends were paid).

22

Even though this approach only gives us a rough proxy of returns, it is certainly better than

excluding these periods, which effectively assumes that the return during stock market closures is

the same as that when the stock markets are open. In the end, we only have one instance of stock

market closure for which we are unable to estimate returns—that of the Tokyo stock exchange in

1946–1947. Appendix H further assesses the impact of return interpolation on the key moments of

our data and finds that, over the full sample, it is negligible.

22

For example, the Swiss stock exchange was closed between July 1914 and July 1916. Our data for 1914

capture the December 1913–July 1914 return, for 1915 the July 1914–July 1916 return, and for 1916 the July

1916–December 1916 return. For the Spanish Civil war, we take the prices of securities in end-1936 and

end-1940, and apportion the price change in-between equally to years 1937–1939.

18

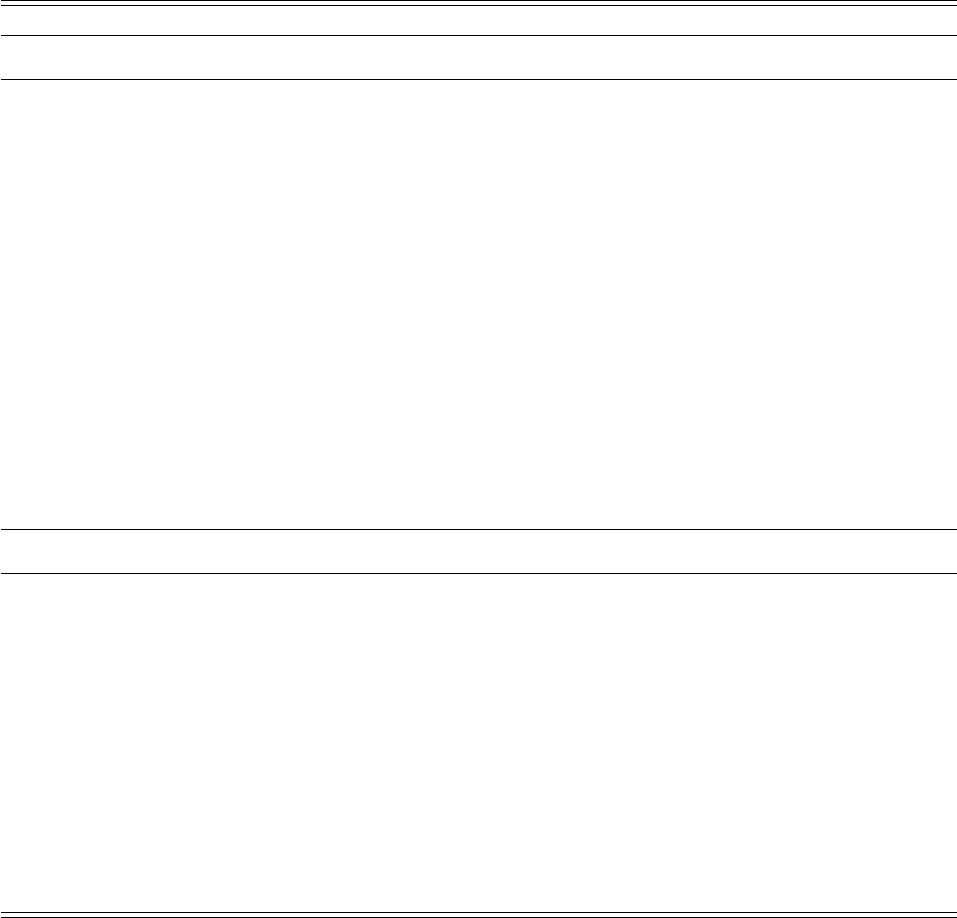

Table III: Geometric annual average and cumulative total equity returns in periods of stock market closure

Episode Real returns Nominal returns Real capitalization

Geometric

average

Cumulative

Geometric

average

Cumulative

Geometric

average

Cumulative

Spanish Civil War, 1936–40 -4.01 -15.09 9.03 41.32 -10.22 -35.04

Portuguese Revolution, 1974–77 -54.98 -90.88 -44.23 -82.65 -75.29 -98.49

Germany WW1, 1914–18 -21.67 -62.35 3.49 14.72

Switzerland WW1, 1914–16 -7.53 -14.50 -0.84 -1.67 -8.54 -16.34

Netherlands WW2, 1944–46 -12.77 -20.39 -5.09 -8.36

Note: Cumulative and geometric average returns during periods of stock market closure. Estimated by

interpolating returns of shares listed both before an after the exchange was closed. The change in market

capitalization compares the capitalization of all firms before the market was closed, and once it was opened,

and thus includes the effect of any new listings, delistings and bankruptcies that occured during the closure.

Table III shows the estimated stock returns during the periods of stock exchange closure in

our sample. The first two columns show average and cumulative real returns, and the third and

fourth columns show the nominal returns. Aside from the case of WW1 Germany, returns are

calculated by comparing the prices of shares listed both before and after the market closure. Such a

calculation may, however, overstate returns because it selects only those companies that “survived”

the closure. As an additional check, the last two columns of Table III show the inflation-adjusted

change in market capitalization of stocks before and after the exchange was closed. This serves as a

lower bound for investor returns because it would be as if we assumed that all delisted stocks went

bankrupt (i.e., to a zero price) during the market closure.

Indeed, the hypothetical investor returns during the periods of market closure are substantially

below market averages. In line with Nakamura, Steinsson, Barro, and Urs

´

ua (2013), we label these

periods as “rare disasters.” The average per-year geometric mean return ranges from a modestly

negative –4% p.a. during the Spanish Civil War, to losses of roughly 55% p.a. during the three years

after the Portuguese Carnation Revolution. Accounting for returns of delisted firms is likely to bring

these estimates down even further, as evinced by the virtual disappearance of the Portuguese stock

market in the aftermath of the revolution.

Having said this, the impact of these rare events on the average cross-country returns (shown

in Table II) is small, around –0.1 percentage points, precisely because protracted stock market

closures are very infrequent. The impact on country-level average returns is sizeable for Portugal

and Germany (around –1 percentage point), but small for the other countries (–0.1 to –0.4 percentage

points). Appendix G provides a more detailed analysis of returns during consumption disasters. On

average, equity returns during these times are low, with an average cumulative real equity return

drop of 6.7% during the disaster years.

Lastly, Nakamura, Steinsson, Barro, and Urs

´

ua (2013) also highlight a more subtle bias arising

from asset price controls. This generally involves measures by the government to directly control

transaction prices, as in Germany during 1943–47, or to influence the funds invested in the domestic

19

stock market (and hence the prices) via controls on spending and investment, as in France during

WW2 (Le Bris, 2012). These measures are more likely to affect the timing of returns rather than their

long-run average level, and should thus have little impact on our headline estimates. For example,

Germany experienced negative nominal and real returns despite the WW2 stock price controls; and

even though the policies it enacted in occupied France succeeded in generating high nominal stock

returns, the real return on French stocks during 1940–44 was close to zero. Both of these instances

were also followed by sharp drops in stock prices when the controls were lifted.

23

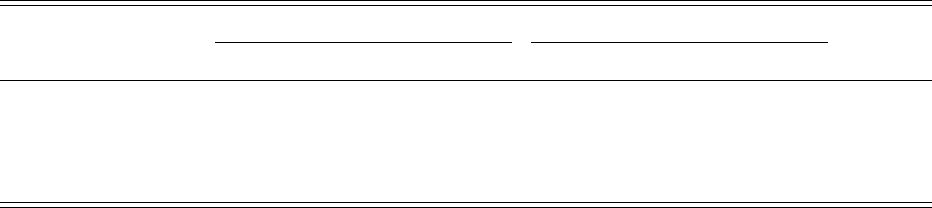

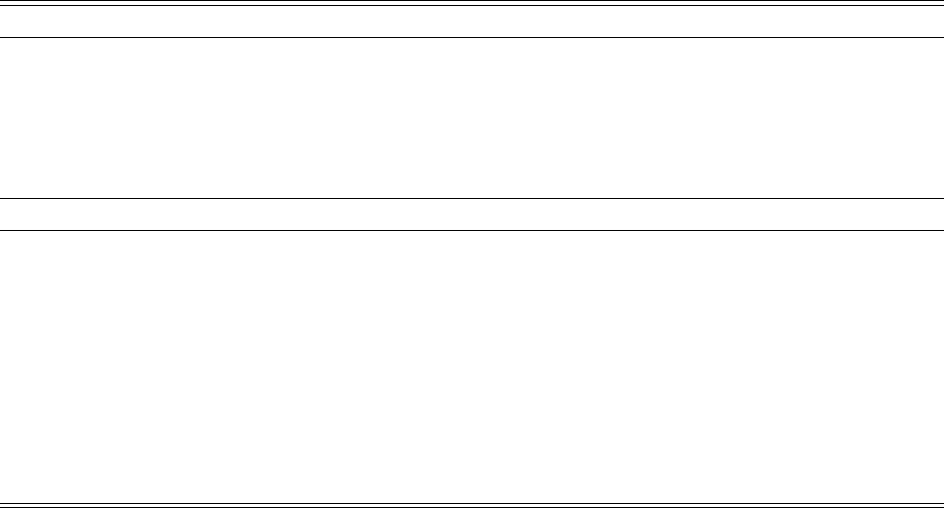

III.C. Accuracy of housing returns

The biases that affect equity returns—weighting and selection—can also apply to returns on housing.

There are also other biases that are specific to housing return estimates. These include costs of

running a housing investment, and the benchmarking of rent-price ratios to construct the historical

rental yield series. We discuss each of these problematic issues in turn in this section. Our focus

throughout is mainly on rental yield data, as the accuracy and robustness of the house price series

has been extensively discussed in Knoll, Schularick, and Steger (2017) in their online appendix.

Maintenance costs

Any homeowner incurs costs for maintenance and repairs which lower the

rental yield and thus the effective return on housing. We deal with this issue by the choice of the

benchmark rent-price ratios. Specifically, we anchor to the Investment Property Database (IPD)

whose rental yields reflect net income—net of property management costs, ground rent, and other

irrecoverable expenditure—as a percentage of the capital employed. The rental yields calculated

using the rent-price approach detailed in Section II.D are therefore net yields. To enable a like-for-

like comparison, our historical benchmark yields are calculated net of estimated running costs and

depreciation. Running costs are broadly defined as housing-related expenses excluding interest,

taxes, and utilities—i.e., maintenance costs, management, and insurance fees.

Applying the rent-price approach to net yield benchmarks assumes that running costs remain

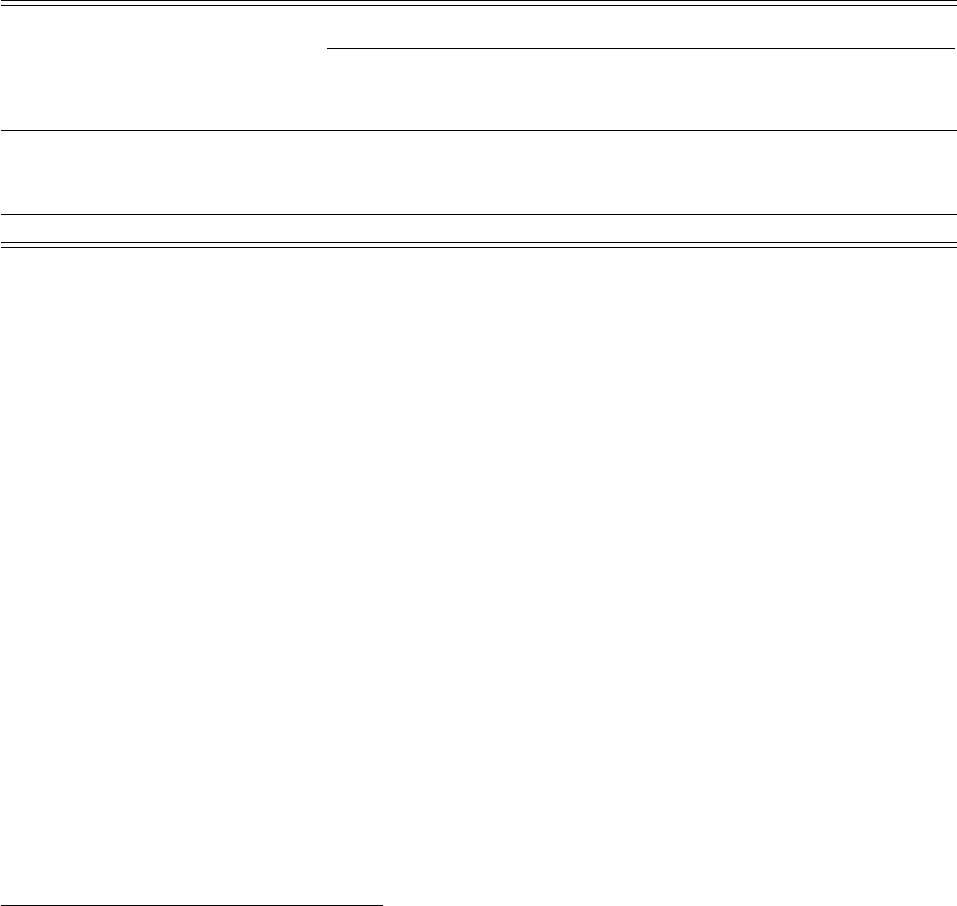

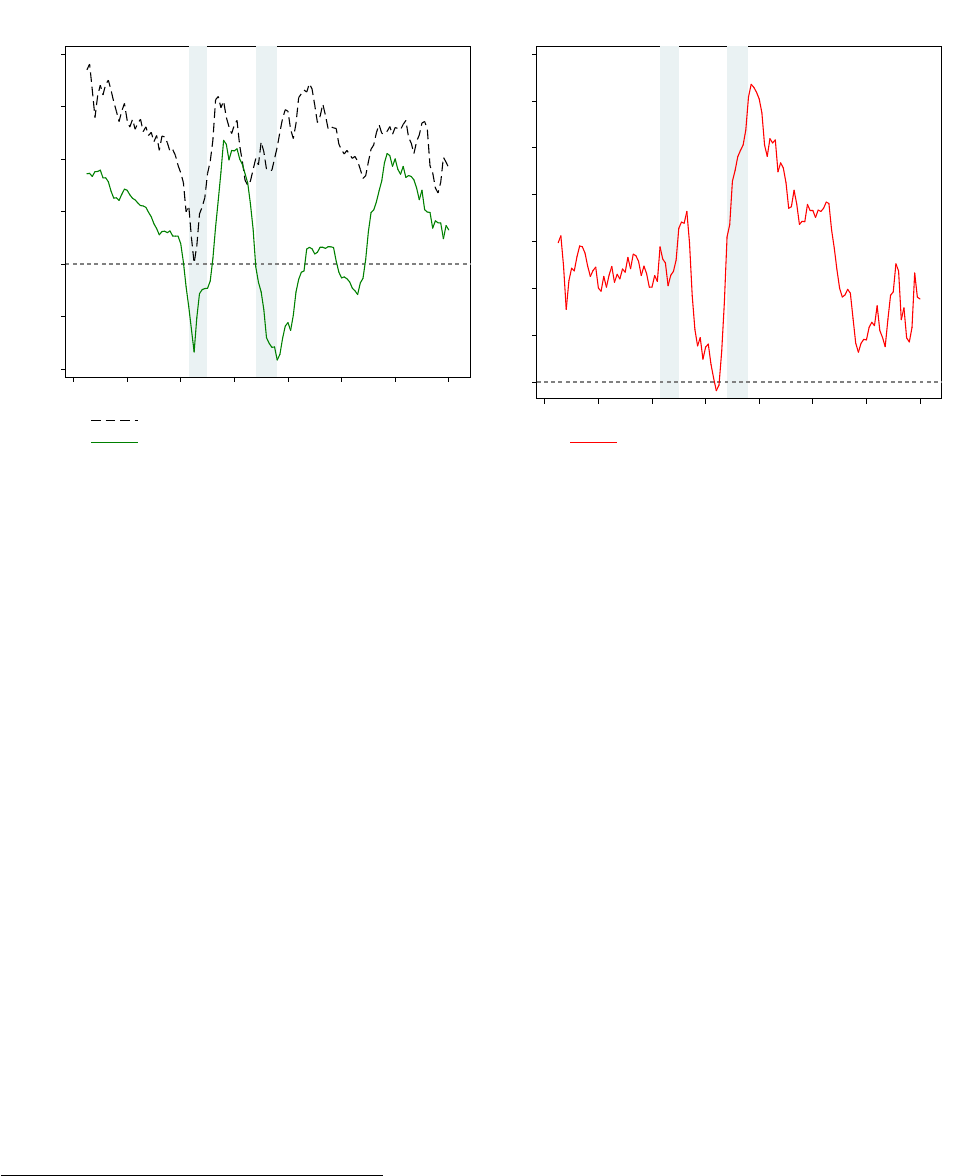

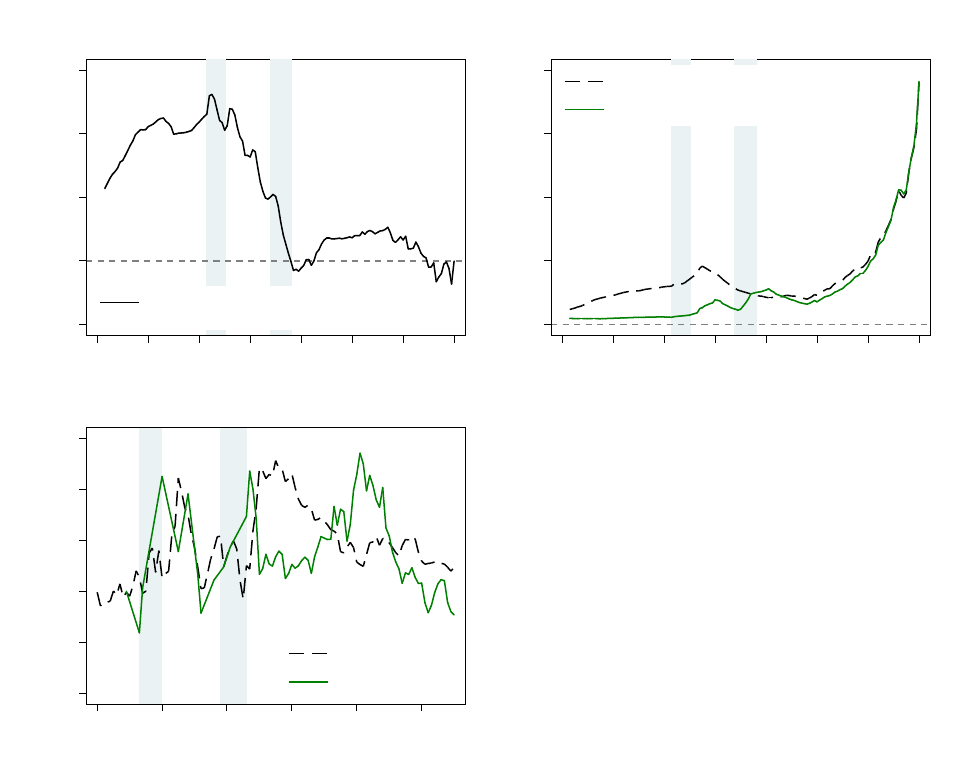

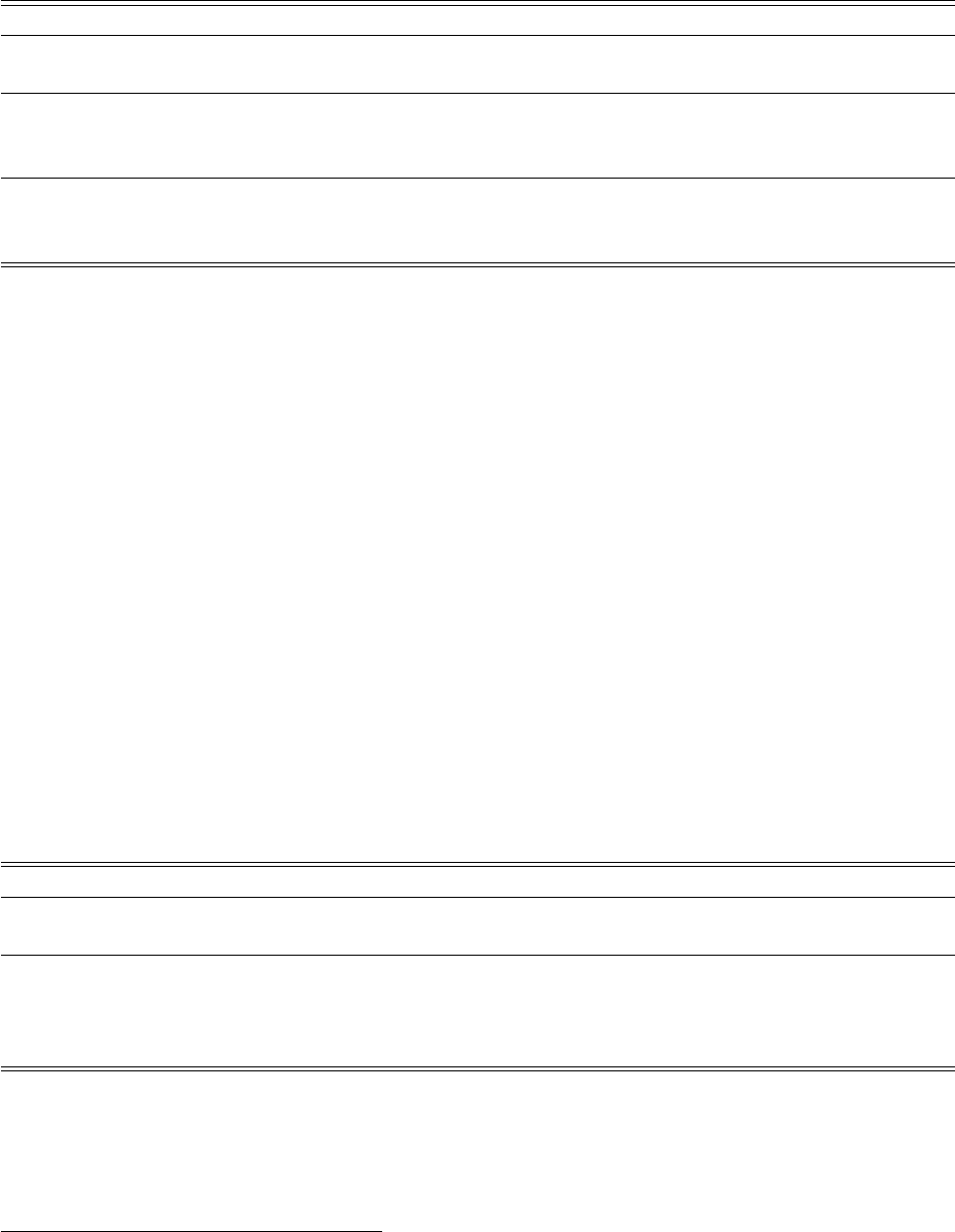

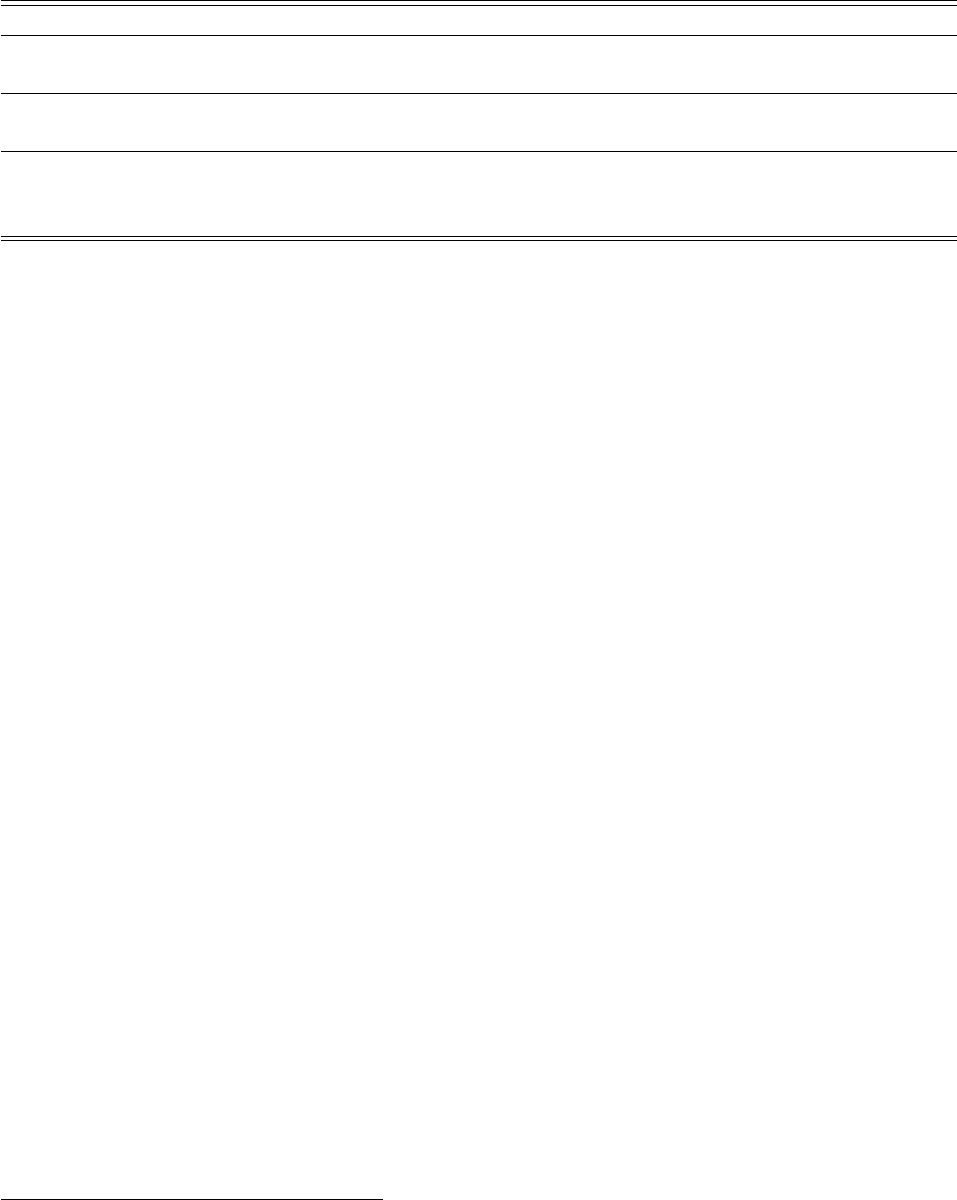

stable relative to gross rental income over time within each country. To check this, Figure III presents

historical estimates of running costs and depreciation for Australia, France, UK, and US, calculated

as the sum of the corresponding housing expenditures and fixed capital consumption items in the

national accounts. The left-hand panel presents these as a proportion of total housing value, and the

right-hand panel as a proportion of gross rent. Relative to housing value, costs have been stable over

the last 40 years, but were somewhat higher in the early-to-mid 20th century. This is to be expected

since these costs are largely related to structures, not land, and structures constituted a greater

share of housing value in the early 20th century (Knoll, Schularick, and Steger, 2017). Additionally,

structures themselves may have been of poorer quality in past times. When taken as a proportion

of gross rent, however, as shown in the right-hand panel of Figure III, housing costs have been

23

The losses in the German case are difficult to ascertain precisely because the lifting of controls was

followed by a re-denomination that imposed a 90% haircut on all shares.

20

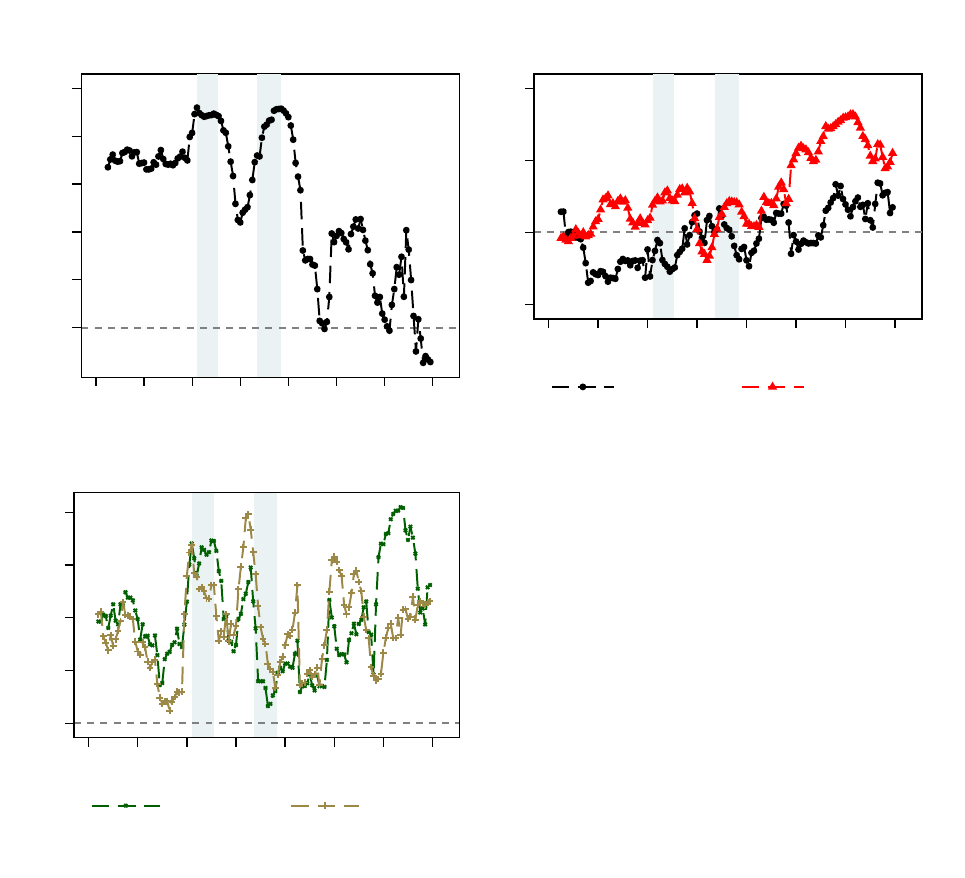

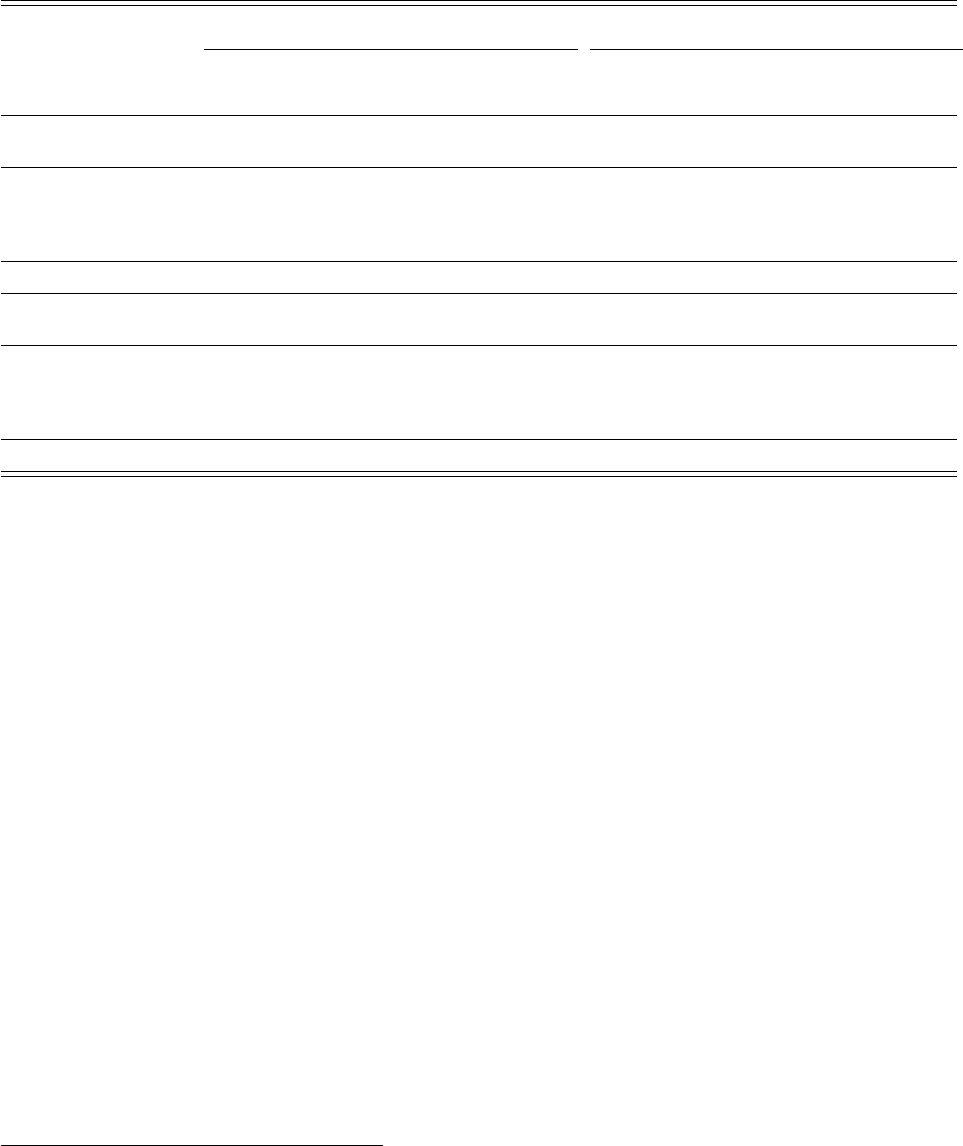

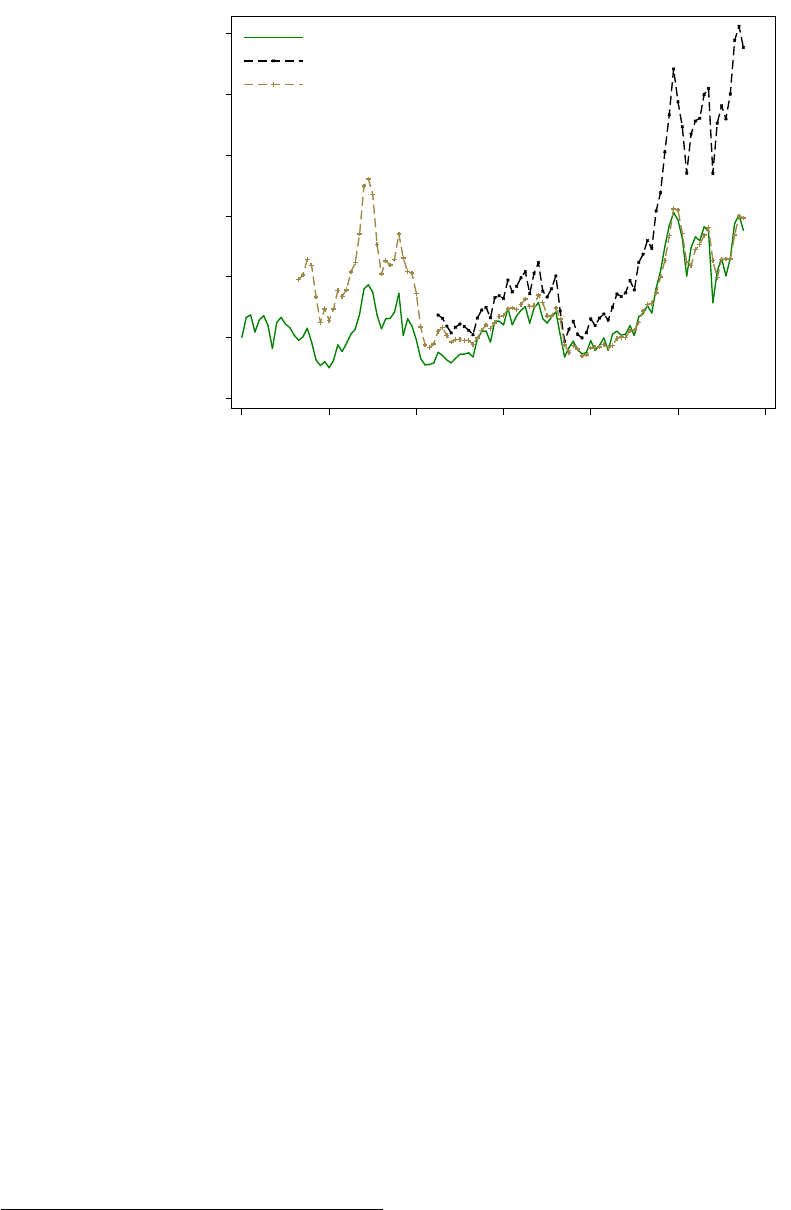

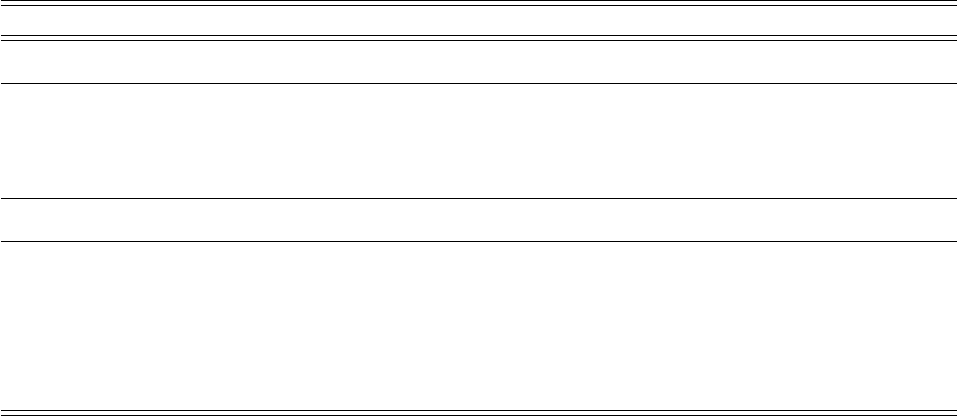

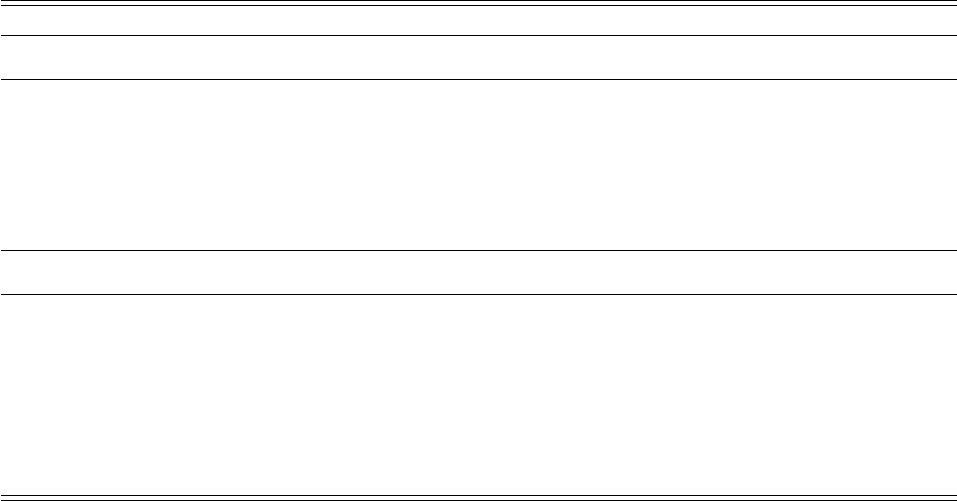

Figure III: Costs of running a housing investment

0 .5 1 1.5 2 2.5 3

1910 1930 1950 1970 1990 2010

Australia France

UK US

Proportion of Housing Value, per cent

0 10 20 30 40 50

1910 1930 1950 1970 1990 2010

Proportion of Gross Rent, per cent

Note: Total costs include depreciation and all other housing-related expenses excluding interest, taxes and

utilities (mainly maintenance and insurance payments). Costs are estimated as the household consumption of

the relevant intermediate housing input, or fixed housing capital, in proportion to total housing wealth (left

panel), or total gross rent (right panel).

relatively stable, or at least not higher historically than they are today. This is likely because both

gross yields and costs are low today, whereas historically both yields and costs were higher, with

the two effects more or less cancelling out. This suggests that the historical rental yields that we

have calculated using the rent-price approach are a good proxy for net yields.

Rental yield benchmarking

To construct historical rental yield series using the rent-price

approach, we start with a benchmark rent-price ratio from the Investment Property Database (IPD),

and extend the series back using the historical rent and house price indices (see Section II.D).

24

This

naturally implies that the level of returns is sensitive to the choice of the benchmark ratio. Moreover,

past errors in rent and house price indices can potentially accumulate over time and may cause one

to substantially over- or understate historical rental yields and housing returns. If the historical

capital gains are overstated, the historical rental yields will be overstated too.

To try to avert such problems, we corroborate our rental yield estimates using a wide range of

alternative historical and current-day sources. The main source of these independent comparisons

comes from estimates using the balance sheet approach and national accounts data. As shown in

equation 12, the “balance sheet” rental yield is the ratio of nationwide net rental income to total

housing wealth. Net rental income is computed as gross rents paid less depreciation, maintenance

24

For Australia and Belgium, we instead rely on yield estimates from transaction-level data (Fox and Tulip

(2014) and

Numbeo.com

, which are more in line with current-day and alternative historical estimates than IPD.

21

and other housing-related expenses (excluding taxes and interest), with all data taken from the

national accounts. The balance sheet approach gives us a rich set of alternative rental yield estimates

both for the present day and even going back in time to the beginning of our sample in a number of

countries. The second source for historical comparisons comes from advertisements in contemporary

newspapers and various other contemporary publications. Third, we also make use of alternative

current-day benchmarks based on transaction-level market rent data, and the rental expenditure

and house price data from

numbeo.com

.

25

For all these measures, we adjust gross yields down to

obtain a proxy for net rental yields.

Historical sources offer point-in-time estimates which avoid the cumulation of errors, but can

nevertheless be imprecise. The balance sheet approach relies on housing wealth and rental income

data, both of which are subject to potential measurement error. For housing wealth, it is inherently

difficult to measure the precise value of all dwellings in the economy. Rental income is largely

driven by the imputed rents of homeowners, which have to be estimated from market rents by

matching the market rent to owner-occupied properties based on various property characteristics.

This procedure can suffer from errors both in the survey data on property characteristics and market

rents, and the matching algorithm.

26

Newspaper advertisements are tied to a specific location, and

often biased towards cities. And transaction-level or survey data sometimes only cover the rental

sector, rather than both renters and homeowners.

Given the potential measurement error in all the series, our final rental yield series uses data

from both the rent-price approach and the alternative benchmarks listed above. More precisely, we

use the following method to construct our final “best-practice” rental yield series. If the rent-price

approach estimates are close to alternative measures, we keep the rent-price approach data. This is

the case for most historical periods in our sample. If there is a persistent level difference between

the rent-price approach and alternative estimates, we adjust the benchmark yield to better match the

historical and current data across the range of sources. This is the case for Australia and Belgium.

If the levels are close for recent data but diverge historically, we adjust the historical estimates to

match the alternative benchmarks. For most countries such adjustments are small or only apply

to a short time span, but for Finland and Spain they are more substantial. Appendix U details the

alternative sources and rental yield construction, including any such adjustments, for each country.

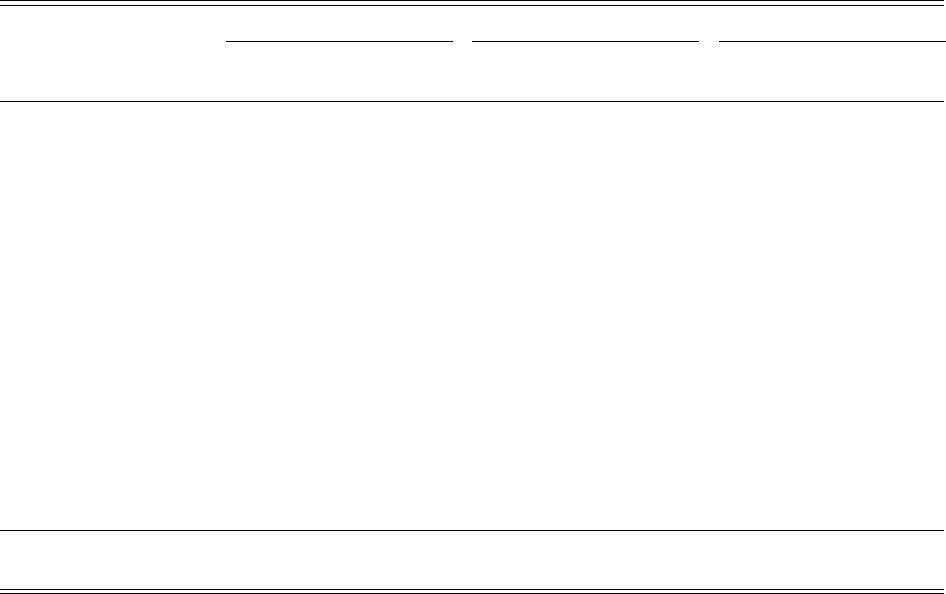

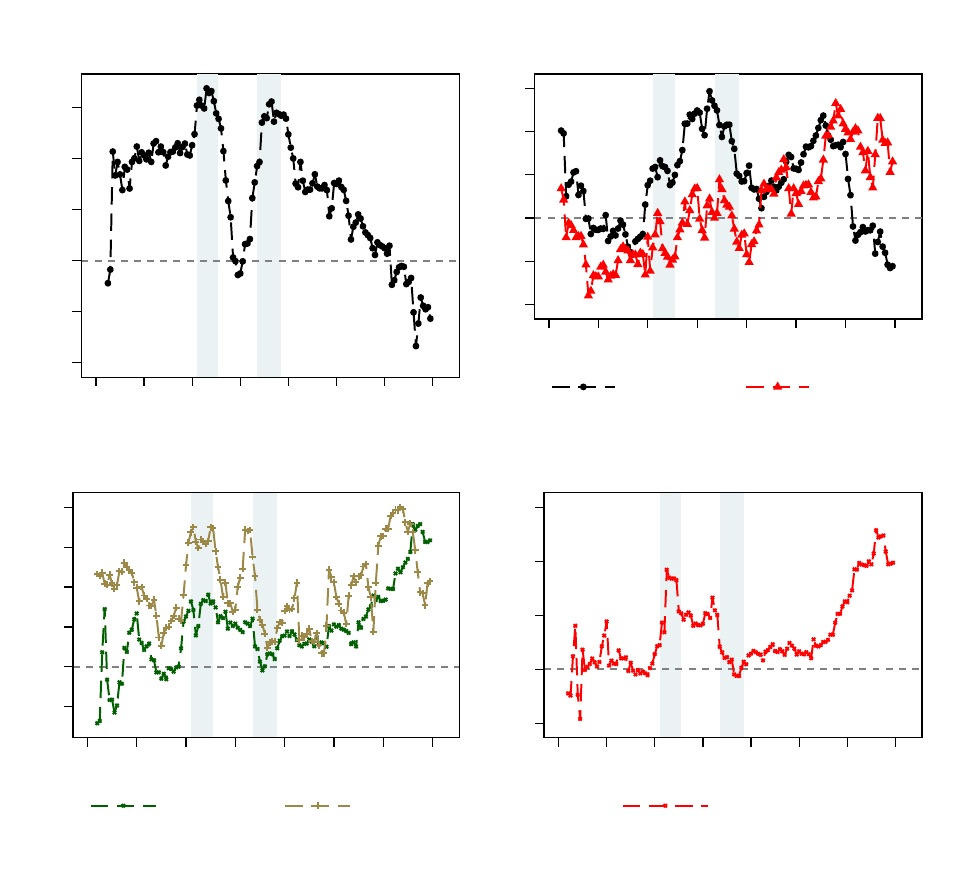

How large is the room for error in our final housing return series? To get a sense of the differences,

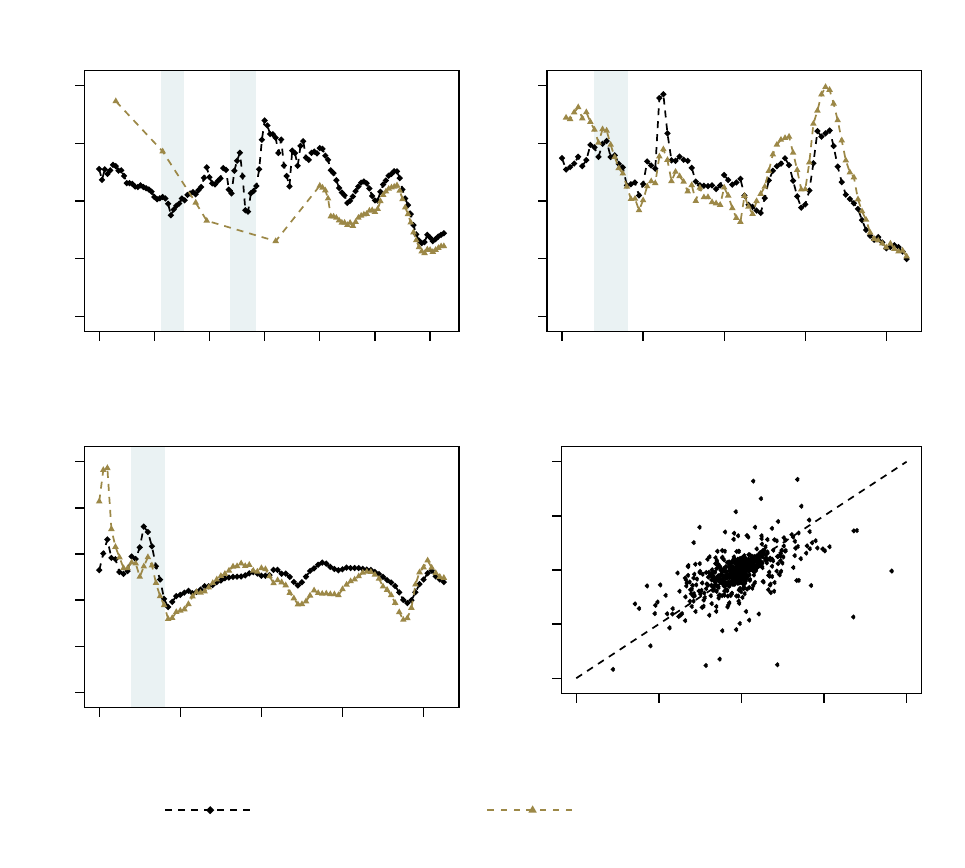

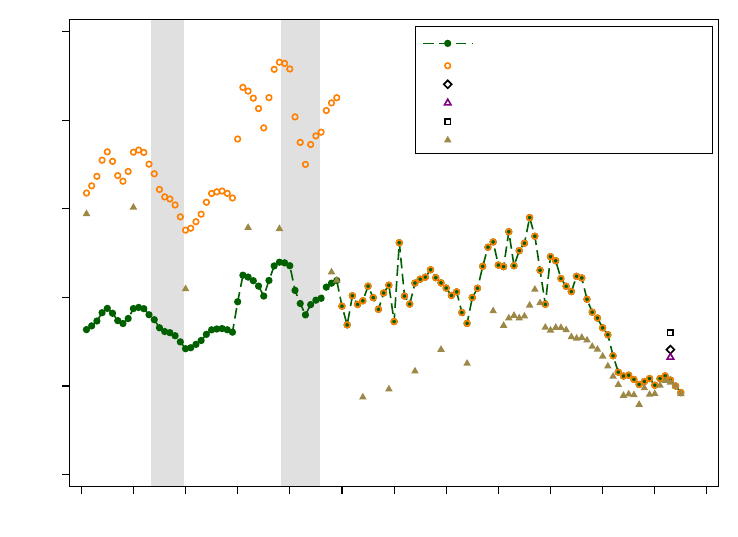

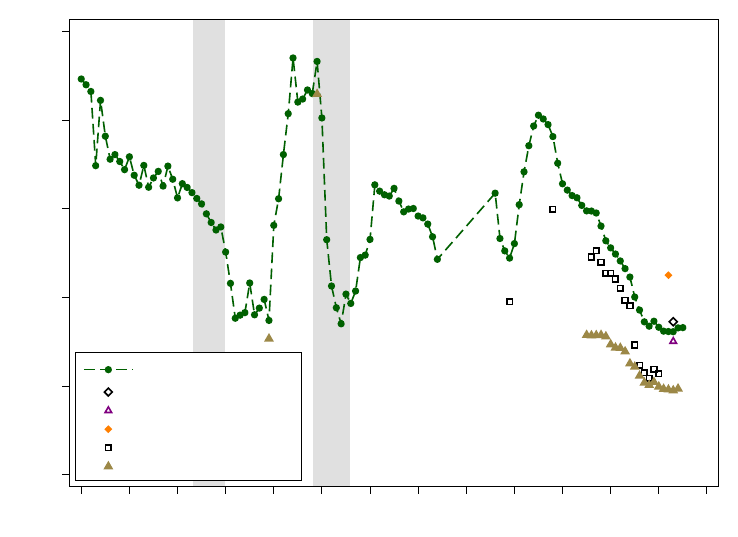

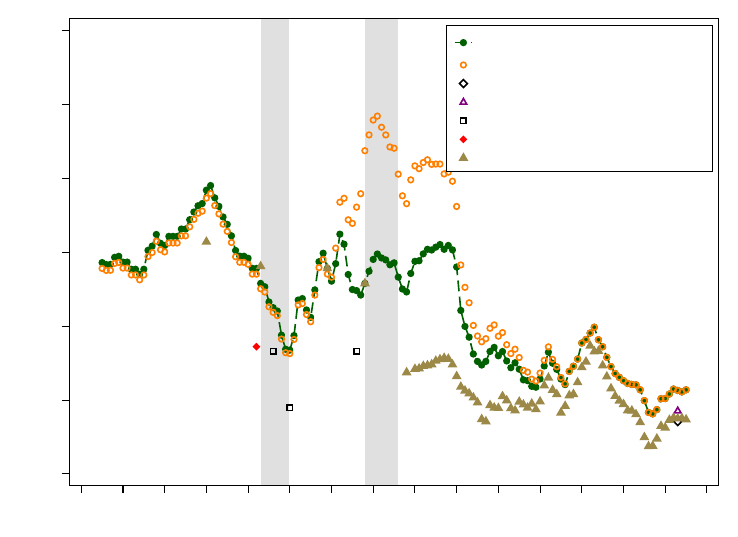

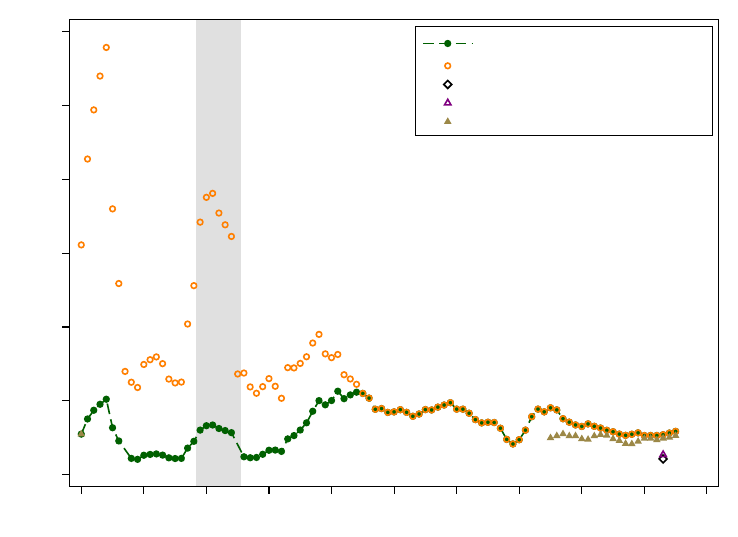

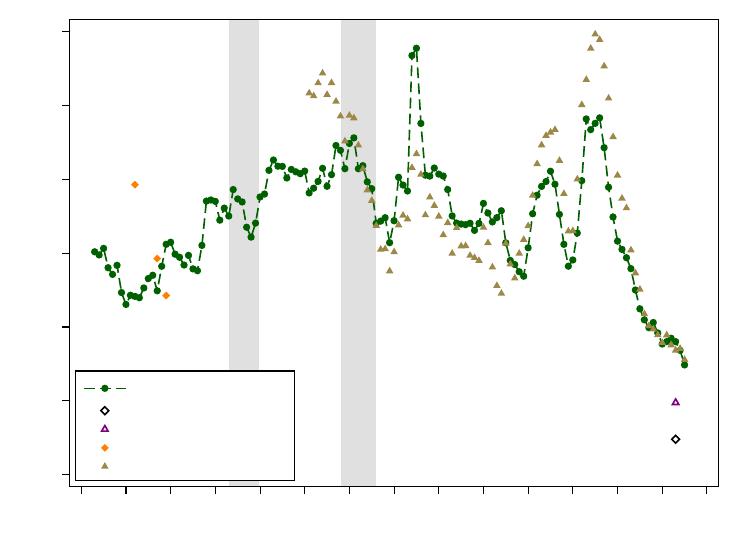

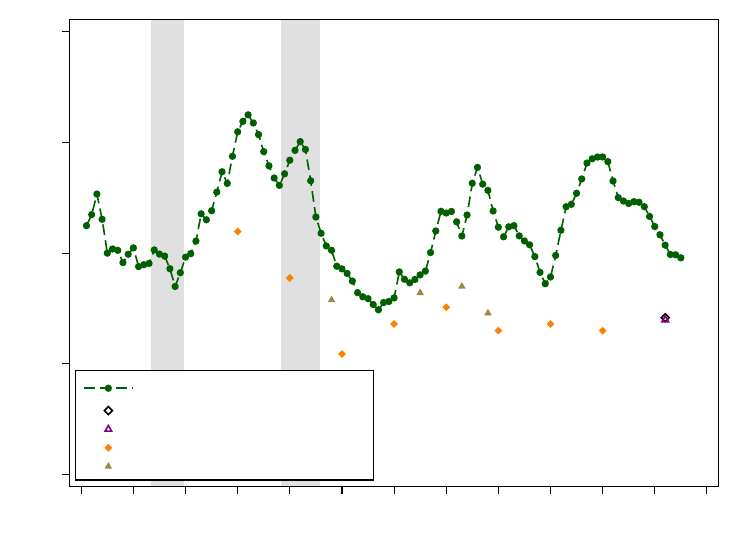

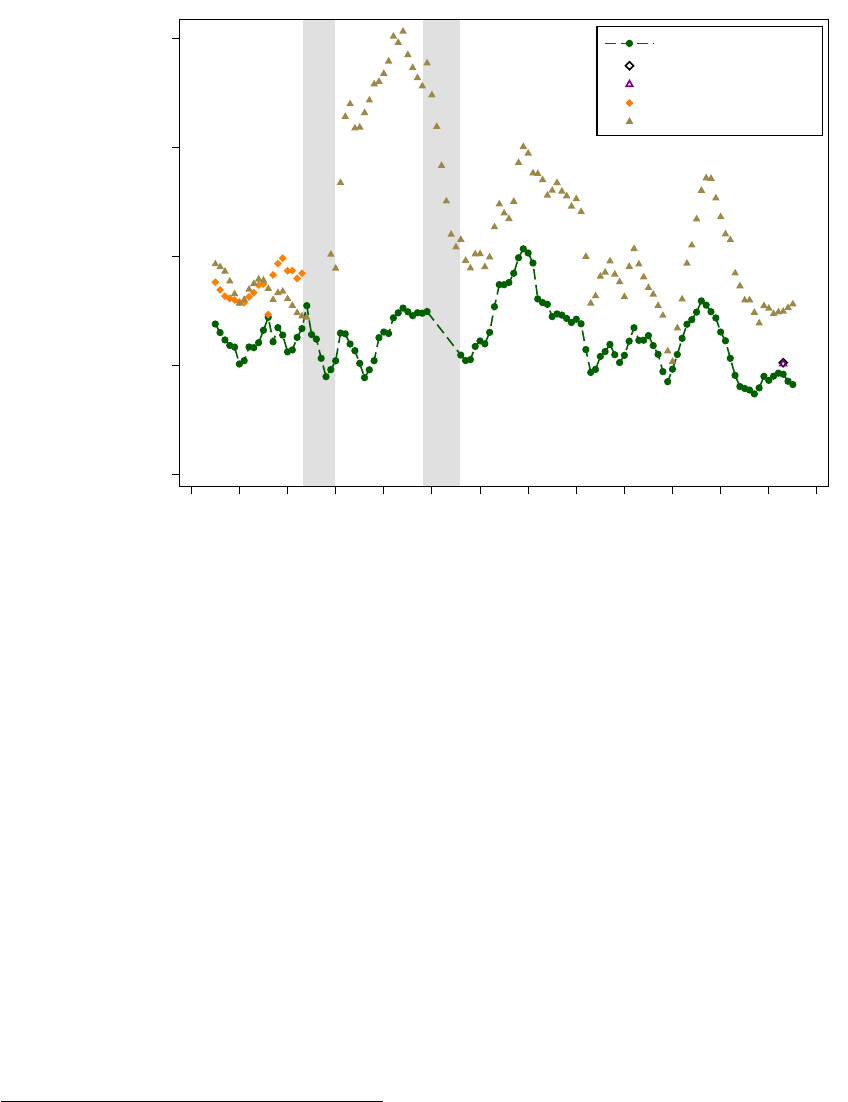

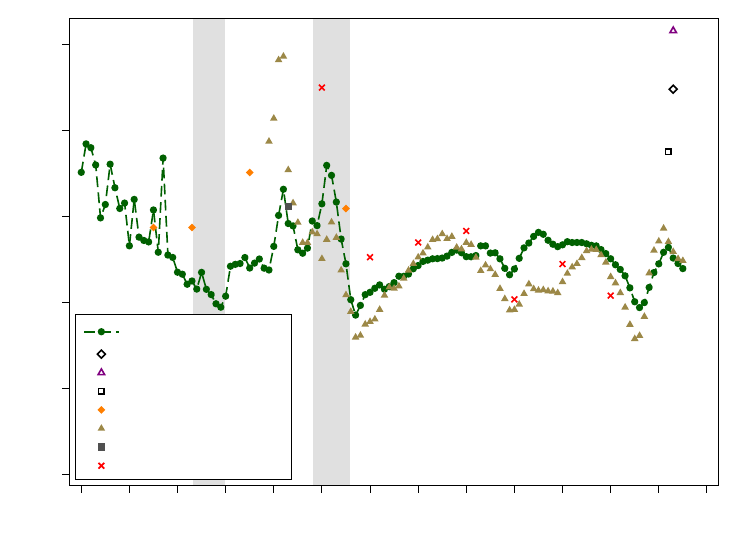

Figure IV compares the rent-price approach of net rental yield estimates (black diamonds) with

those using the balance sheet approach (brown triangles). The first three panels show the time series

of the two measures for France, Sweden, and US, and the bottom-right panel shows the correlation

25

The high-quality transaction level data are available for Australia and the US, from Fox and Tulip (2014)

(sourced from RP Data) and Giglio, Maggiori, and Stroebel (2015) (sourced from Trulia) respectively. We use

the Fox and Tulip (2014) yield as benchmark for Australia. For the US, we use IPD because it is in line with

several alternative estimates, unlike Trulia data which are much higher. See Appendix U for further details.

26

For example, in the UK a change to imputation procedures in 2016 and the use of new survey data

resulted in historical revisions which almost tripled imputed rents (see Office for National Statistics, 2016).

We use a mixture of the old and new/revised data for our historical estimates.

22

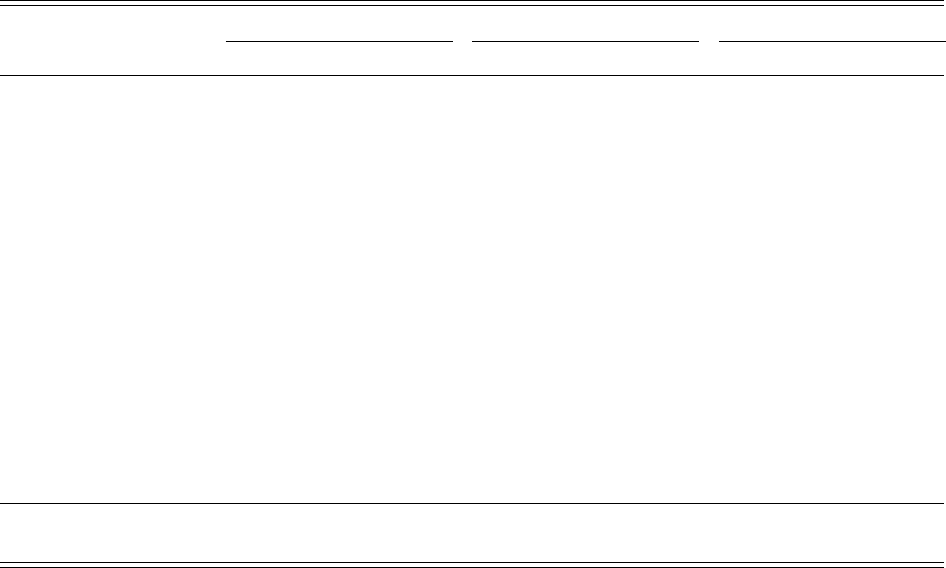

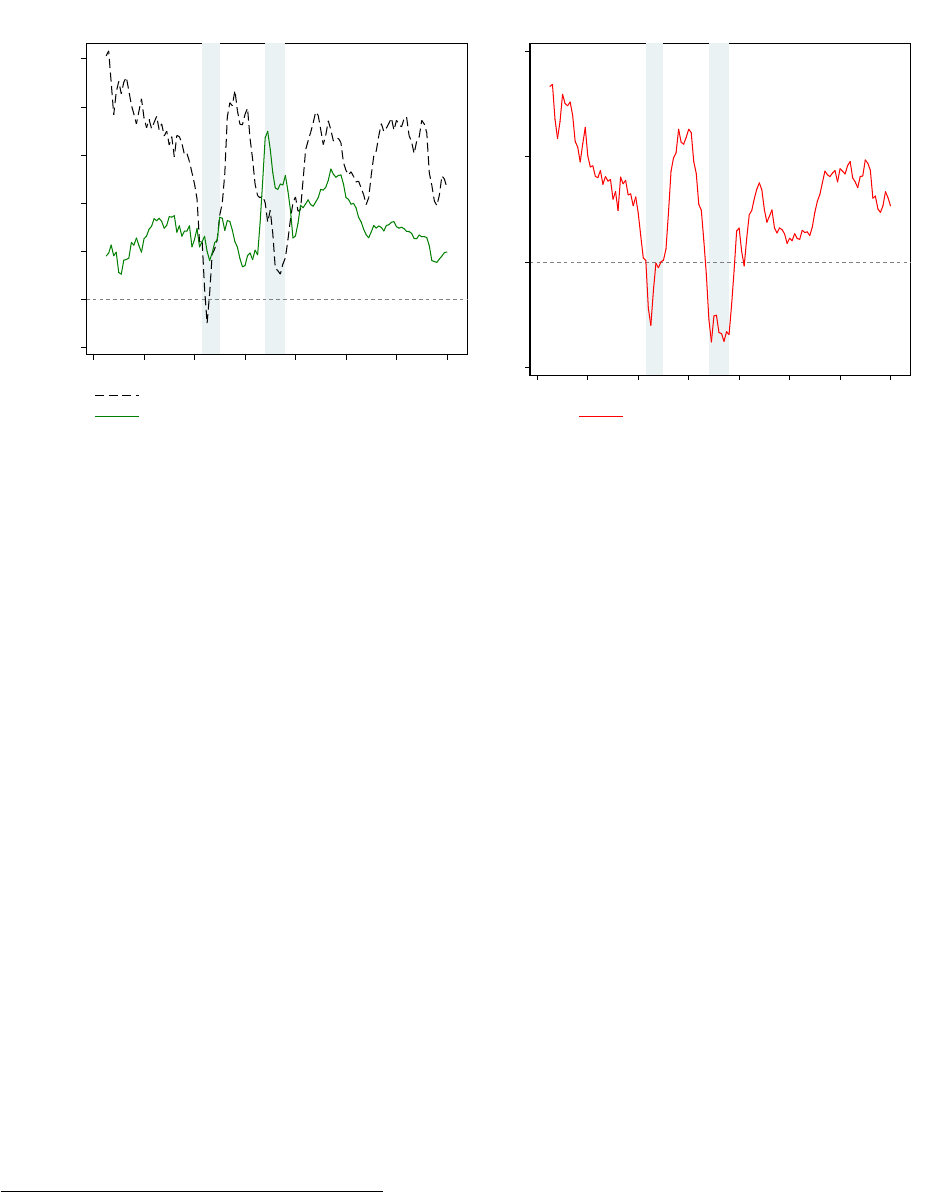

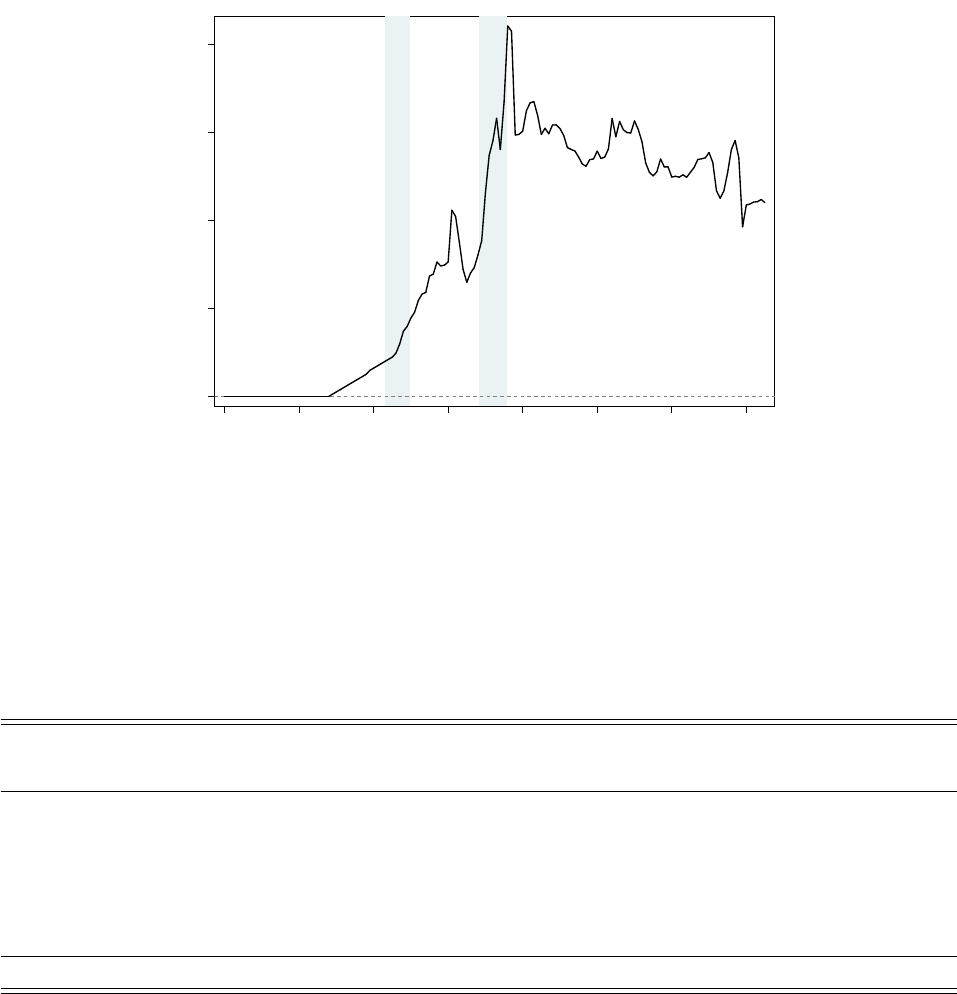

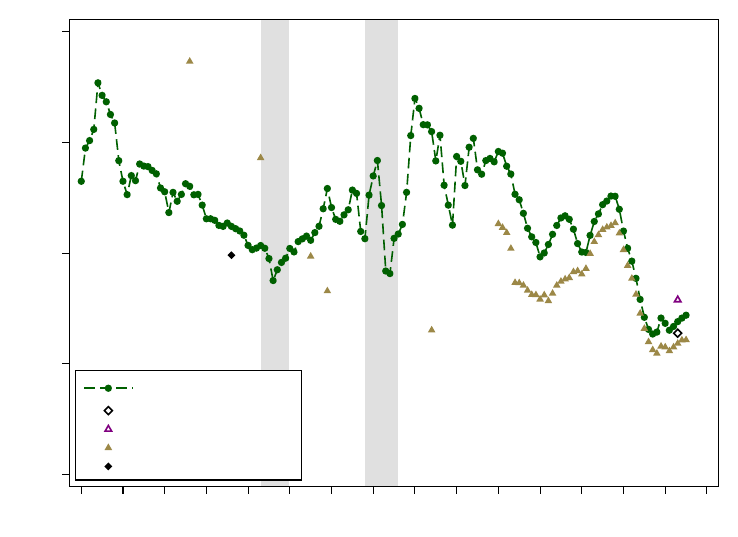

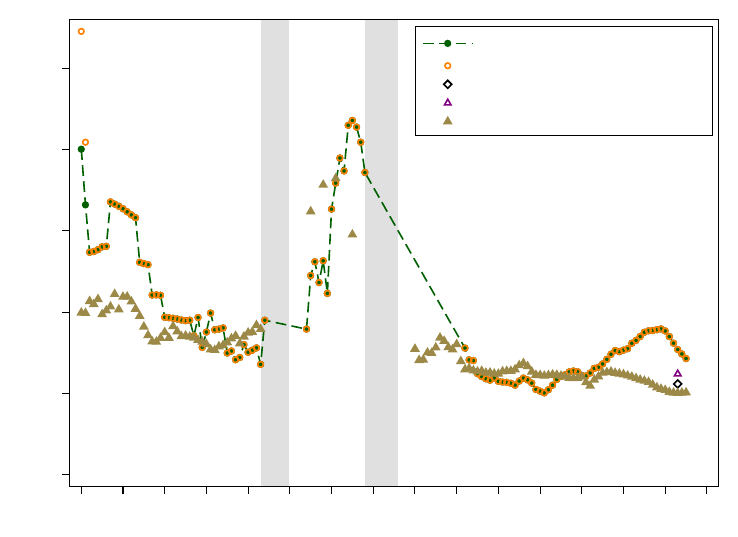

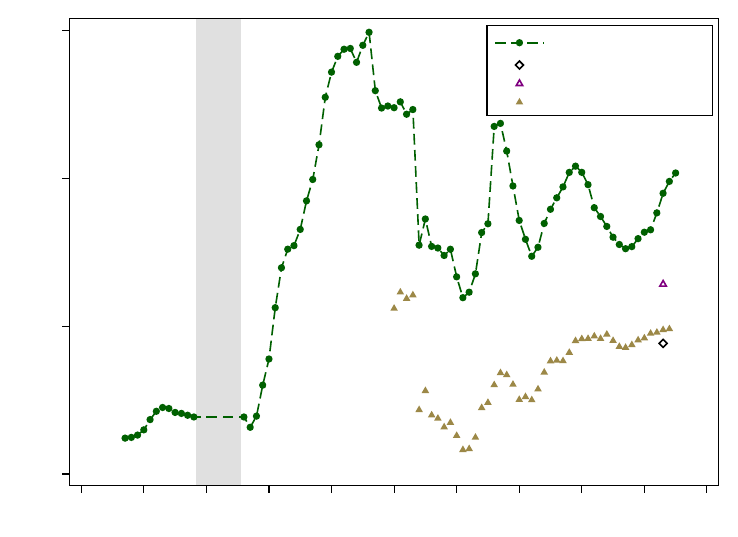

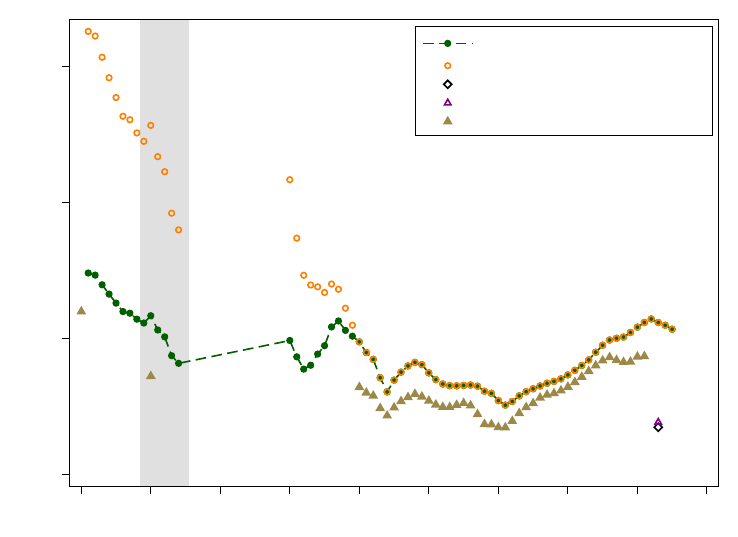

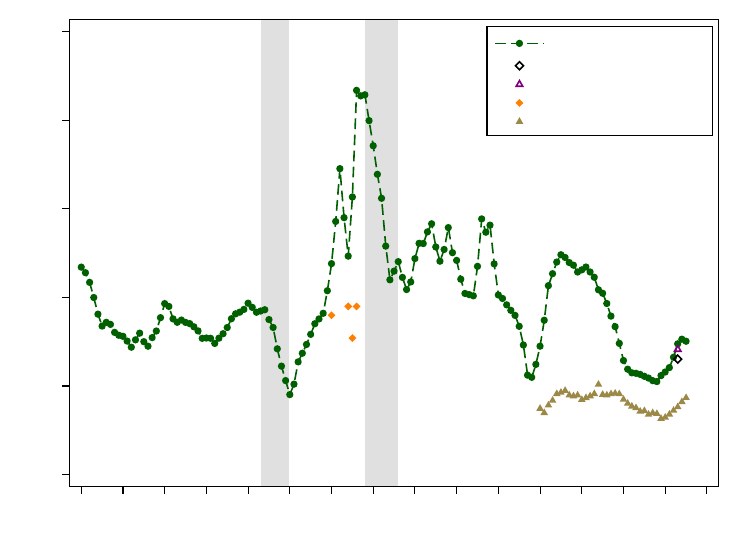

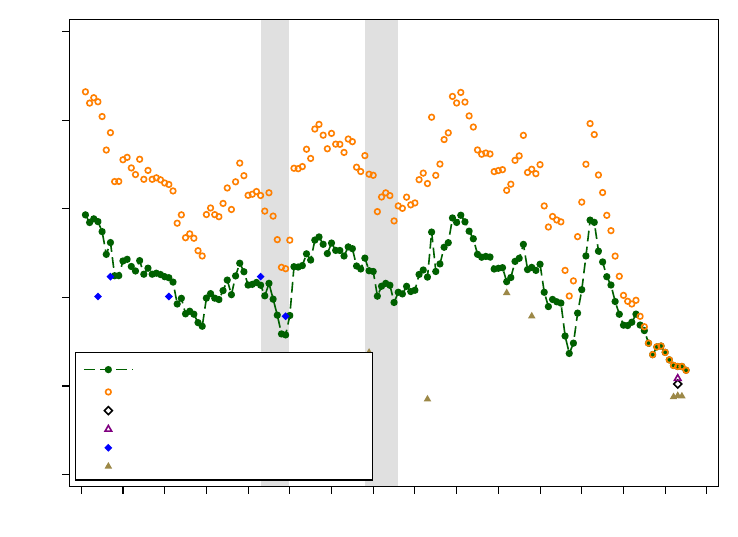

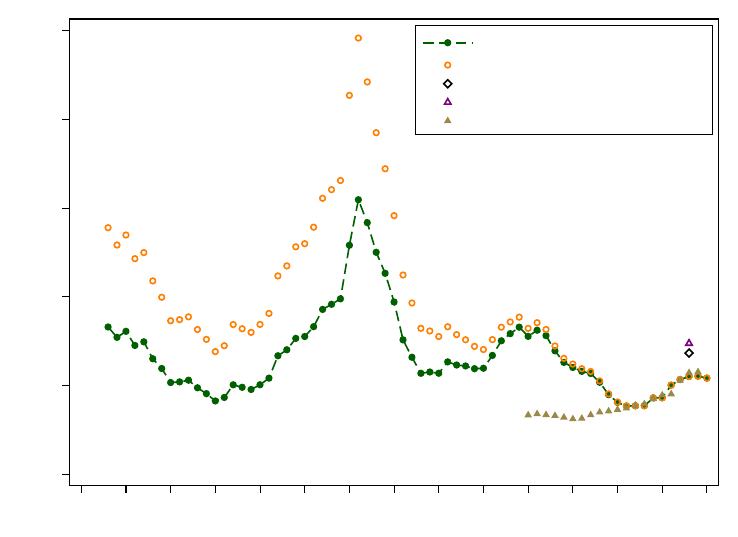

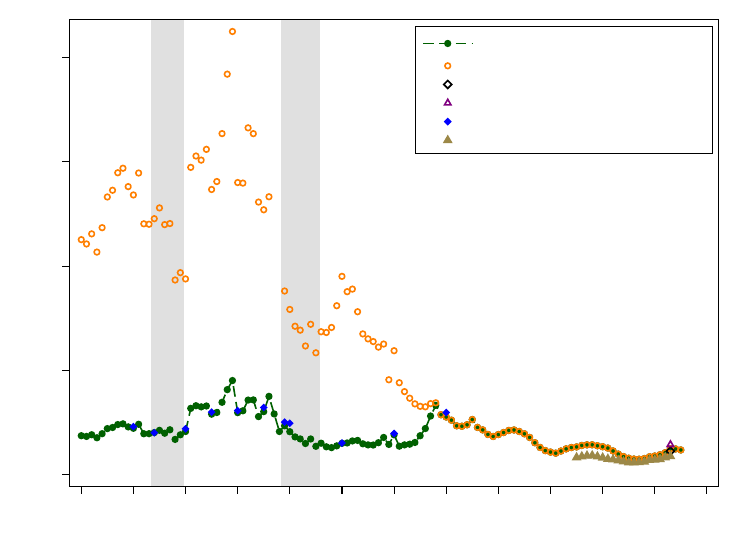

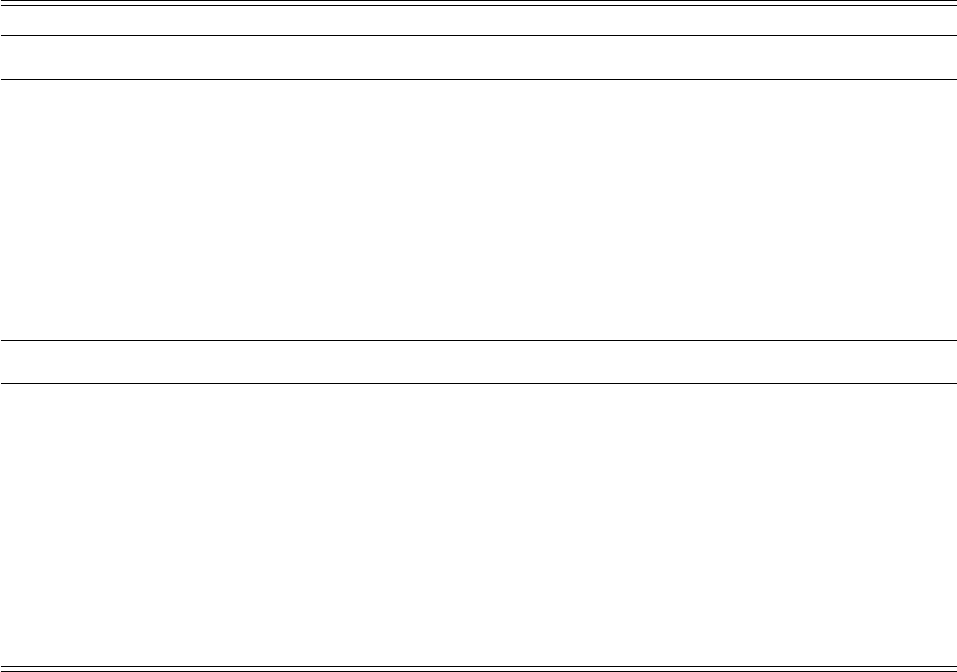

Figure IV: Comparison of the rent-price and balance-sheet approaches for historical rental yields

0 2 4 6 8

1890 1910 1930 1950 1970 1990 2010

France

0 3 6 9 12

1930 1950 1970 1990 2010

Sweden

0 2 4 6 8 10

1930 1950 1970 1990 2010

USA

-2 -1 0 1 2